Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

How Sustainable is USD Weakness post FOMC

Read MoreIn our past article “US Dollar Outlook into FOMC Meeting on March 16“, we argue that the Fed is likely going to stay put and temper the rate hike expectation and this action should cause U.S. Dollar weakness. It happened as expected with the Fed last Wednesday lowers the median 2016 dot to two hikes from four hikes. The Fed cited […]

-

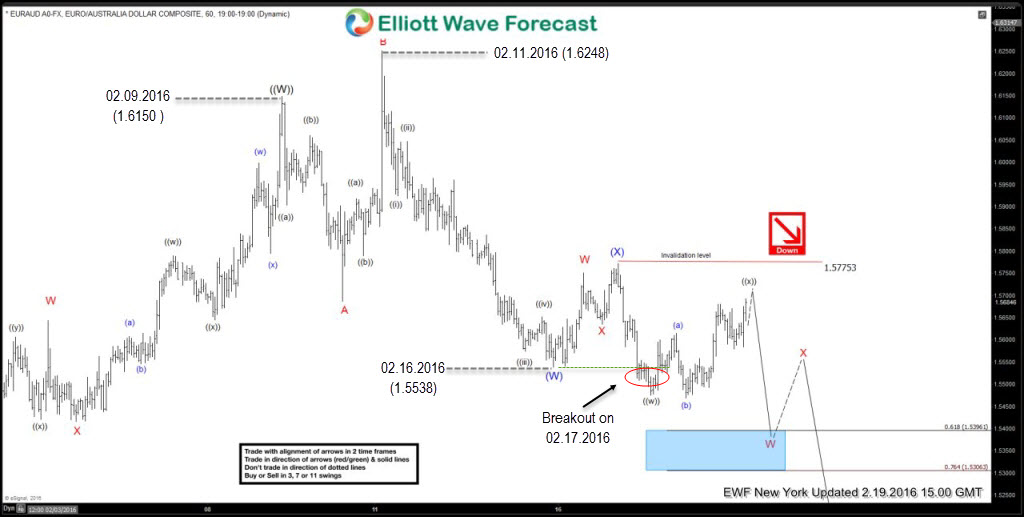

$EURAUD Elliott Waves Forecasting the decline

Read MoreIn this technical blog we’re going to take a quick look at $EURAUD price structure we had on 2.19.2016 to explain Ellott Wave Forecast we had back then. 1 Hour chart below presents New York Update from Februar 19. 2016 date. It suggests the cycle from the 02.09. date ( 1.6150 high) ended at 1.5538 […]

-

US Dollar Outlook into FOMC Meeting on March 16

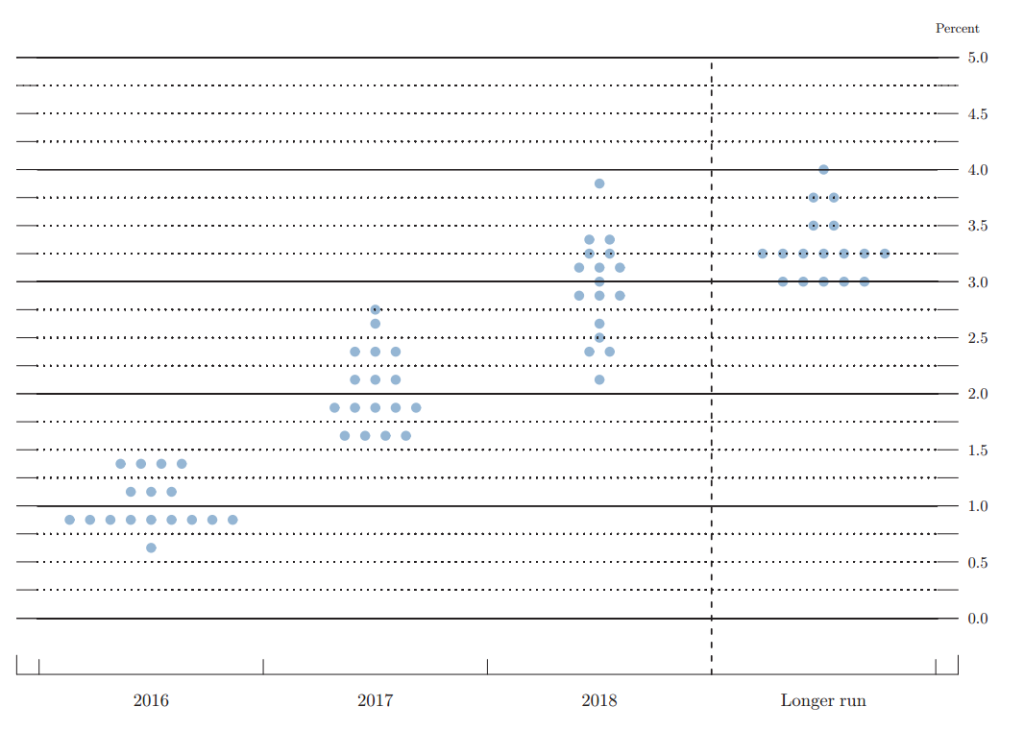

Read MoreWhen the Fed raised the rate last year, the minutes suggest that they were relatively hawkish and expected 4 more rate hikes in 2016, as December Fed’s dot plot shows. Subsequent events after the December meeting however have seen oil, commodities, and indices selling off sharply, giving pressure to the headline inflation rate. Central banks around the […]

-

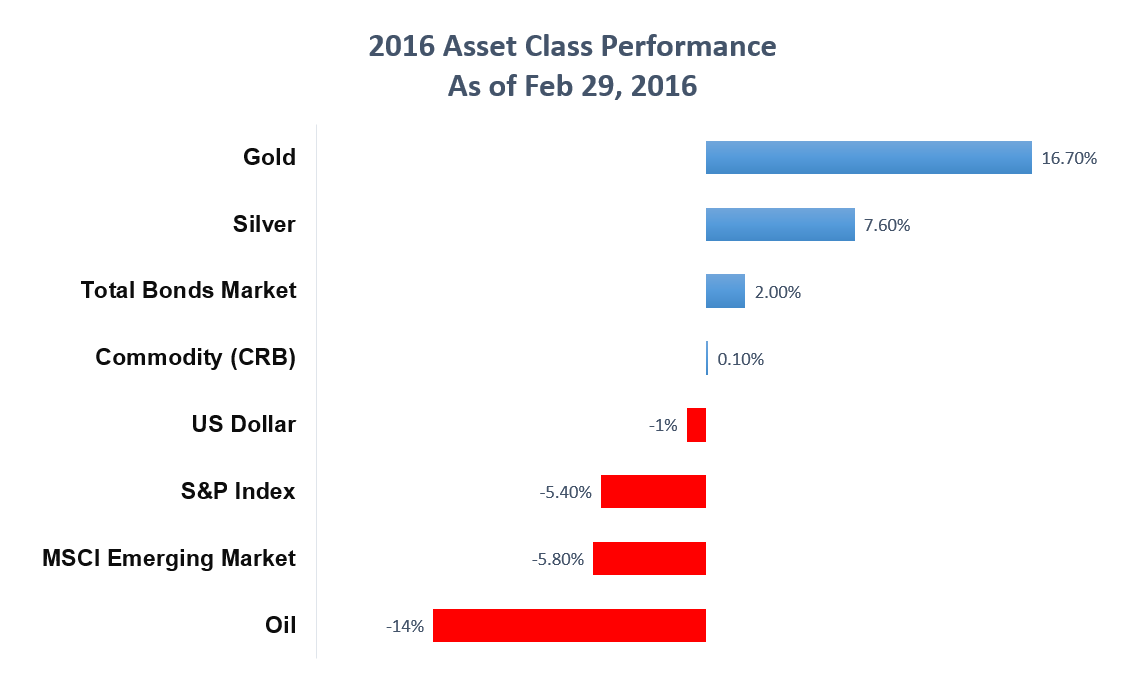

Is Gold’s luster finally coming back?

Read MoreAfter being shunned by investors for more than 5 years, gold has made an impressive start in 2016. As of Feb 29, gold registered 16.7% return, which is considerably above other asset classes. Below is the performance comparison between different asset classes as of Feb 29, 2016. There are several factors which contribute to the […]

-

Daily Set up video 1.12.2016

Read More3.3.2016 We at Elliott Wave Forecast like to present the trading ideas in a form of videos. We believe in trading extremes and always with the trend. Here is an example of old Daily Trading Setup video to show how we present the ideas to members. Our belief is to identify an area that is […]

-

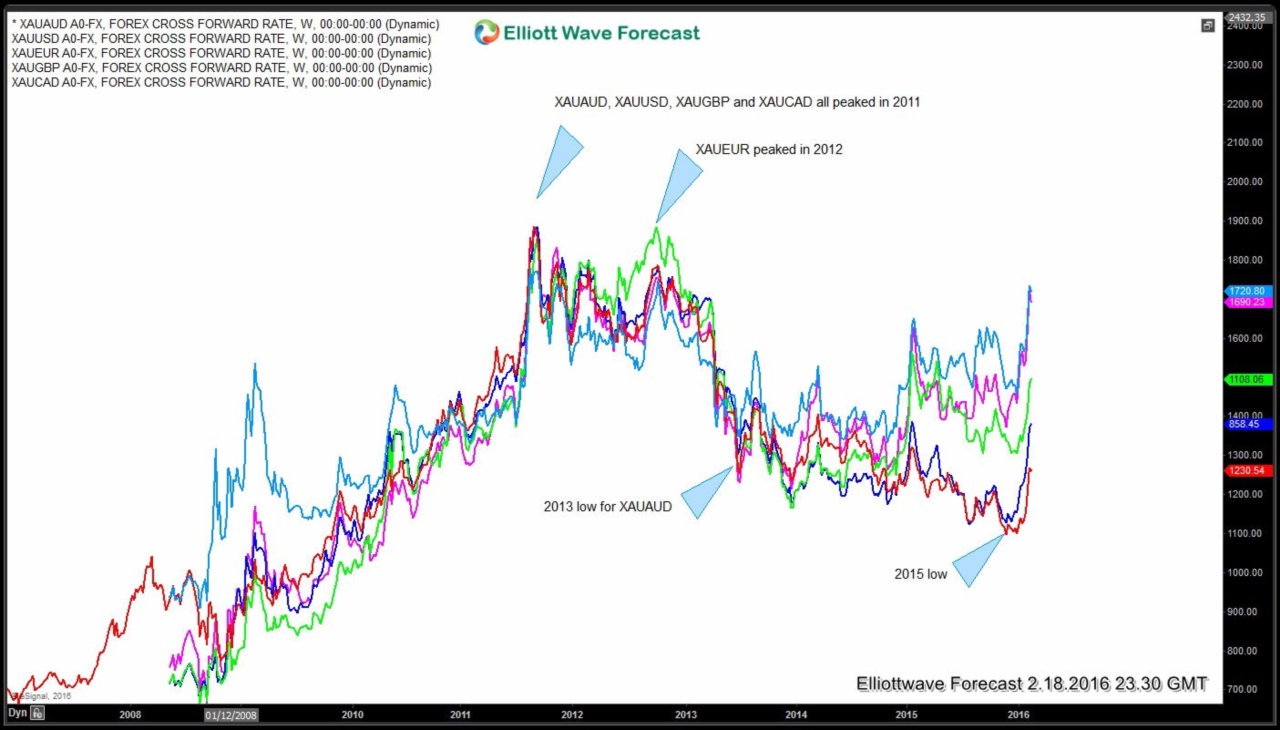

Gold: Will the rally extend or fail?

Read MoreGold (XAU) formed a peak against most major world currencies in 2011. This included XAUAUD, XAUUSD, XAUGBP and XAUCAD while XAUEUR peaked a little later in 2012. This was an important peak and resulted in a few years of downward price action in Gold against all major World currencies. Since December 2015, Gold has been rallying […]