Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

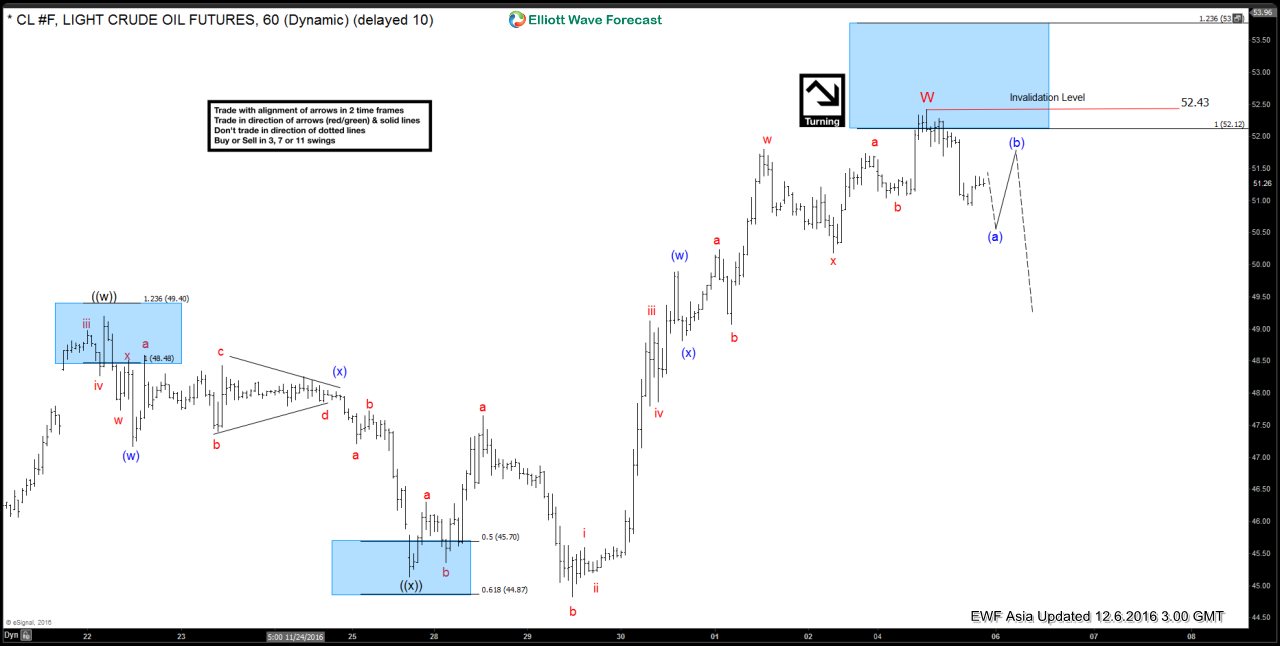

Oil Elliott Wave Forecast 12.6.2016

Read MoreShort Term Oil Elliott wave forecast suggests that the rally from 11/14 low is unfolding as a double three where wave ((w)) ended at $49.2, wave ((x)) ended at $44.82. and wave ((y)) of W is proposed complete at $52.43. Near term, while bounces stay below there, oil is expected to turn lower within wave X […]

-

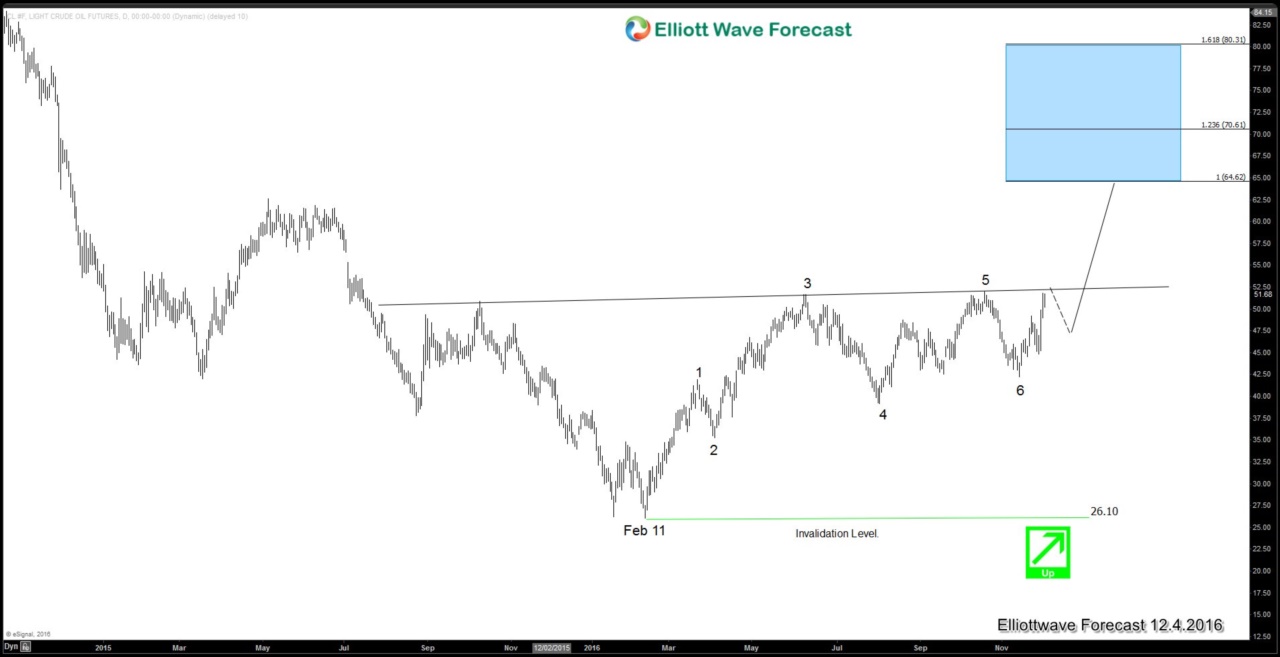

Oil Elliott Wave Sequence is Bullish

Read MoreOil’s price has been completely crushed in the past 3 years. From $112.2 peak in Aug 2013, Oil’s price dropped 77% until it finally found a support in Feb 2016 at $26. From Feb 2016 low, Oil Elliott wave sequence is showing 5 swing (daily chart below), which suggests that further upside is possible. Last Wednesday […]

-

Gold Forecast through Gold-to-Silver Ratio

Read MoreIn this article, we will attempt to do short term and medium term Gold forecast through the chart of Gold-to-Silver ratio. The aftermath of Donald Trump’s election initially saw Gold rallying 5% on Nov 9, only to be completely reversed. Since then, we saw U.S. Dollar’s rally accelerated against other major currencies. USD Index made […]

-

Trump Reflation Trade

Read MoreThe past decade has seen massive reliance on Monetary Policy by Central Bank to maintain economic momentum, but not enough Fiscal Policy or stimulative government intervention. The election of Donald Trump as the new U.S. president is thought to change that. In his first speech as president-elect, Mr. Trump highlighted investment in infrastructure, reinforcing the […]

-

Gold (XAUAUD) Elliott Wave Analysis calling for 2220

Read MoreIn February 2016, we spotted 5 swings up from April 2013 low (XAUAUD) and argued that by the time it completed 7 swings up from April 2013 low, it would have almost broken above August 2011 peak which will make the weekly sequence bullish. In 2nd quarter of 2016, we saw Gold (XAUAUD) making a […]

-

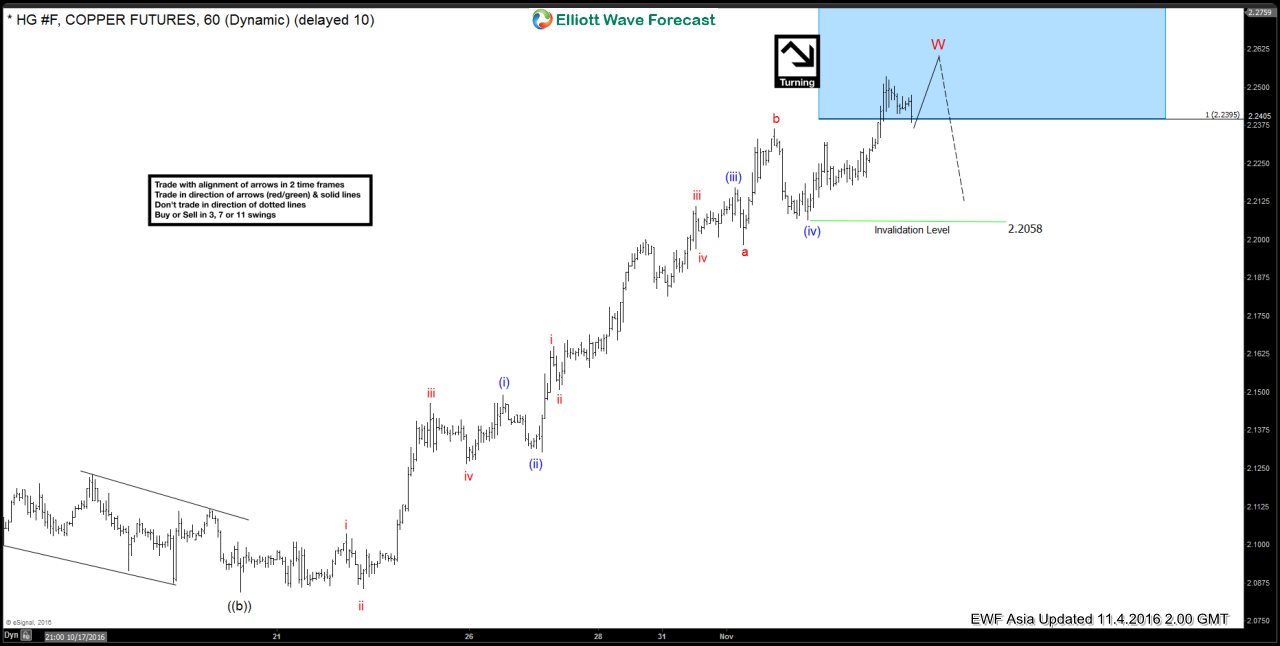

Copper Short-term Elliott Wave Analysis 11.4.2016

Read MoreBest reading of Elliott wave cycles suggests that cycle from 8/30 low is unfolding as a zigzag where wave ((a)) ended at 2.219 and wave ((b)) ended at 2.0845. Wave ((c)) is in progress as 5 waves and the metal has reached 100% of the ((a)) and ((b)) so minimum requirement is met to call wave […]