Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

Elliott Wave View: Peloton ($PTON) The Next Leg Up

Read MorePeloton ($PTON) had a very nice run before topping December 2019, and may be ready for the next leg up. The caveat with analyzing companies that have recently gone public is there is not much history to analyze. However, the structure that Peloton has since hitting the all time lows suggests the next bull run […]

-

Elliott Wave View: Virgin Galactic ($SPCE) Extending The Impulse

Read MoreVirgin Galactic ($SPCE) has had an impressive rally after setting all time lows after its IPO in the fall of 2019 and continues to impress as it extends the rally in a wave ((3)) impulse. Up from the 11/25/19 lows at 6.90, $SPCE ended a 5 waves cycle on 1/3/20 at 11.90 in wave ((1)) […]

-

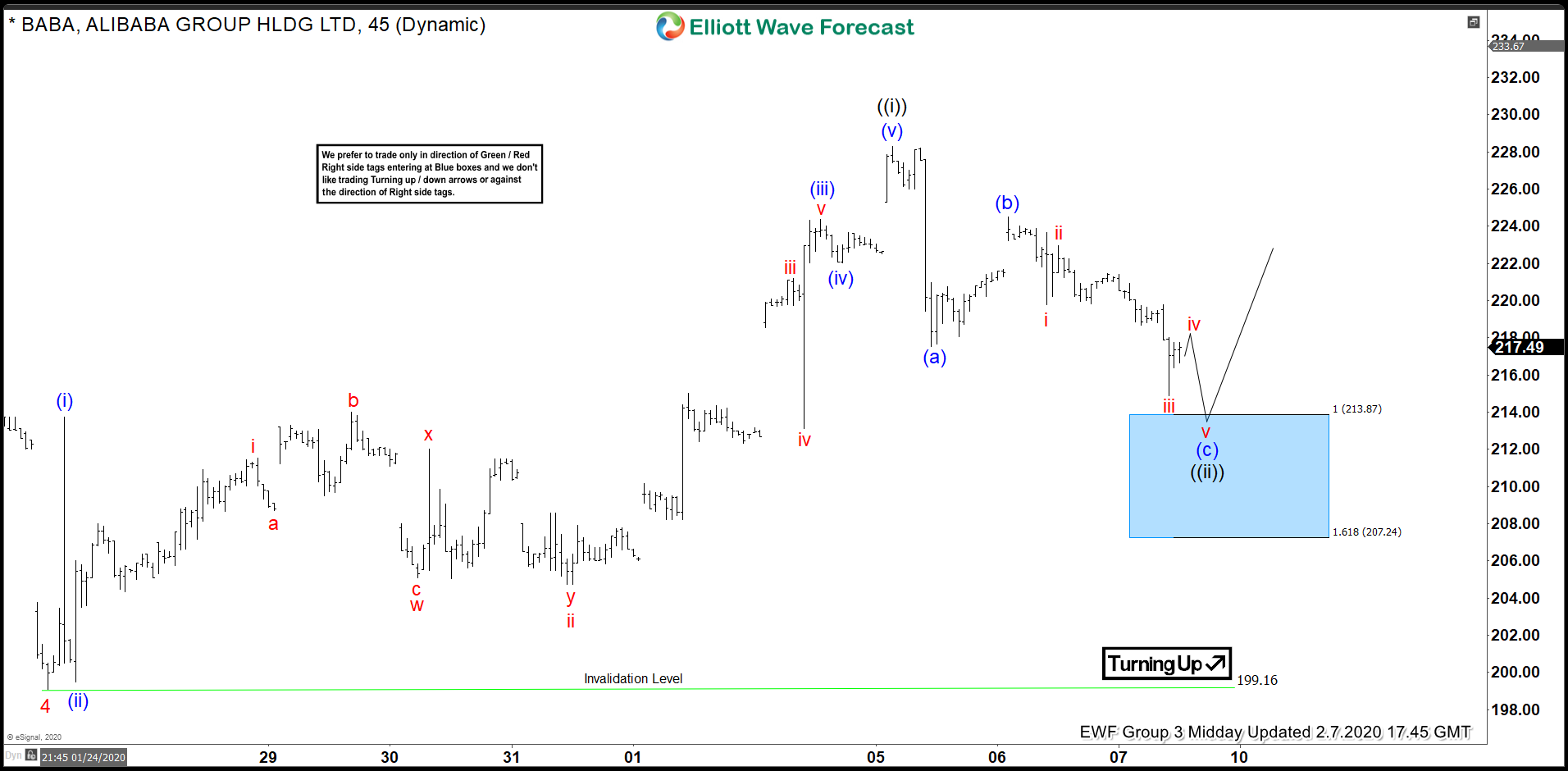

BABA Found Byers At The Blue Box After Elliott Wave Zig Zag Pattern

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of BABA. As our members know BABA has recently given us pull back against the 199.12 low. Pull back unfolded as Elliott Wave Zig Zag Pattern. We expected buyers to appear at the Blue Box , […]

-

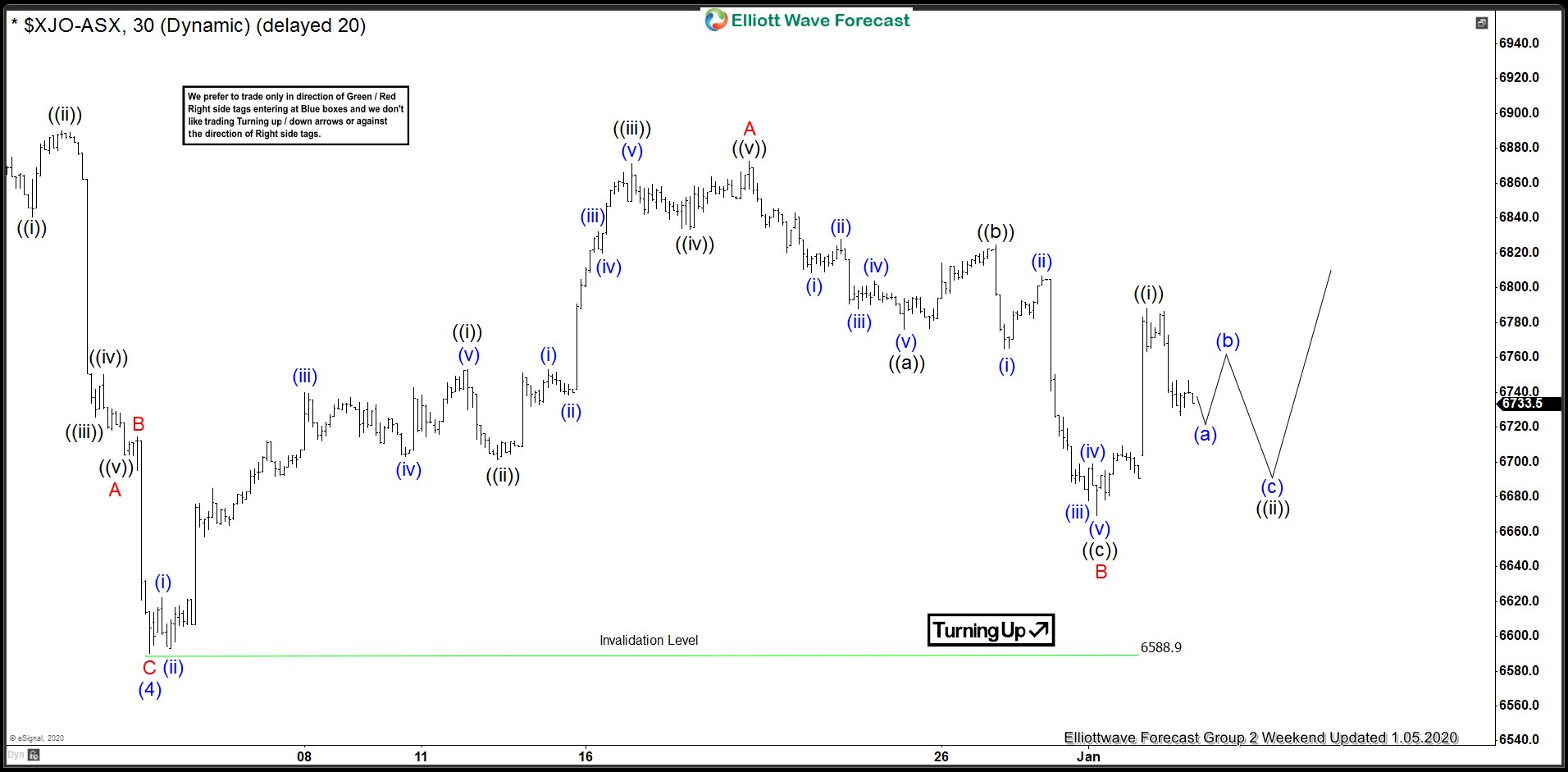

$ASX Forecasting The Rally After Elliott Wave Zig Zag Pattern

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of $ASX published in members area of the Elliottwave-Forecast . As our members know, $ASX is showing incomplete bullish sequences in the cycle from the December 2018 low. Consequently we recommended members to avoid selling the Index […]

-

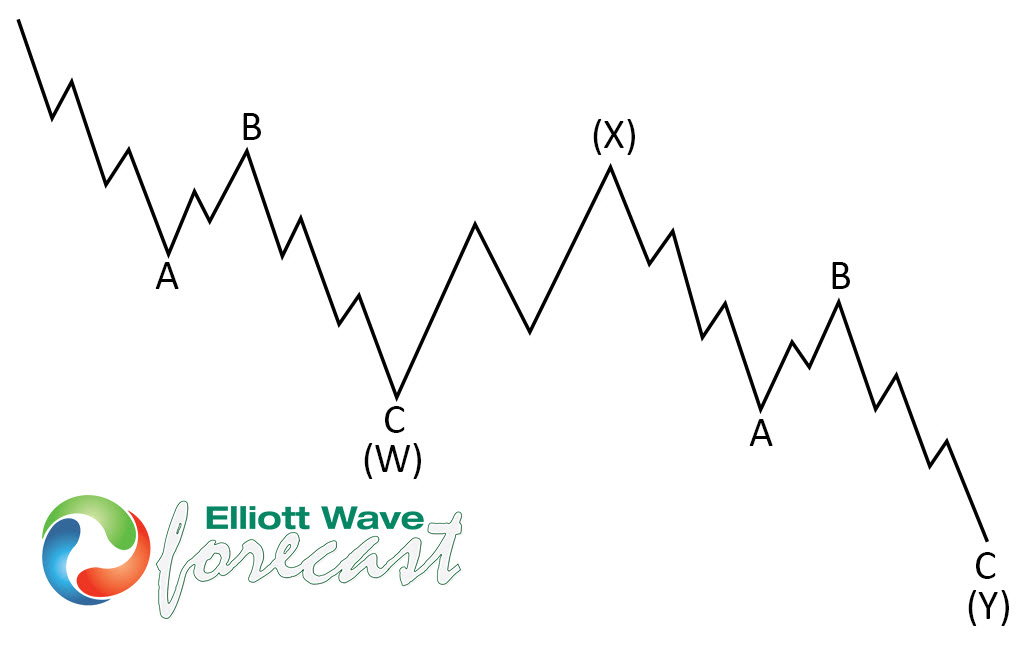

AUDUSD Forecasting The Rally After Double Three Pattern

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of AUDUSD published in the membership area of the elliottwave-forecast . As our members know, AUDUSD recently gave us rally within the short term cycle from the 11/29 low . We got 3 waves pull back , that unfolded […]

-

COPPER ( $HG_F ) Forecasting The Rally After Double Three Pattern

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of COPPER ( $HG_F) published in members area of the Elliottwave-Forecast . As our members know, COPPER recently corrected the short term cycle from the 2.6132 (November 14th ) low. Pull back unfolded as Elliott Wave Double […]