Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

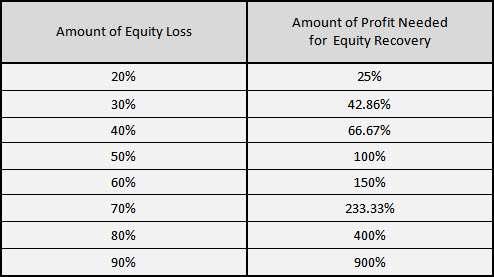

An Important Lesson on Money Management

Read MoreThere are 3 major key factors in Trading that every professional trader should have: 1. Ability to forecast the market 2. Good Money management 3. Good Psychology. It’s crucial for all three factors to be included in order to succeed. If just one of these 3 mentioned factors is missing, the trader will fail. In […]

-

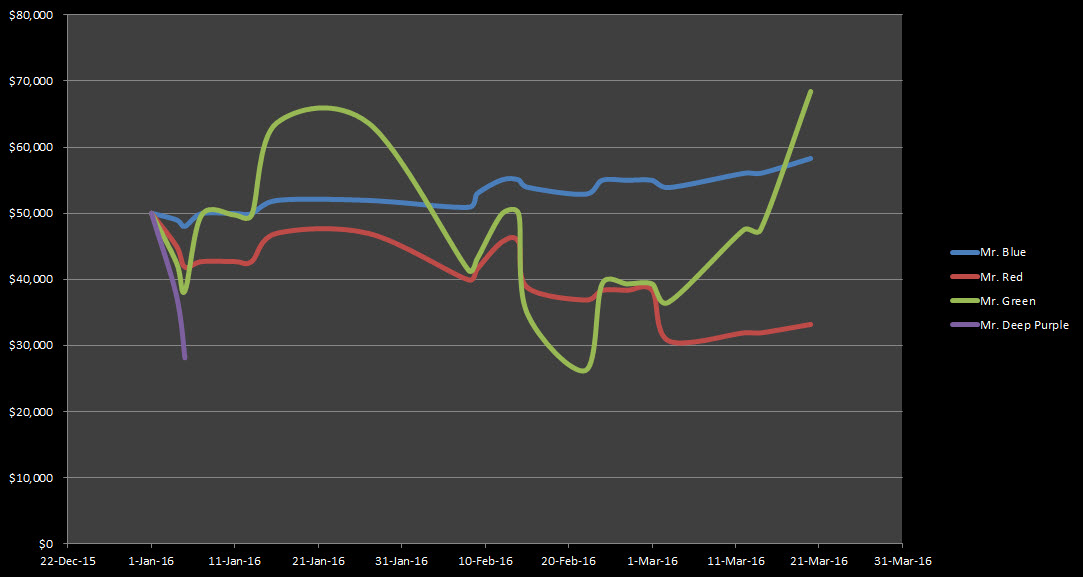

What happens when you don’t follow the 2% rule

Read MoreAs we have mentioned, every trader besides ability to forecast the market well, should also have good psychology and good money management in order to be successful. One of the most important things is to know how to manage the risks well and keep them as low as possible. As the rule says, you shouldn’t […]

-

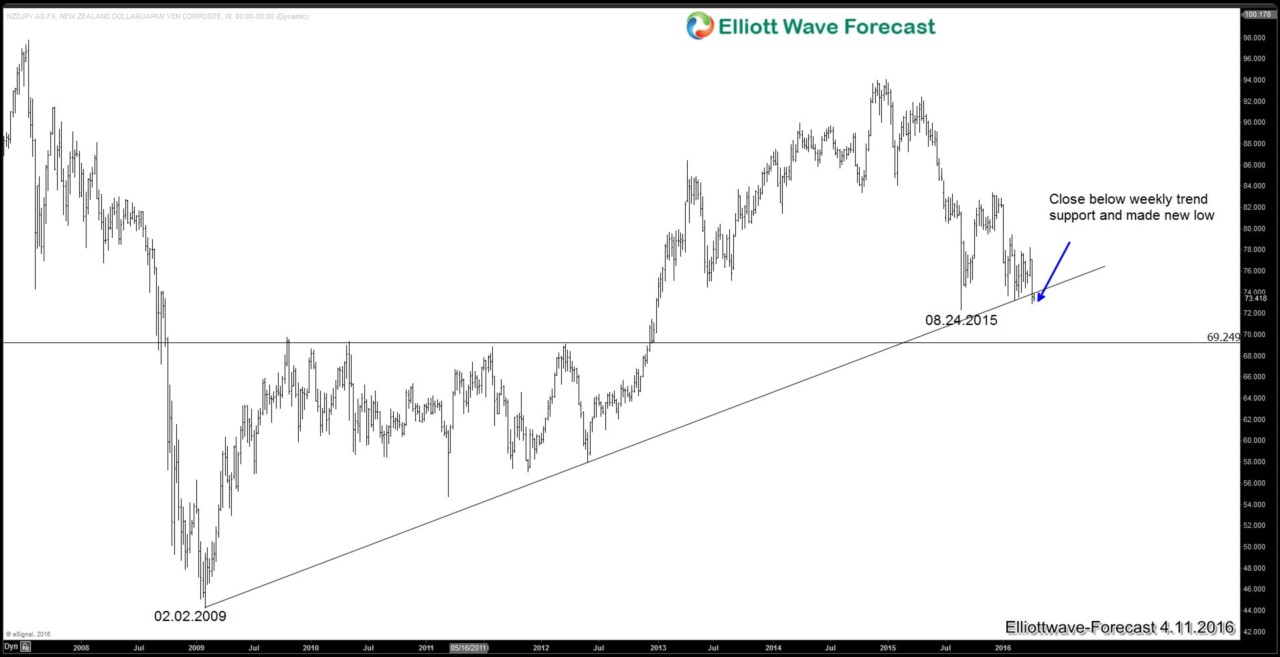

Why NZDJPY may continue lower

Read MoreIn our past article dated Feb 21 titled “Weak NZ Inflation in 4Q 2015 may force RBNZ to cut rate“, we lay out a case that RBNZ (Reserve Bank of New Zealand) is one of the few central banks which still has conventional monetary policy in their toolbox to battle low inflation. With the latest quarterly inflation released […]

-

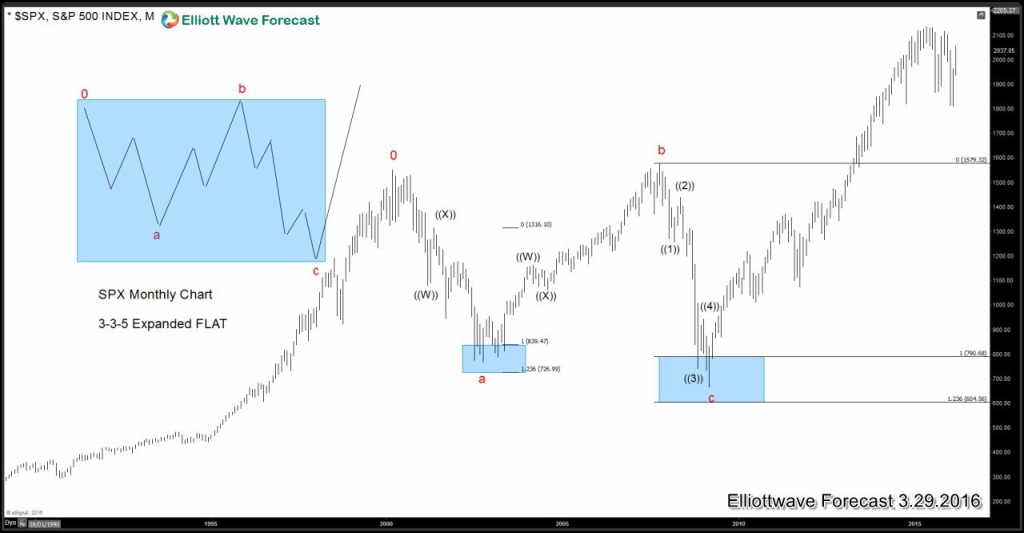

Was SPX rally from 2009 lows based off of QE?

Read MoreQuantitative easing mainly known as “QE program” was the biggest emergency economic stimulus in the history. The U.S. Federal Reserve’s once-in-a-lifetime program to buy immense piles of bonds, month after month, in an extraordinary effort to restart a recession-deadened economy came to an end in October 2014 after adding more than $3.5 trillion to the Fed’s balance […]

-

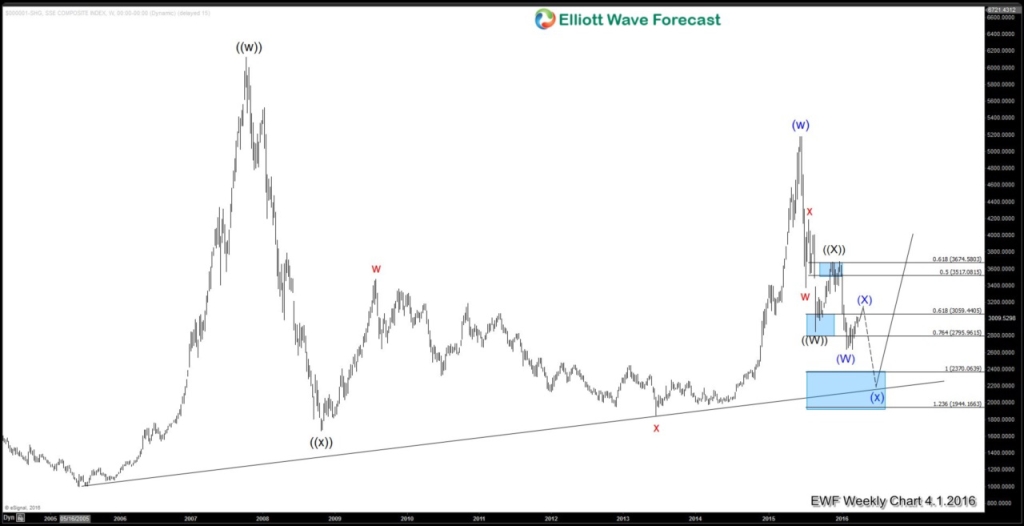

Revisiting Shanghai Index for the Path of Global Indices

Read MoreLast year, in our video dated November 2, 2015 we warned our viewers that the Chinese stock market still has more downside to go. We argued that Shanghai Composite Index may retest the 2008 low towards 1944 – 2370 area. The forecast proved accurate and the Chinese stock market resumed a strong selloff in the first one and half months in 2016. The […]

-

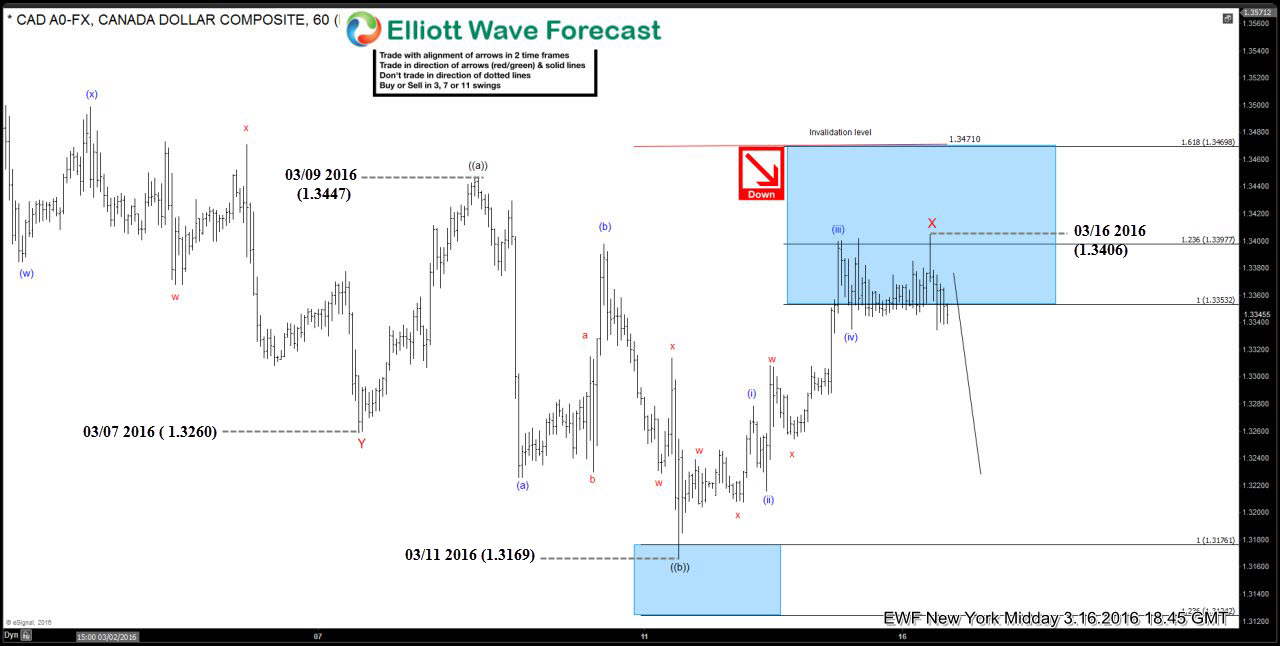

Elliott Wave Quiz: Could you recognize the structure ?

Read MoreLately we were doing a lot of educational blogs, explaining various Elliott Wave Patterns through real Market examples. Now we invite you to take this short Quiz in order to test your Elliott Wave knowledge. $USDCAD chart below shows our forecast from 16. March 2016 .It’s calling x red connector completed at 1.3347 and suggesting further […]