Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

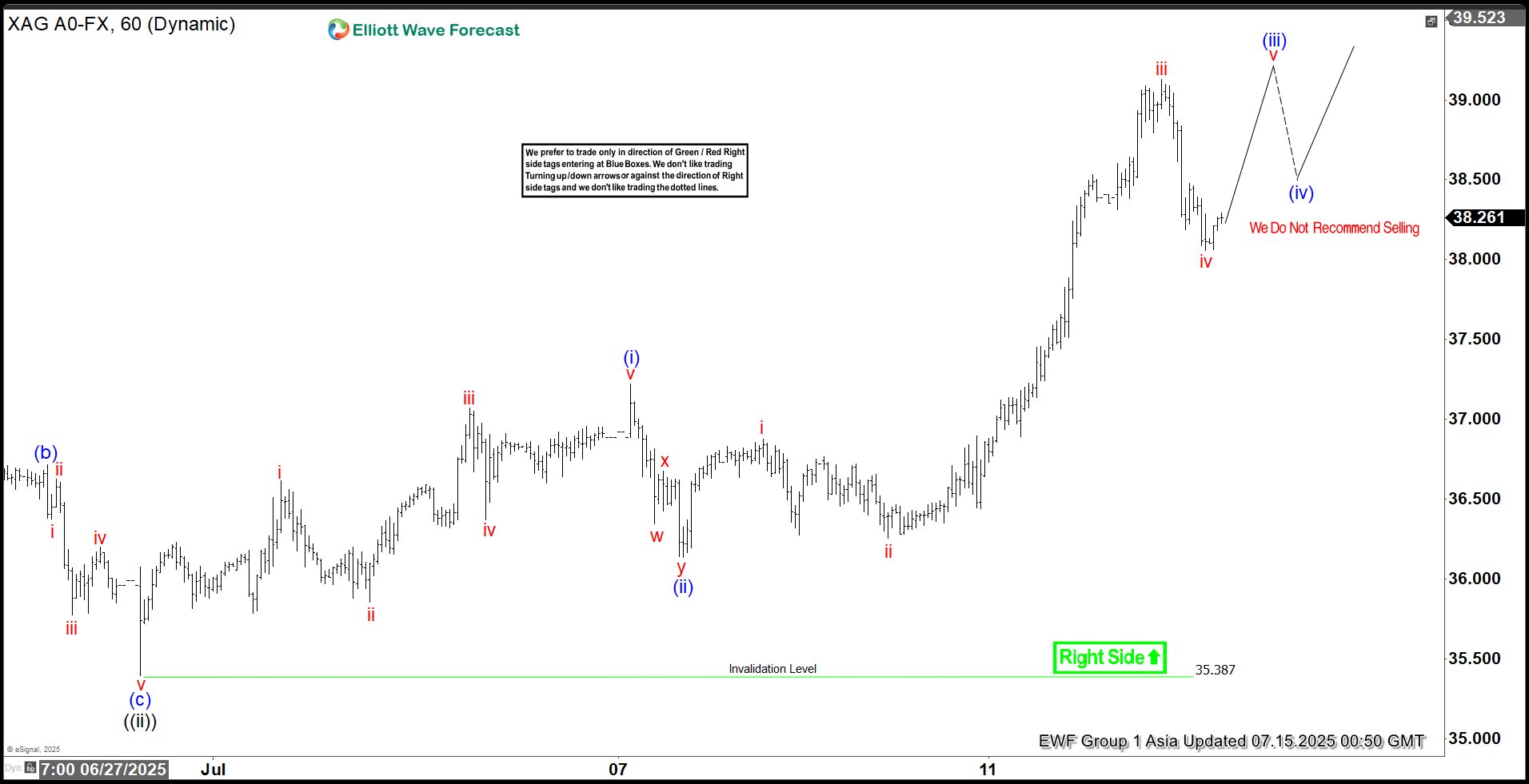

Elliott Wave Analysis: XAGUSD (Silver) Poised to Extend Higher in Nested Impulse

Read MoreSilver (XAGUSD) is extending higher in a nested impulse. This article and video look at the Elliott Wave path of the metal.

-

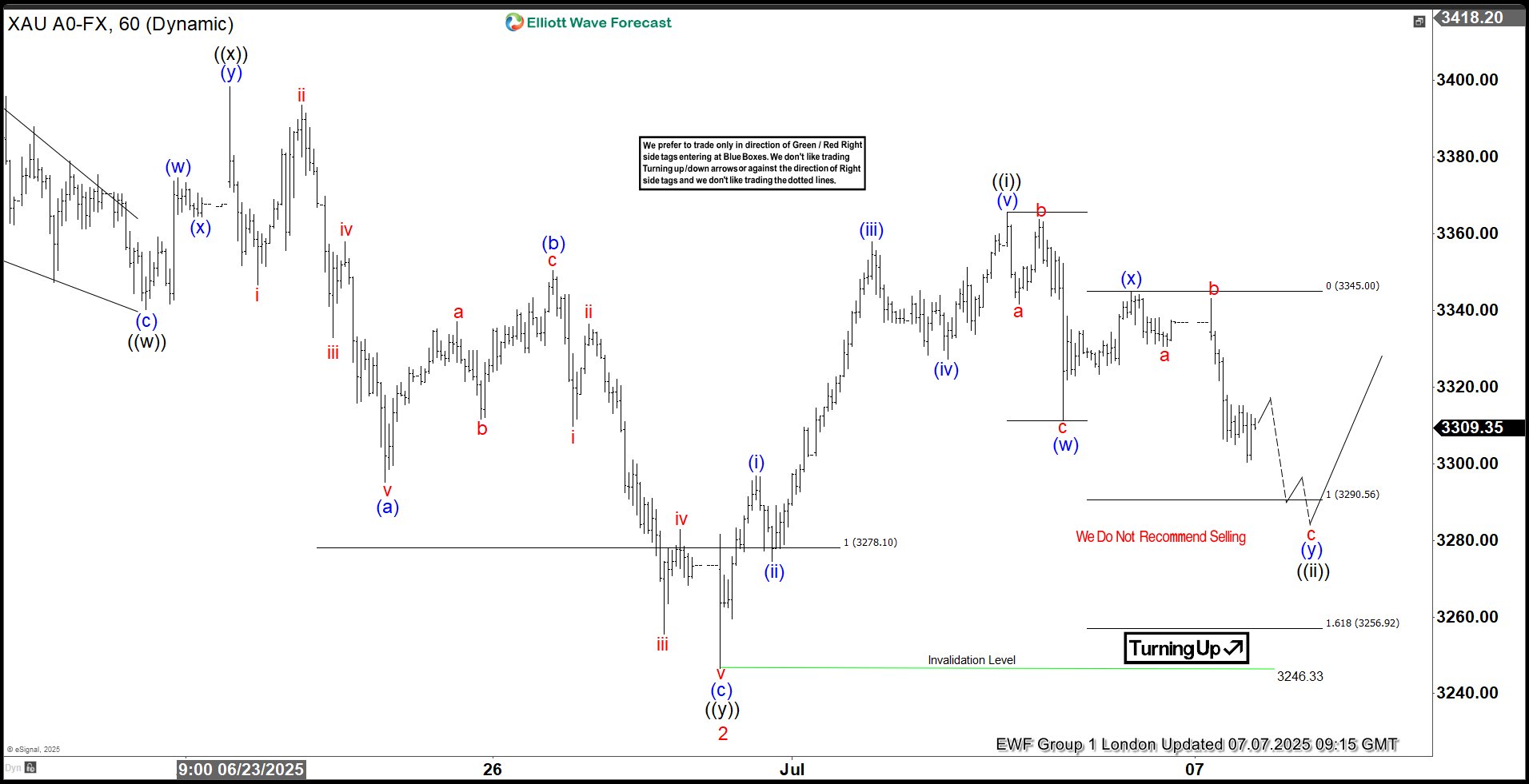

GOLD (XAUUSD) Calling the Rally from the Intraday Equal Legs Area

Read MoreHello fellow traders, In this technical article, we are going to present Elliott Wave charts of GOLD (XAUUSD) . As our members know we are long in GOLD from previous equal legs area. As a result, members are now benefiting from profits in positions that remain risk-free. Recently, the commodity completed another intraday correction within […]

-

GOLD (XAUUSD) Elliott Wave: Forecasting the Rally from the Equal Legs Area

Read MoreHello fellow traders, In this technical article, we are going to present Elliott Wave charts of GOLD (XAUUSD) . As our members know we are long in GOLD from previous equal legs area. As a result, members are enjoying profits in risk-free positions. Recently ,the commodity completed its intraday correction at the Equal Legs zone. […]

-

Elliott Wave Outlook: Gold (XAUUSD) Signals Bullish Trend Resumption

Read MoreGold (XAUUSD) has likely resumed the bullish trend. This article and video discusses the Elliott Wave path of the metal in the shorter cycle.

-

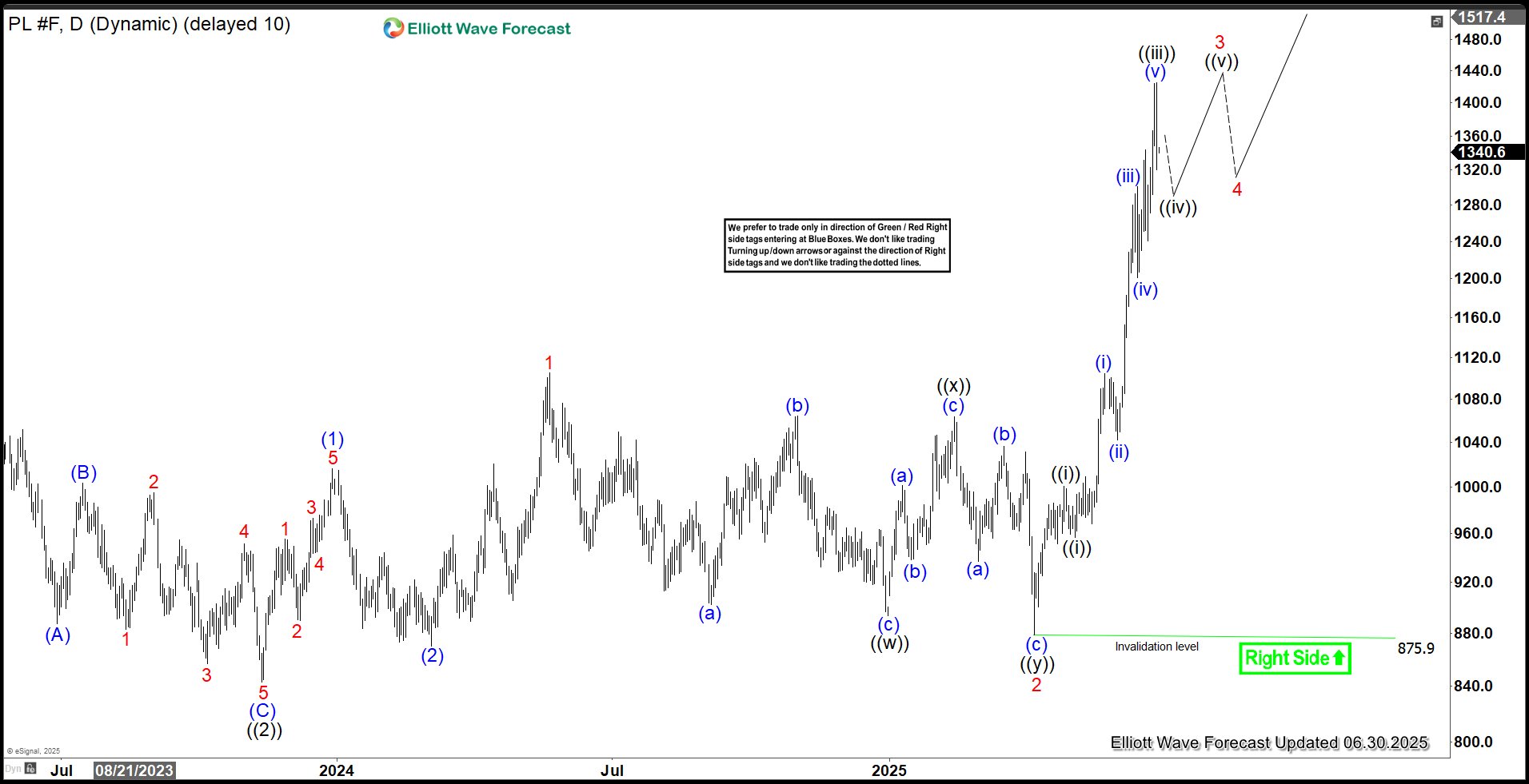

Platinum (PL) Soars, Kicking Off Fresh Bullish Rally

Read MorePlatinum (PL) has broken out of its bearish channel this month, signaling strong bullish trend momentum. This article explores the latest long-term Elliott Wave technical outlook. Platinum (PL) Monthly Elliott Wave Chart The monthly platinum chart indicates that the Grand Cycle wave ((II)) correction concluded at 562. The metal has since turned bullish, advancing in […]

-

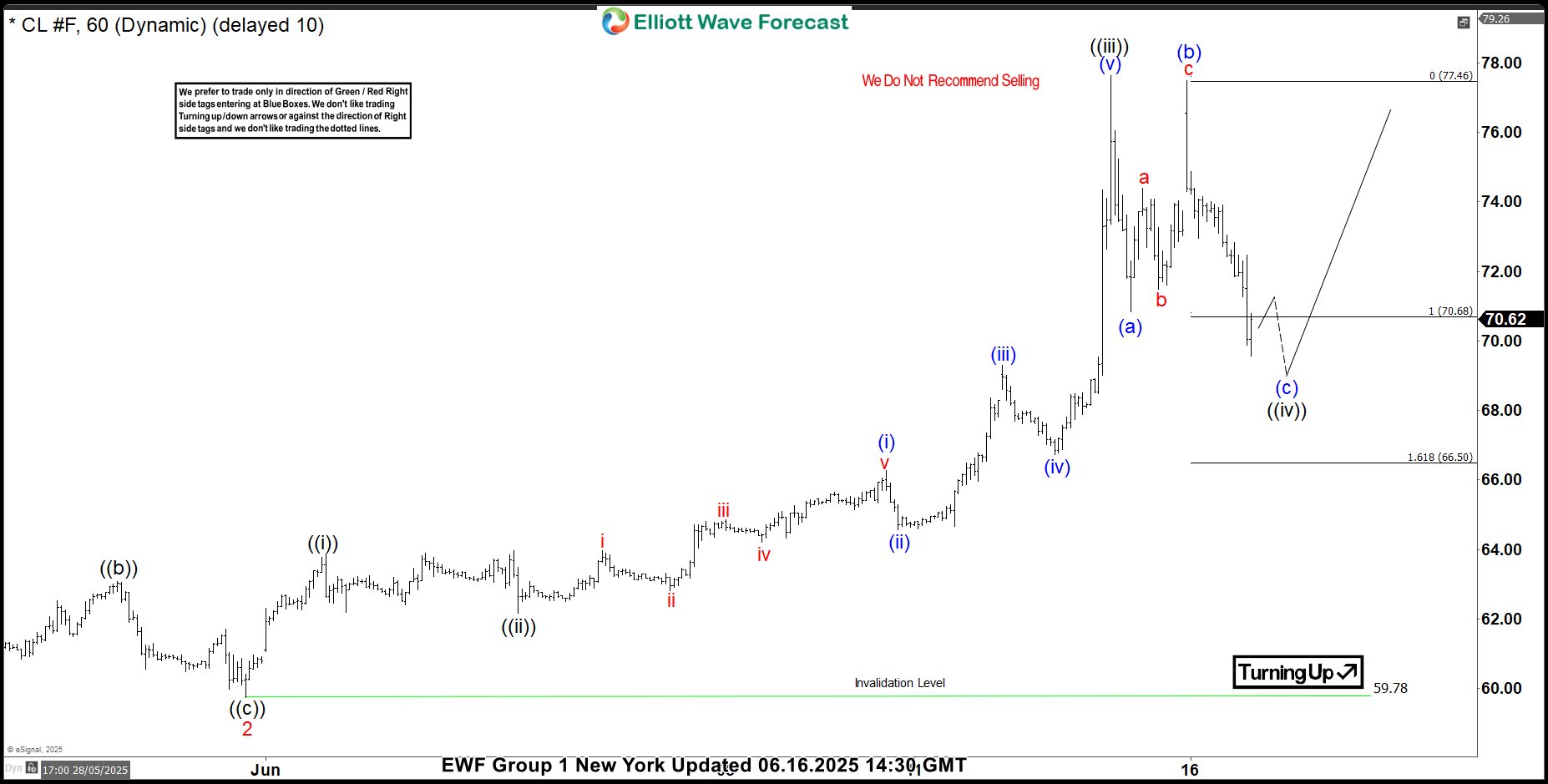

OIL (CL_F) Erased the Entire Gain Since the Start of the Conflict

Read MoreHello fellow traders. In this technical article we’re going to take a quick look at the Elliott Wave charts of OIL , published in members area of the website. As our members are aware, OIL is now potentially forming irregular Flat pattern against the 55.25 low. Recently we saw a clear 3-wave pullback, followed by […]