Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

Elliott Wave View Calling for Extension Higher in Oil

Read MoreOil shows a 5 waves up from June 5 low suggesting further upside is likely. This article and video shows the short term Elliott Wave path.

-

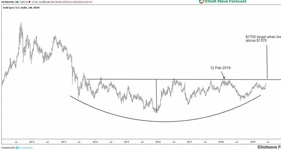

Gold Soars as Bets on US Rate Cut Grows

Read MoreAfter 5 months of correction, Gold found strength again and hit more than three-month high on Tuesday. The move higher comes on the expectation that the U.S. Federal Reserve would cut interest rate to offset the U.S – China trade war. Recent commentary by the Fed governors and Chair hinted the willingness to do a […]

-

Elliott Wave View: High Frequency Box Suggested Natural Gas Sell Off

Read MoreI want to share with you some Elliott Wave charts of Natural Gas Futures which we presented last month. You see the 4-hour updated chart presented to our clients on the 5/20/19. Natural Gas had a 4-hour right side tag against 2.910 peak suggesting more downside. It ended the cycle from 02/27/19 peak in black wave ((v)) at […]

-

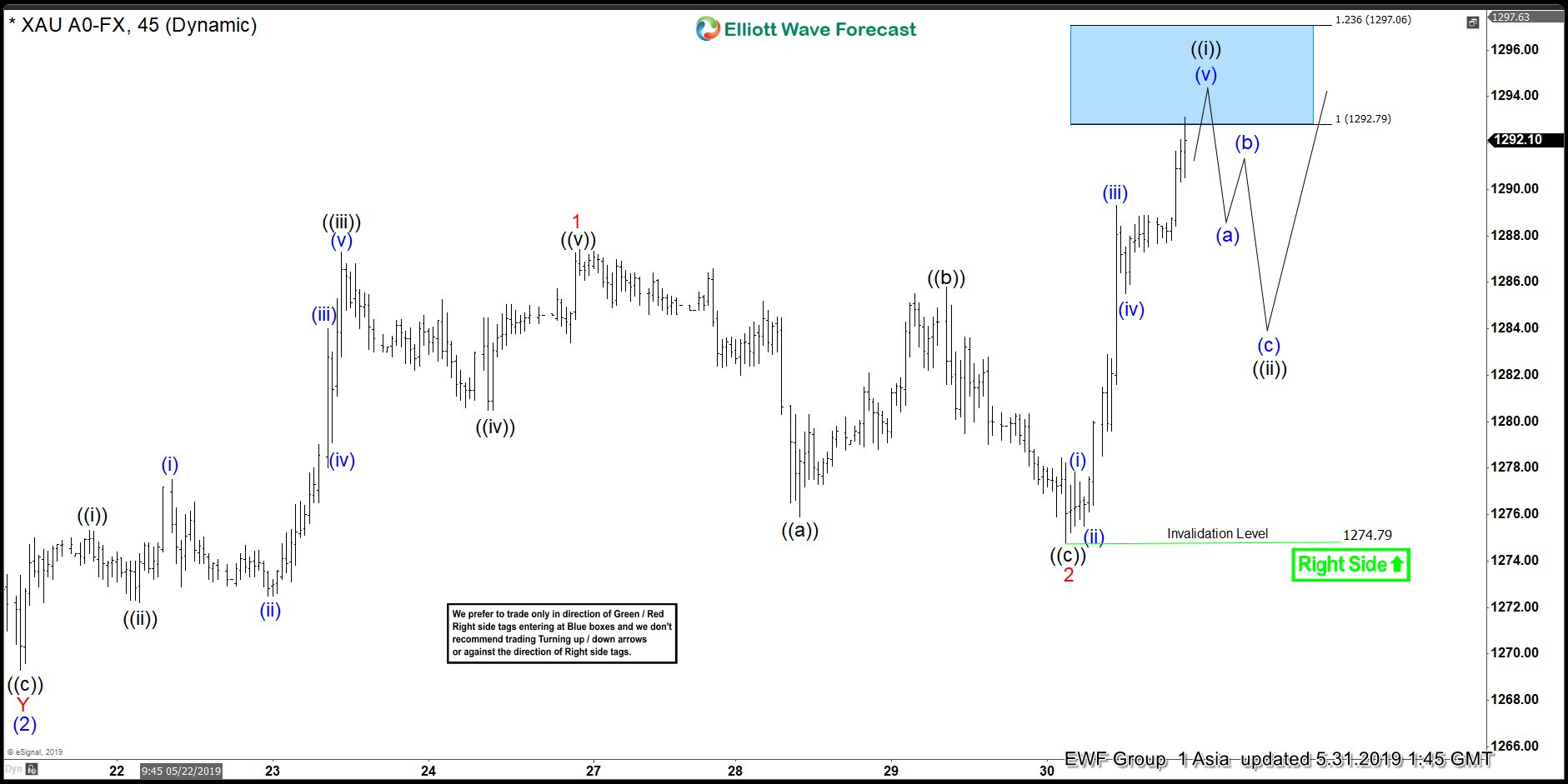

Elliott Wave View: Gold Should Remain Supported

Read MoreGold Elliott wave view suggests that it should remain supported & higher based on Silver reaching the extreme from Feb 2019 peak. This article & video talks the short term Elliott Wave paths.

-

Elliott Wave View: Oil Looking for Further Downside

Read MoreOil shows a 5 waves move from April 24 peak which gives a possibility of more downside.This article and video shows the short term Elliott Wave path.

-

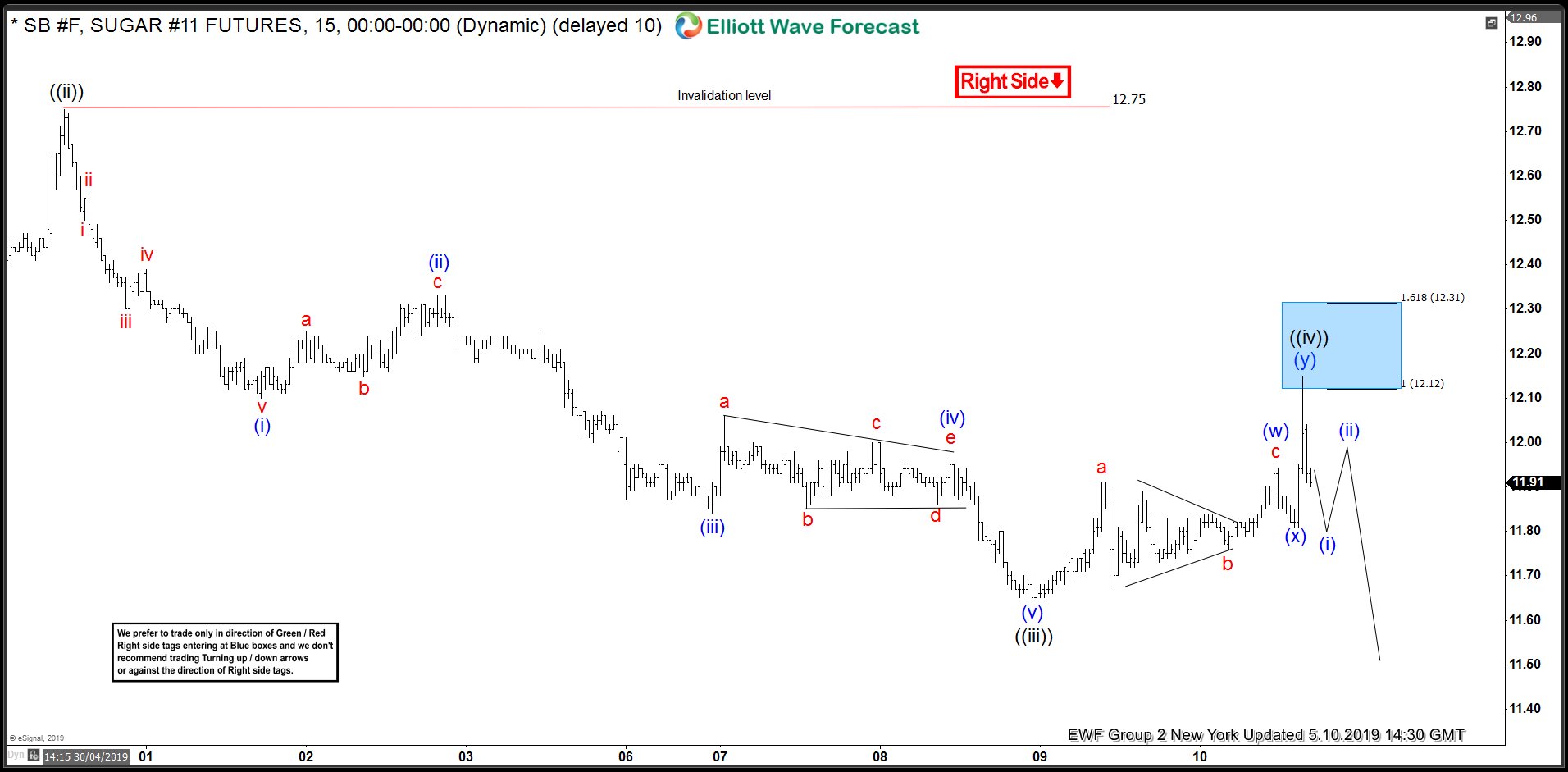

Sugar: Selling The Elliott Wave Bounces At Blue Box Areas

Read MoreIn this technical blog, we take a look at the past performance of 1 hour Elliott Wave charts of Sugar, in which our members took the advantage of blue box areas into the direction of the right side tag.