Elliott wave Theory : The Truth behind the subjection

As everyone knows by now, we at Elliottwave-Forecast, are always betting in the future. When you do forecasting for a living, it become a habit looking ahead everyday instead of looking behind. During the history of mankind, many theories and projects have been developed and created, but if we held onto the initial versions, we neither would have enjoyed the developments we have today, nor our society would be so up to the time, and our living conditions much worse. Elliottwave-Forecast has been in business for over a decade and like every Elliott wave participant, we started believing and practising the Theory as it was develop by Ralph Nelson Elliott in the 1930’s and as he mentioned in the book, The Wave Principle. As we have always said he had a great mind and made a great discovery to be able to see the Patterns in the market. However, we also believe that the work was not complete and even when it was a tremendous discovery, there is no way, it can’t be improved almost 80 year later. As humans, we tend to avoid progress, a look at the history tell us that most major developments were done by individuals and not by the crowd and those Individuals have been called crazy and their work referred to as non-sense. We at Elliottwave-Forecast, believe in making progress for the good and because we produced over 54000 charts a year using The Elliott wave Theory, we understand what aspects of the original theory as mentioned in the book are not enough and need improving / adjusting.

Having said that, we need to open our mind and understand some concepts. Firstly, “Ego” which, by definition, means a person’s sense of self-esteem or self-importance, also the part of the mind that mediates between the conscious and the unconscious and is responsible for reality testing and a sense of personal identity. Ego, is one of the reasons many humans do not allow something new to come in and consider discovering something new as if it were something wrong. Secondly, “Development” which can be referred to as the process of developing or being developed like evolution, growth, maturation, expansion, enlargement, spread, progress; success etc, we can see that it’s nothing more than the humans constantly looking for answers. Thirdly, it’s “Reality” that we need to understand, it is a very strong human weakness, and sometimes hard to understand. By definition, it’s the world or the state of things as they actually exist, as opposed to an idealistic or notional idea of them., Relating these three words or concepts can provide clues about subjectivity of Elliott Wave Theory, as written in the books which follow the original work of Mr Elliott, and why it doesn’t work the way it should.

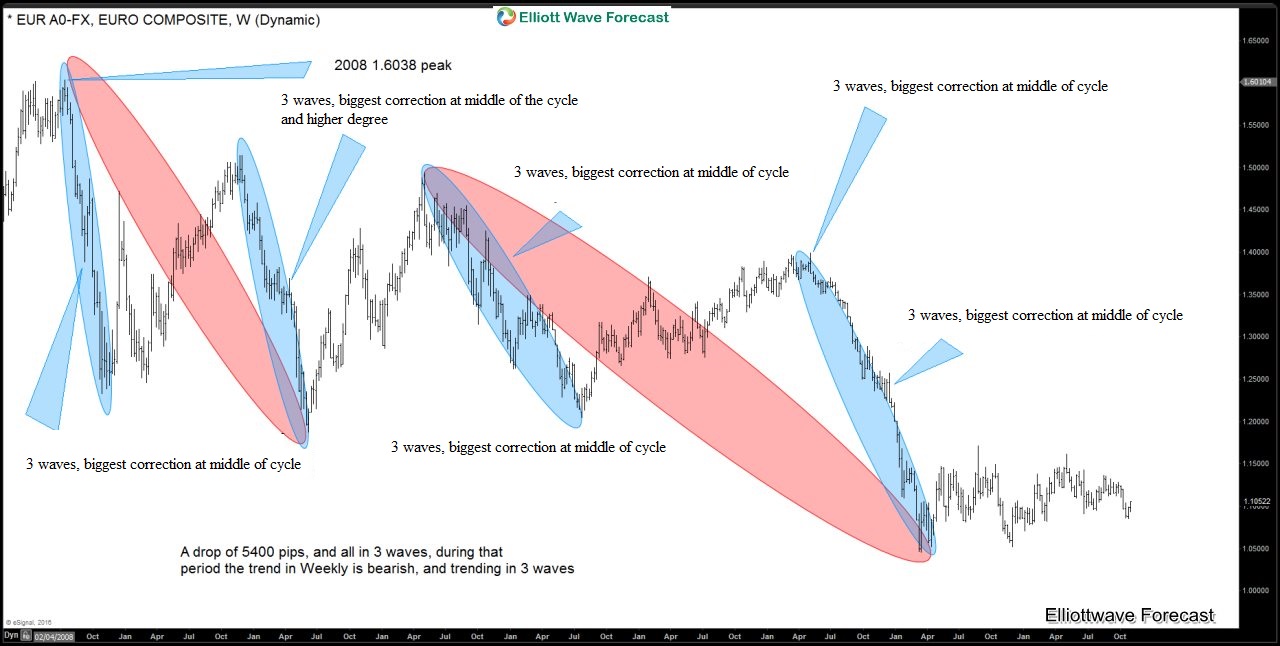

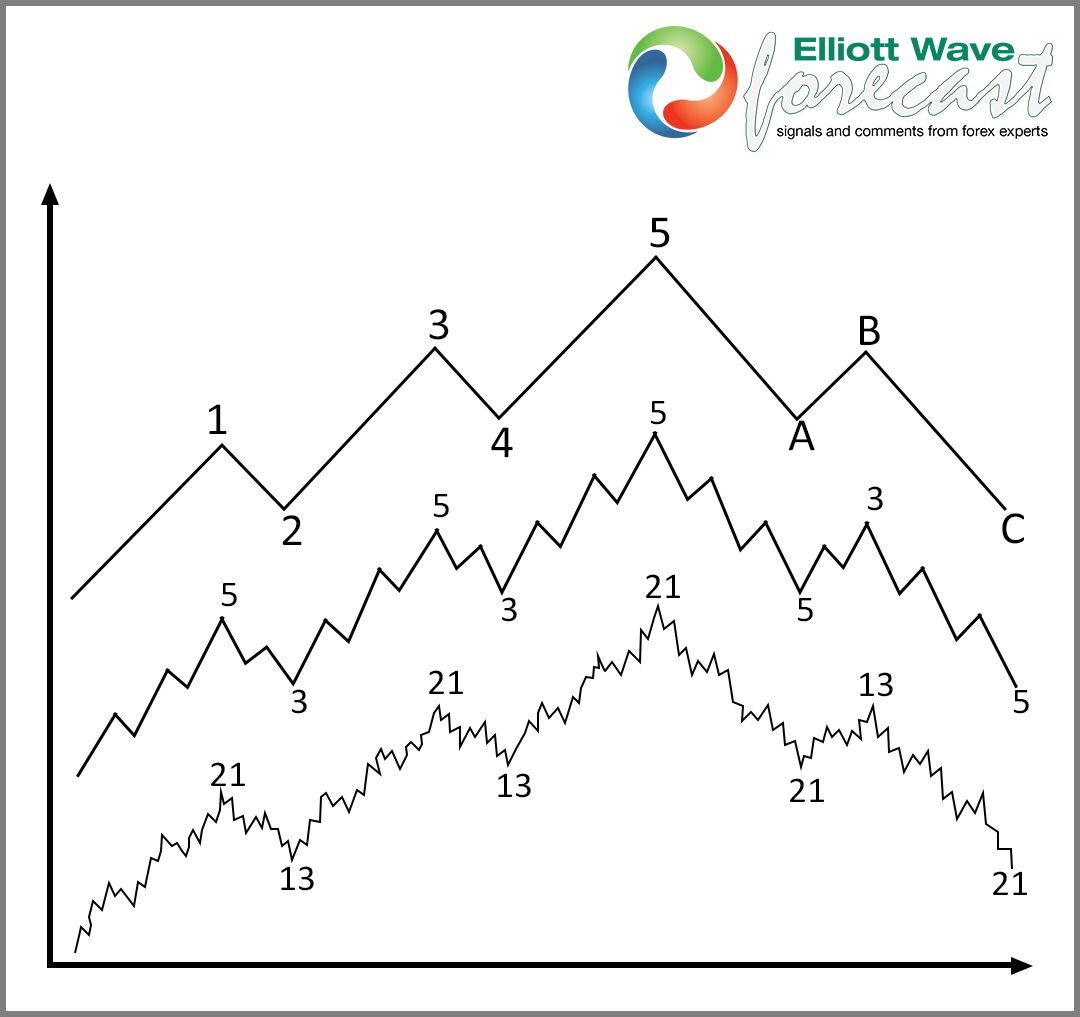

After this explanation, let’s talk about the Theory and how it stands with the major rules and ideas. The first idea is that the markets exhibit certain repeated patterns. Mr Elliott’s primary research was with stock market data for the Dow Jones Industrial Average. This research identified patterns or waves that recurred in the markets. Very simply, in the direction of the trend, expect five waves. Any corrections against the trend are in three waves. Three wave corrections are lettered as “a, b, c.” These patterns can be seen in long-term as well as in short-term charts. This is something, which we do not agree, with because we have seen many markets which trend in 3 waves even in the longer term and correct also in 3 waves with one thing for certain that a correction can never be in 5 waves which the Theory suggests as well. Therefore, we believe the Theory needs an adjustment there. Below is a Weekly chart of EURUSD and since the peak at 2008, we can see a drop of almost 5600 pips but the entire decline is in series of 3 waves and not a single 5 wave cycle is there in the weekly time frame. As shown in the chart, the Instrument drops a lot during 7 years and provided a bearish trend, if were following the Elliott Wave Theory as in the books, we would have been forcing 5 waves on the decline when everything was in 3 waves, then reality hits after the Market starts rallying after the corrective sequences completed or reached the target. Therefore, we reiterate that the idea that the Market trends in 5 waves and corrects in 3 waves doesn’t apply to all markets and hence it’s not accurate and has not been accurately described in the book. Mr Elliott developed the Theory basing most of his work in the Dow Jones which is an Index and it’s usually the Indices which mostly trend in 5 waves due to the human development factor. Forex and most other markets trend and correct in 3 wave sequences.

We follow the Main rules which are the following:

Wave 2 never retraces more than 100% of wave 1.

Wave 3 cannot be the shortest of the three impulse waves, namely waves 1, 3 and 5.

Wave 4 does not overlap with the price territory of wave 1, except in the rare case of a diagonal triangle formation.

These rules are still valid and we apply it every day, but adjustment like extensions, details, momentum in triangles, RSI divergences in wave 5, cycles and sequences need to be added to the Theory in other for it to be applied in the proper way.

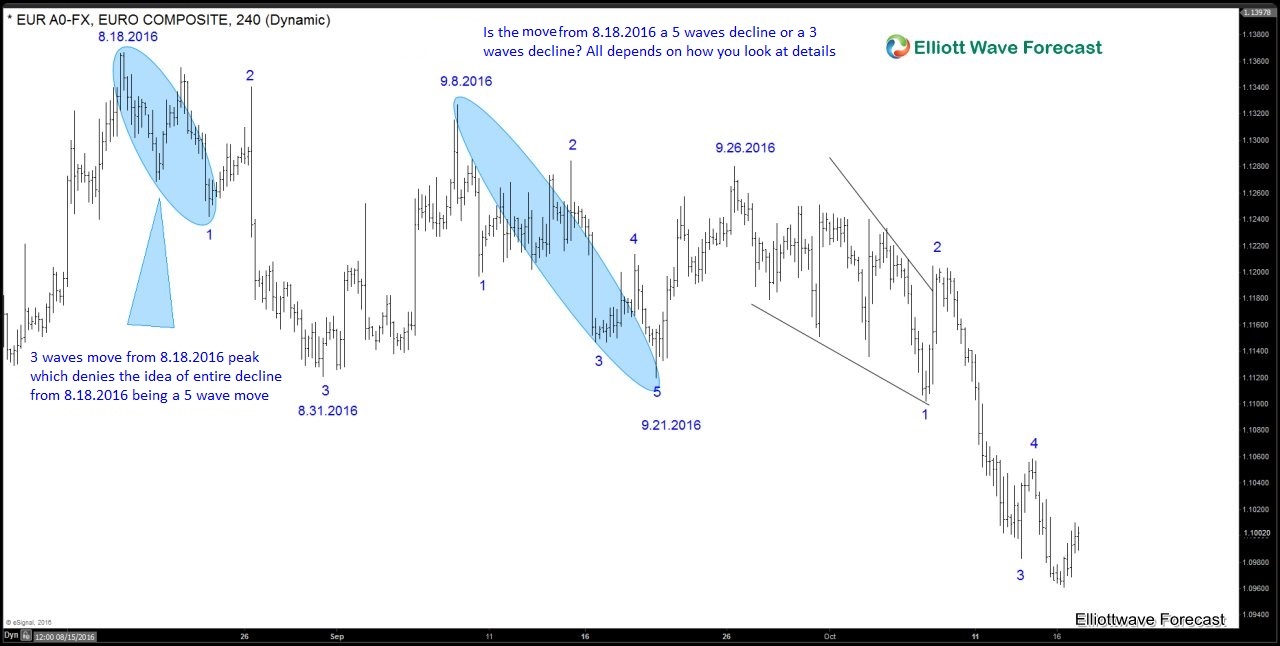

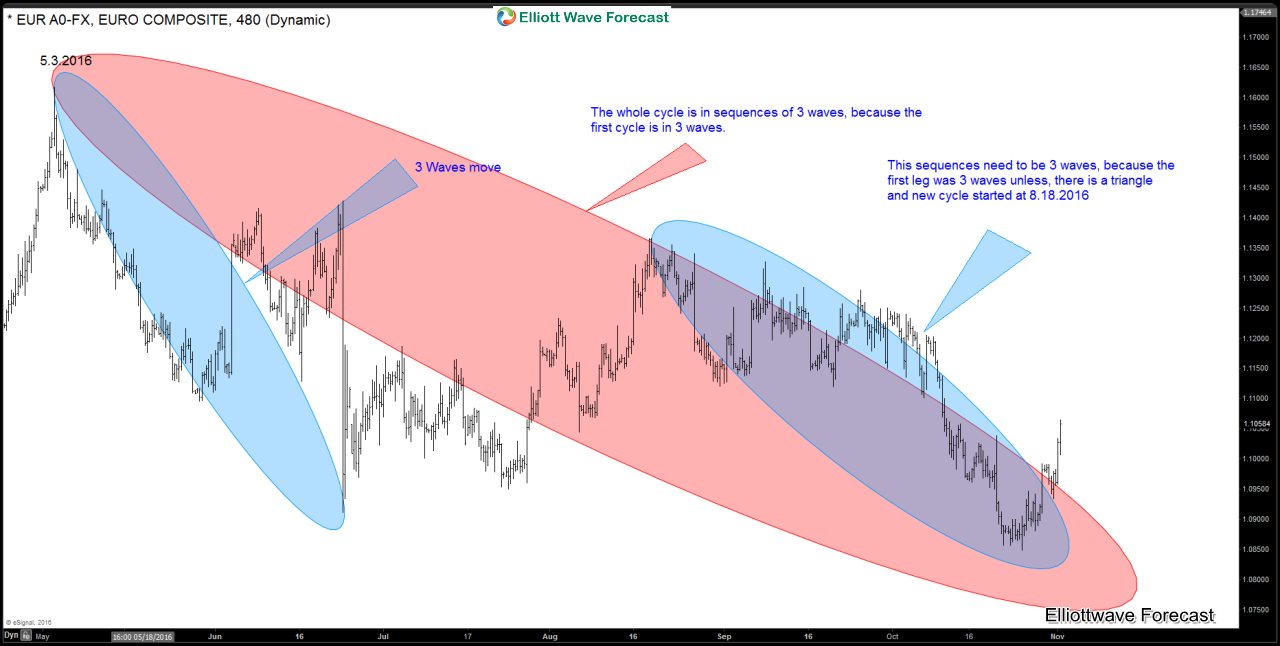

Details are also a huge issue with many wavers because we, as humans, tend to take the easy way out and consequently, most of the times realise what happened in hindsight. When EURUSD dropped from peak at 8.18.2016 and accelerated lower, later around 10.17.2016 low, everyone started counting the decline to be an incomplete 5 wave move and then the reality hit and now there are no more 5 waves and all we can see down from 8.18.2016 peak is a 3 waves. The Theory said, that every sub wave of a 5 waves move needs to be in 5 waves in every single time frame, and consequently, when that is not the case, the whole higher degree move cannot be 5 waves. The Next 2 charts explain this in more detail, we never saw the move from 8.18.2016 as 5 waves because the initial decline from 8.18.2016 peak is in 3 waves and then the previous sequences was in 3 waves and too shallow to be a contracted triangle which is not supported in momentum. If a waver followed those details, they would not have been chasing 5 waves lower and would have expected a bounce in EURUSD. So, reality is that details matter, and most of the times the wavers or traders get frustrated when Elliott wave theory does not work and place all the fault in the Elliott wave theory when the reality is that sometimes it’s not the theory but we as wavers do not follow or look into the details like every sub wave of an impulse wave needs to be in 5. Also, each sub wave needs to to have divergence in 5 and the completed cycle needs to show 3 divergence at the end. Also, that a triangle needs to be contracted in both price and momentum. All these new additions would have forecast the reaction in EURUSD and avoided the trap of chasing 5 waves in every move and blaming the Theory for it later on.

We hope this blog helps to make everyone a better waver and also understand our mission of developing a better Theory without denying the basic rules and great work of Mr Elliott. We are leader and we do not need to follow something for the sake of following. We do two daily live analysis session in which we teach a lot of these concepts and the market dynamics and of course provide the forecast for the market. If you liked what you read and want to learn more about our techniques, you can sign up for a Free 14 day Trial here.

Back