Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

$SPY S&P 500 Tracking ETF

Read MoreWe have seen a sharp sell off in the instrument & S & P 500 Index since the 19th of May, 2015 however think it is a corrective double three decline from the 213.81 high down to the 182.40 lows of August 24th . We think this is most likely a wxy structure and part of a larger […]

-

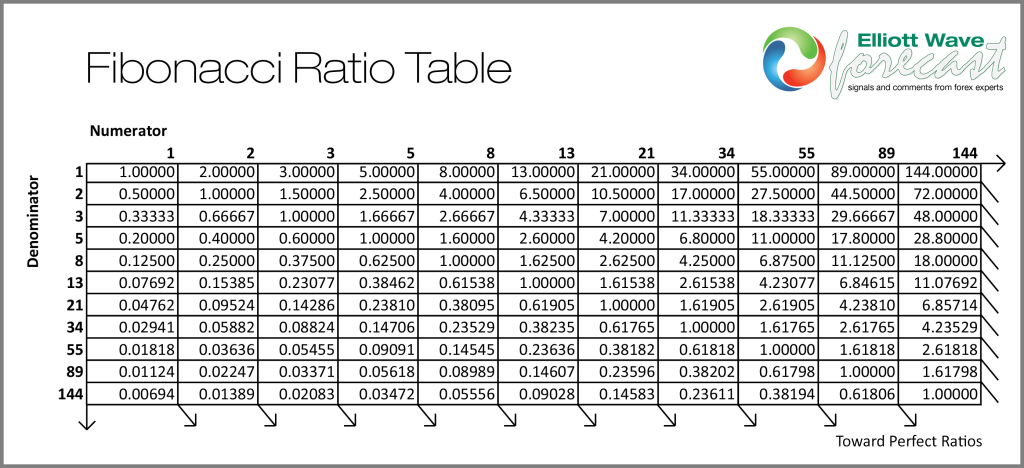

The market, golden ratio, and the sequence

Read MoreMarket Dynamic and Nature Nature is the biggest enigma, that we as Human always try to decode. For Centuries, we have been trying to understand everything and find out many secrets around the Universe. We have come very far from living in caves to being able to travel to the moon. The reality is that […]

-

$IWM Russell 2000 tracking ETF

Read MoreWe have seen a sharp sell off in the Russell 200 Index since the 23rd of June, 2015 however think it is a corrective double three decline from the 129.13 high down to the 108.26 lows of August 24th . We think this is most likely a wxy structure and part of a larger […]

-

AUDCAD Elliottwave Analysis 8.11.2015

Read MoreThis is an Elliott Wave Analysis video update on $AUD/CAD. This pair is not part of the 42 instrument we cover. If you are interested to learn more about Elliott Wave or how we can help you, click to join FREE 14 days trial.

-

-

Difference between WXY and ABC structure

Read MoreZig-Zag or ABC is the most popular corrective pattern in Elliott Wave Theory. At the mention of the word “correction” many Elliott Wave practitioners would think of a Zig-Zag pattern and that’s one of the traps in modern analyzing . If you expect to see an ABC pattern in corrections every time, you’ll get more […]