Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

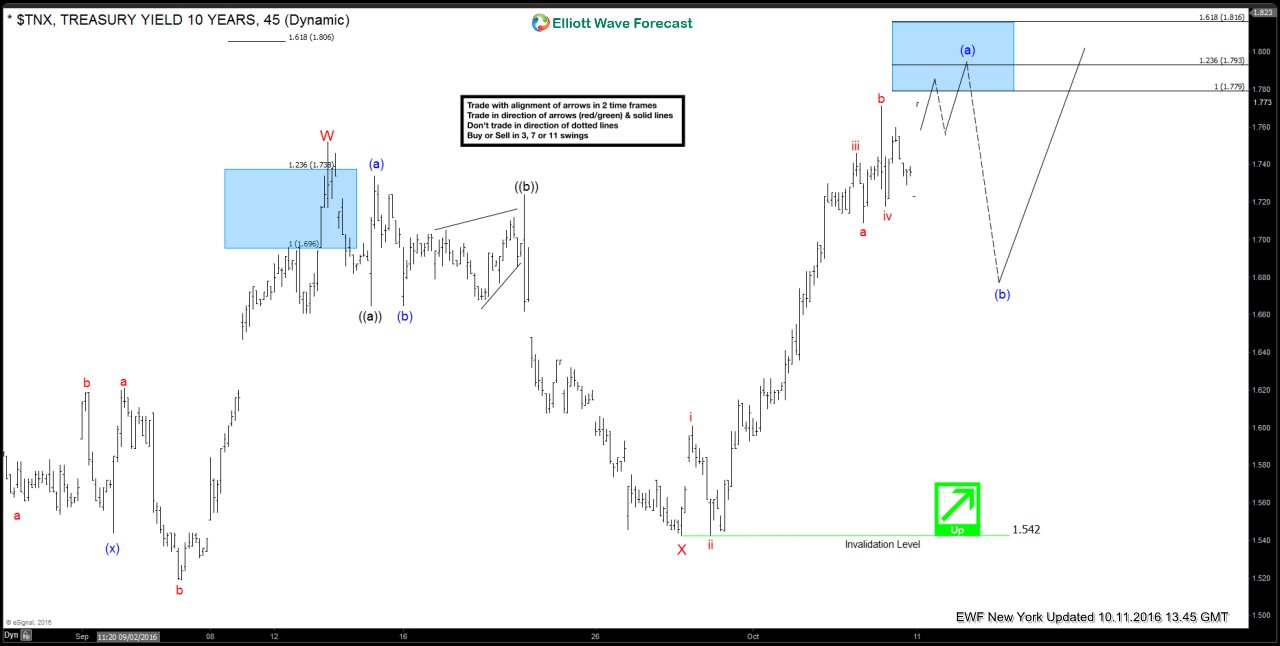

$TNX (10 Year Yields) Short-term Elliott Wave Analysis 10.12.2016

Read MoreShort term Elliott wave count suggests that pullback to 1.542 at 9/28 ended wave X. The rally from there looks to be unfolding as a 5 wave move and could complete in 1.779 – 1.816 area. Afterwards, it would need to break below the red wave iv low at 1.718 to confirm wave (a) completed and wave […]

-

$TNX (10 Year Yields) Short-term Elliott Wave Analysis 10.11.2016

Read MoreShort term Elliott wave count suggests that pullback to 1.542 at 9/28 ended wave X. The rally from there looks to be unfolding as a 5 wave move and could complete in 1.779 – 1.816 area. Afterwards, it would need to break below the red wave iv low at 1.718 to confirm wave (a) completed and wave […]

-

How to Identify the Right Side of Elliott Wave Cycles

Read MoreThe Trading Reality Check Many traders come to the Marketplace with the illusion of becoming rich and following the steps of successful people in movies or TV series when they see the private jets, boat, and big houses. Some come with the humble idea of providing for their family using trading as a form of Income. The […]

-

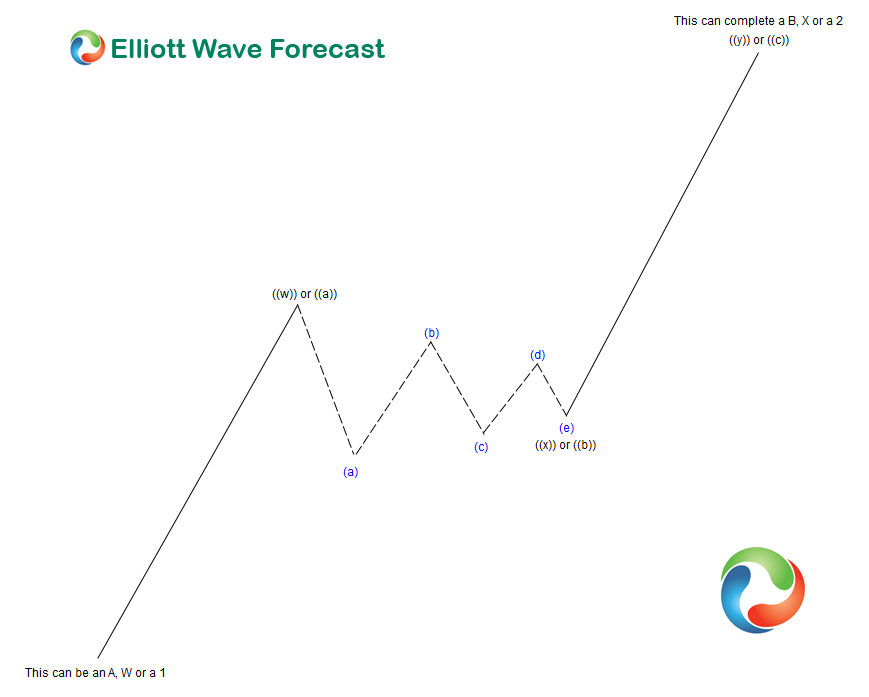

Elliott Wave Theory Structure : Double Three with a Contracting Triangle in the connector Wave B or X

Read MoreElliott Wave Theory Structure : Double Three with a Contracting Triangle in the connector Wave B or X As mentioned here before double three structures are common to see in the market and as it has been pointed out before they can also be the Elliott wave formation that a particular market instrument is trending […]

-

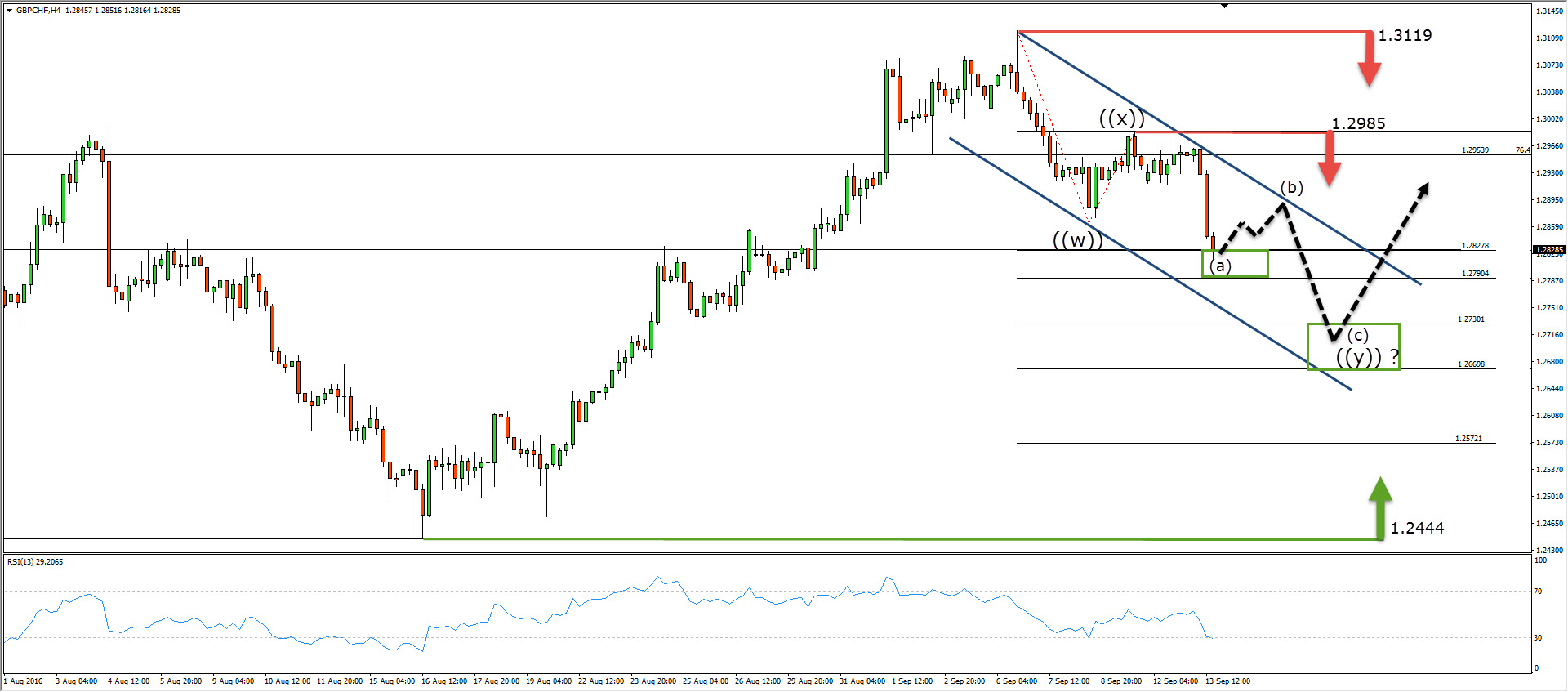

A technical look at $GBPCHF

Read More$GBPCHF Hello fellow traders, in this technical blog we’re going take a look at the short term Elliott Wave analysis of $GBPCHF currency pair. In the larger time frames we see the pair reached the extreme area in the daily cycle from the last year’s peak (19th November). It hit the important tech zone at 1.2444 […]

-

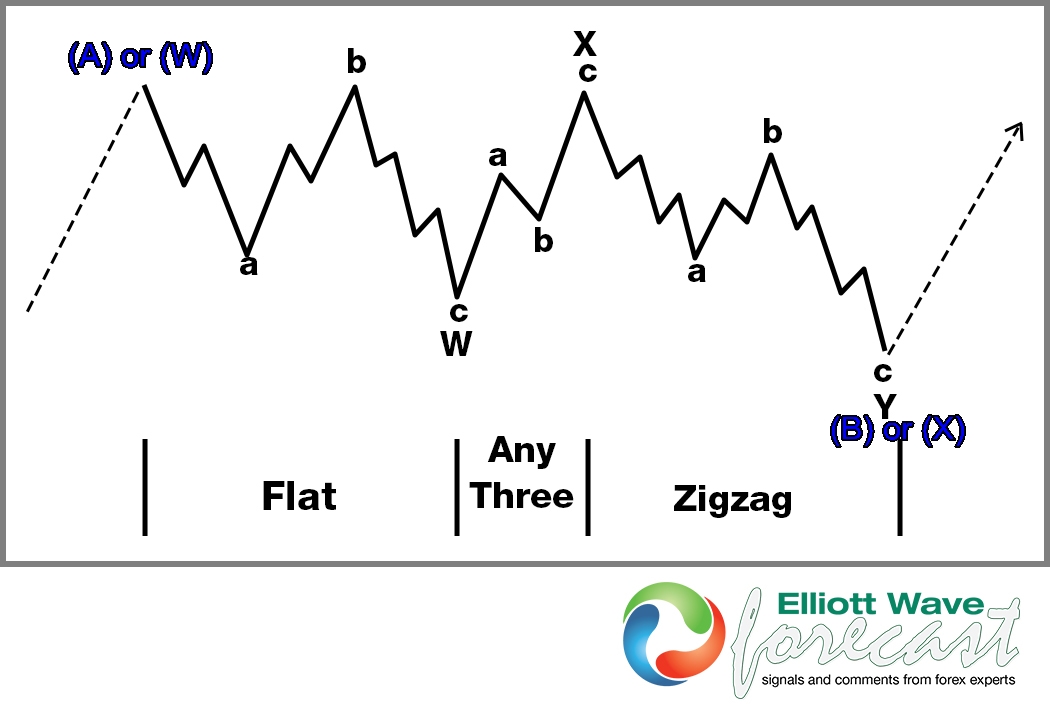

Elliott Wave Theory Structure : A Double Three Combination

Read MoreDouble three structures are common occurrences in the market and as it has been pointed out before they can also be the Elliott wave formation that a particular market instrument is trending within the larger degrees and time frames. As pointed out here before, it is simply impossible in some markets to get a legitimate […]