Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

HG_F (Copper): Impulsive Elliott Wave Rally

Read MoreHG_F (Copper) is up more than 4% this week and the rally from 12/5 (2.942) low started off in a choppy fashion but has gained enough legs to take the form of an impulse. In this blog, we will take a look at Elliott Wave labelling of the rally from 12/5 low in Copper metal. Below […]

-

Gold To Silver Ratio Showing Next Move for Silver

Read MoreHello fellow traders, in this article I want to discuss with you the Gold to Silver Ratio. Before we get into that let me explain it shortly. Well, the gold to silver says how many silver ounces it takes to buy one ounce of gold. Which basically tells us how many ounces of silver we […]

-

XAU AUD Elliott Wave View: 2016 Lows Still Holding

Read MoreBack in November 2016, we mentioned that XAUAUD should find buyers in 1540 – 1487 area and bounce ideally to resume the rally for new highs or in 3 waves at least. XAU AUD reached the mentioned area a few weeks later in December 2016, found a low at 1525 on 12/15/2016 and started rallying. Rally got rejected […]

-

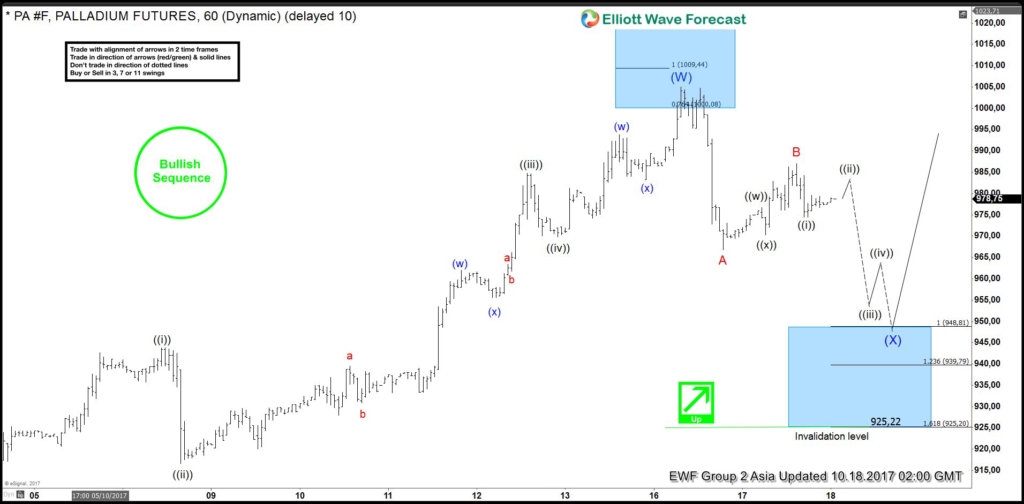

Palladium Buying the Elliott Wave dips

Read MoreIn this Technical blog, we are going to take a quick look at the past 1 hour Elliott Wave performance of Palladium. Which we presented to our clients at elliottwave-forecast.com. We are going to explain the structure from 10/16 (1005.21) cycle below. Palladium 1 Hour October 18 Asia updated Elliott Wave Chart A rally from 9/20 low (898.27) to 10/16 peak […]

-

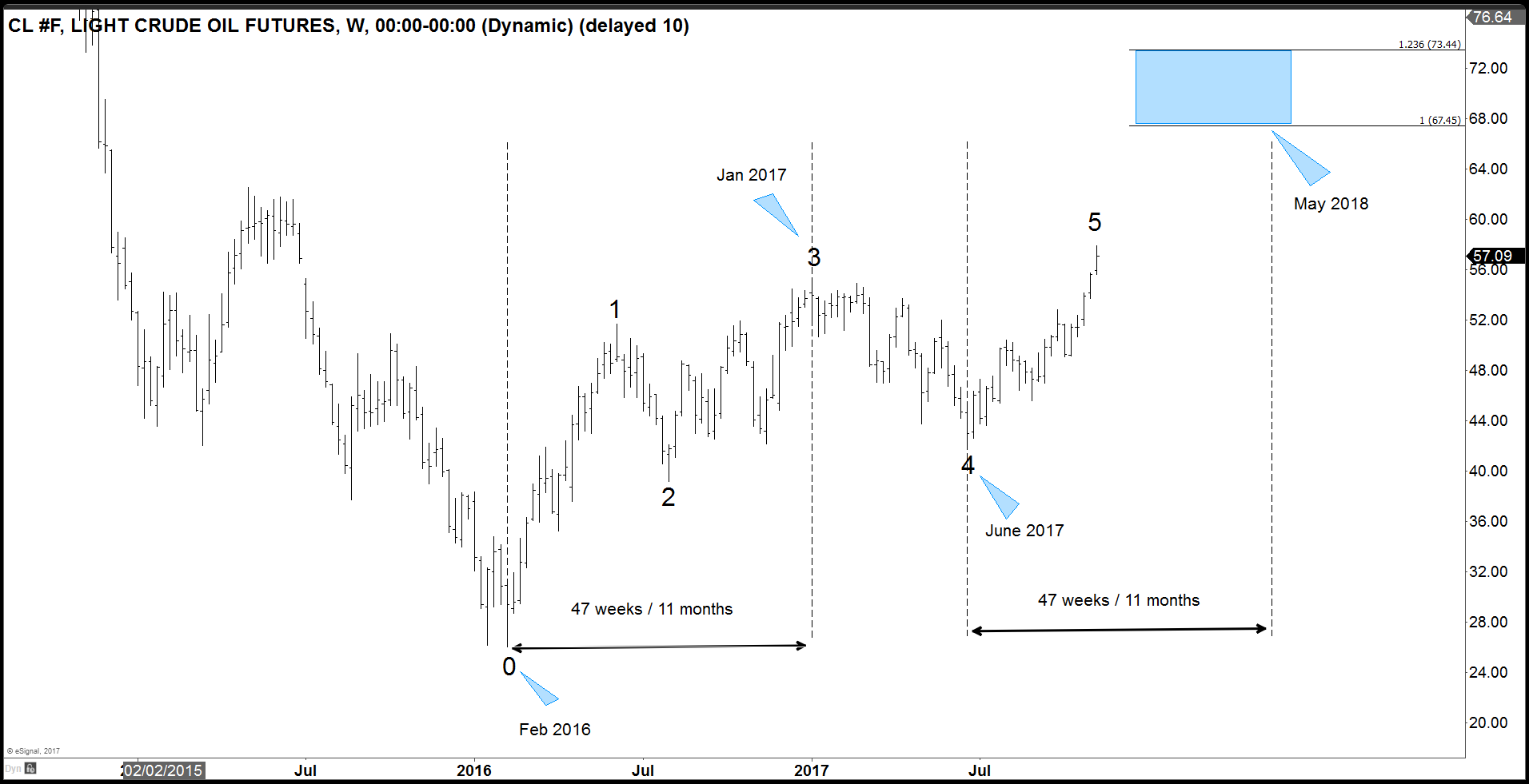

Oil markets turn bullish with shift to backwardation

Read MoreThis week both Brent Crude and WTI (Light Sweet Crude Oil) made a new price high in more than 2 years with Brent Crude rising to $64 per barrel and WTI to $57 per barrel. These price gains come before the OPEC’s meeting later this month on Nov 30. In the past two years, OPEC has imposed production cuts in […]

-

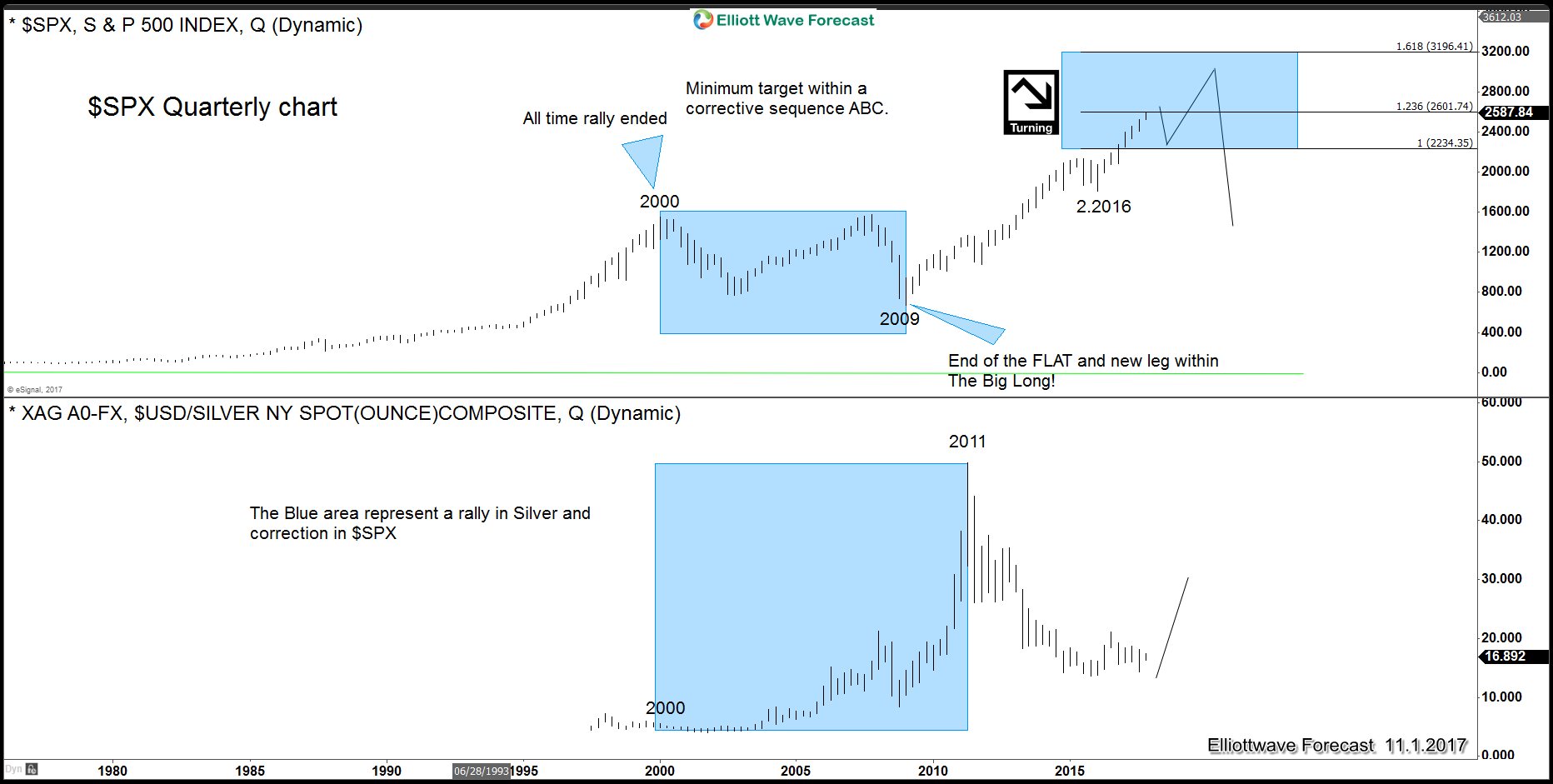

Silver: The Smartest Way to Sell The World Indices

Read MoreCommodities have been in an All-time correction since they peaked in 2011 and they can be showing the next good Long-term Trading or an Investing opportunity across the Market. Commodities like Silver and Gold have always represented value and we cannot expect that value to disappear all of a sudden. Silver is a very interesting […]