In this technical article we’re going to take a quick look at the Elliott Wave charts of Soybeans Futures ( $ZS_F ) , published in members area of the website. As our members know, ZS_F has recently given us 3 waves recovery against the 1.36703 peak. The commodity found sellers appeared right at the equal legs zone. Let’s break down our Elliott Wave forecast further in this article.

ZS_F H1 Update 07.19.2024

The current analysis indicates that the ZS_F commodity is undergoing a ((iv)) black recovery, which is correcting the cycle from the 1169’6 peak. This recovery appears to be unfolding as an Elliott Wave Zig Zag Pattern. However, the price structure of the correction remains incomplete at this moment. Consequently, we anticipate further upside movement in the near term, targeting the 1116’1-1133’0 area, which is identified as the selling zone. Within this zone, we expect sellers to emerge, which could potentially lead to a further decline towards new lows. Therefore, we do not recommend buying this commodity. Instead, we advise taking short positions from the marked area.

Reminder : You can learn more about Elliott Wave Patterns at our Free Elliott Wave Educational Web Page.

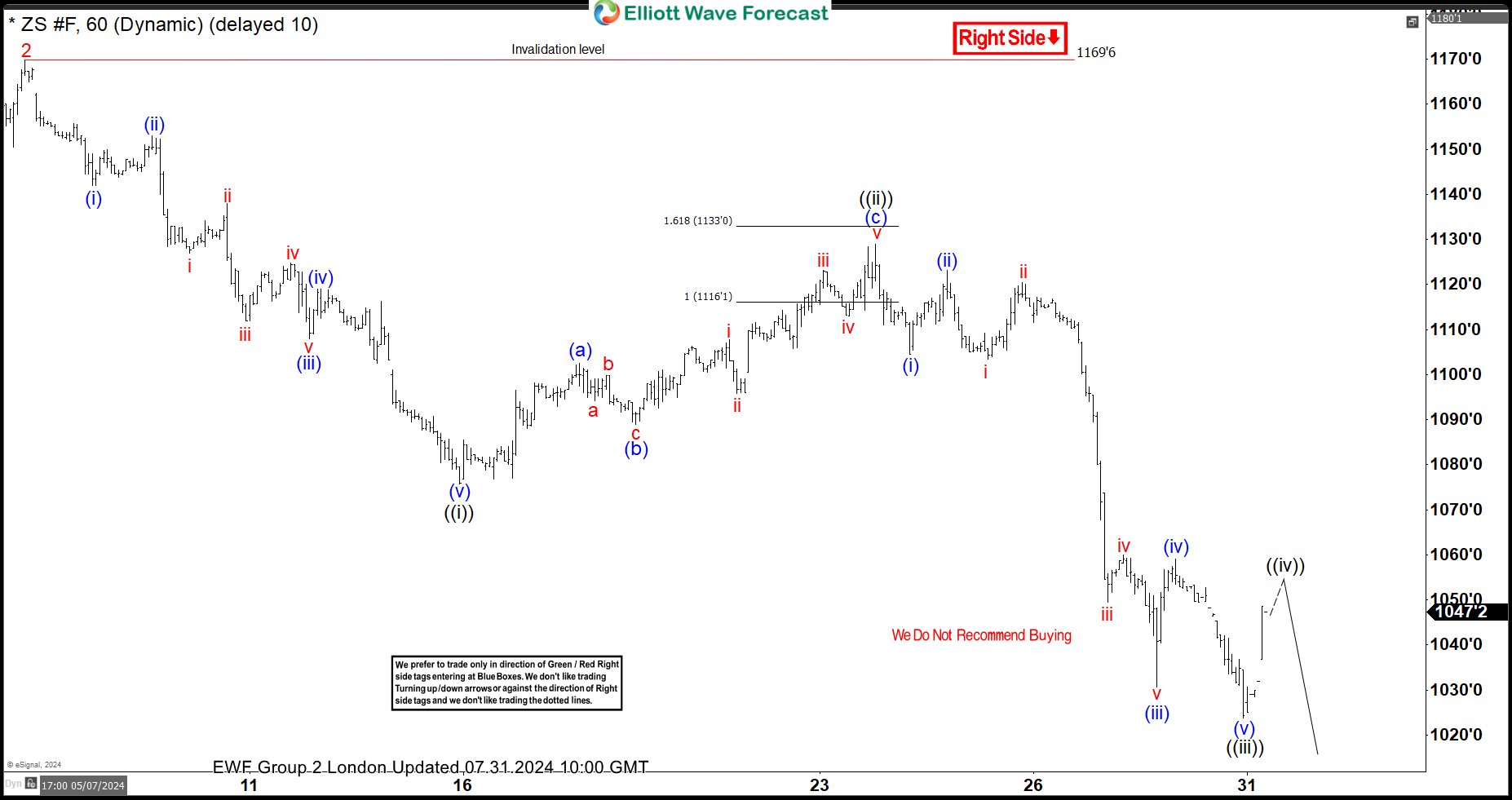

ZS_F H1 Update 07.31.2024

Soybeans Futures has found sellers as expected, resulting in a significant decline from the Equal Legs zone. As a result, the commodity has broken the previous low, confirming that the next leg down is in progress. We advise against buying the commodity during any bounce. We keep favoring the short side. The optimal strategy is to sell the rallies in 3, 7, or 11 swings against the 1169’6 pivot.

Remember, the market is dynamic, and the presented view may have changed in the meantime. For the most recent charts and target levels, please refer to the membership area of the site. The best instruments to trade are those with incomplete bullish or bearish swing sequences. We put them in Sequence Report and best among them are presented in the Live Trading Room

New to Elliott Wave ? Check out our Free Elliott Wave Educational Web Page and download our Free Elliott Wave Book.