5 Waves advance is a concept in Elliott Wave Theory which is named after Ralph Nelson Elliott (28 July 1871 – 15 January 1948). He was an American accountant and author. Inspired by the Dow Theory and by observations found throughout nature, Elliott concluded that the movement of the stock market could be predicted by observing and identifying a repetitive pattern of waves.

Elliott was able to analyze markets in greater depth, identifying the specific characteristics of wave patterns and making detailed market predictions based on the patterns. Elliott based part his work on the Dow Theory, which also defines price movement in terms of waves, but Elliott discovered the fractal nature of market action. Elliott first published his theory of the market patterns in the book titled The Wave Principle in 1938.

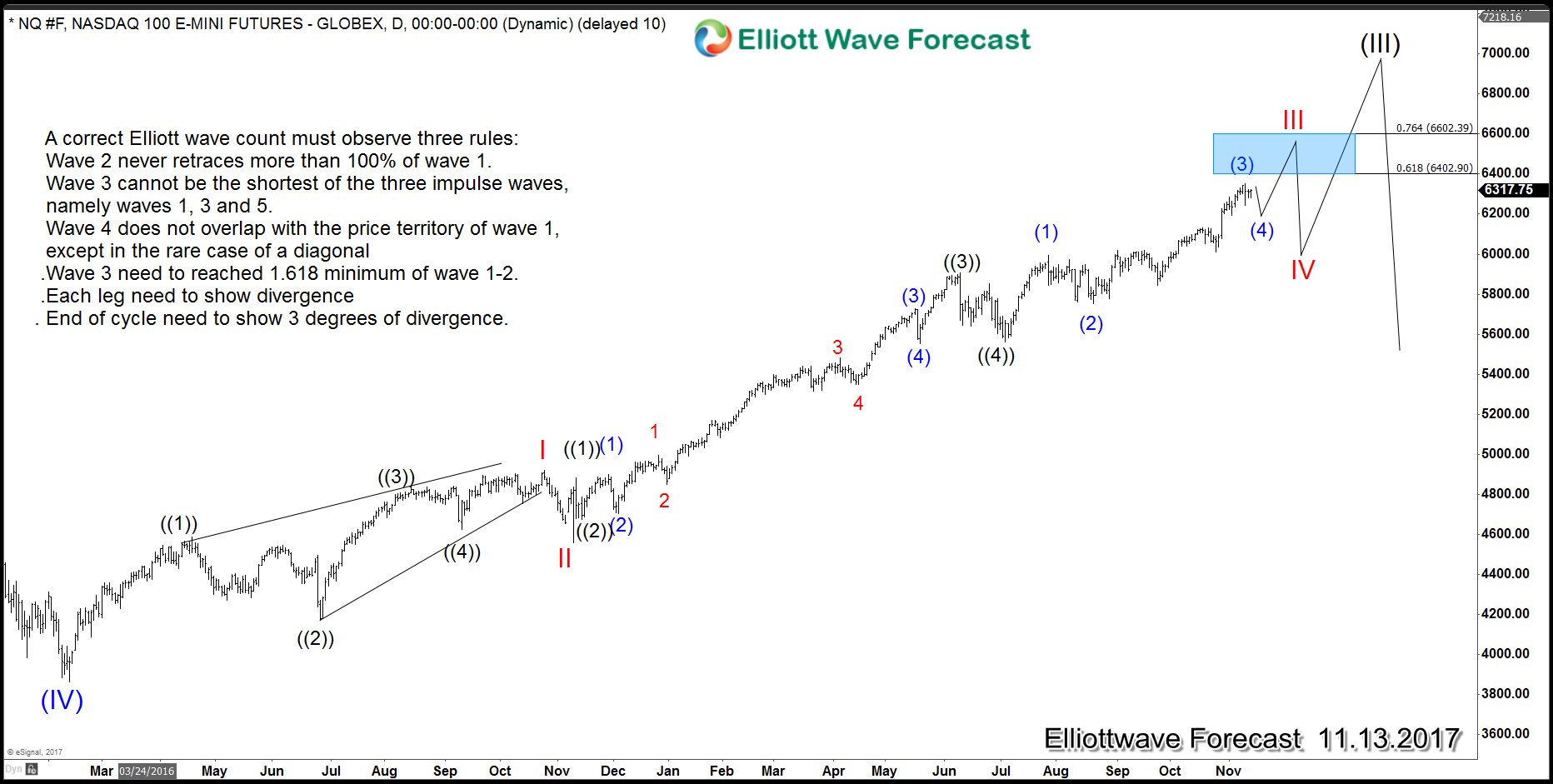

The Pattern can be described as movement in the direction of the trend is unfolding in 5 waves (called motive wave) while any correction against the trend is in three waves (called corrective wave). The movement in the direction of the trend is labelled as 1, 2, 3, 4, and 5. The three wave correction is labelled as a, b, and c. These patterns can be seen in long term as well as short term charts.

This is an example of the 5 waves with all sub-divisions also in 5 waves.

Guidelines

- Impulse wave subdivides into 5 waves. In Figure 2, the impulse move is subdivided as 1, 2, 3, 4, 5 of minor degree

- Wave 1, 3, and 5 subdivisions are impulse. The subdivisions in this case are ((i)), ((ii)), ((iii)), ((iv)), and ((v)) in minute degree.

- Wave 2 can’t retrace more than 100% of wave 1 i.e. It can’t go beyond the beginning of wave 1

- Wave 3 can not be the shortest wave of the three impulse waves, namely waves 1, 3, and 5

- Wave 4 does not overlap with the price territory of wave 1

- Wave 5 needs to end with momentum divergence

- Each leg need to have divergence and wave wave 3 of 3 needs to hold the higher momentum.

- Wave 3 needs to be at least 1.618 extension related to 1-2, otherwise become an ABC.

The following chart and video explain the 5 waves in the NQ #F (NASDAQ 100 E-MINI FUTURES) since lows at 2.2016

NQ_5 5 Waves Advance Video

We explain how each leg is following the 5 waves advance (Impulse) and how they should develop into the future. Avoid breaking any of the rules, otherwise the idea will be incorrect. Times have changed and we have more tools like RSI to determine and provide a better forecast than in 1930’s, so we have been adding new ideas to the theory some of which could be found at our Free page on Elliott Wave Theory.

Back