Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

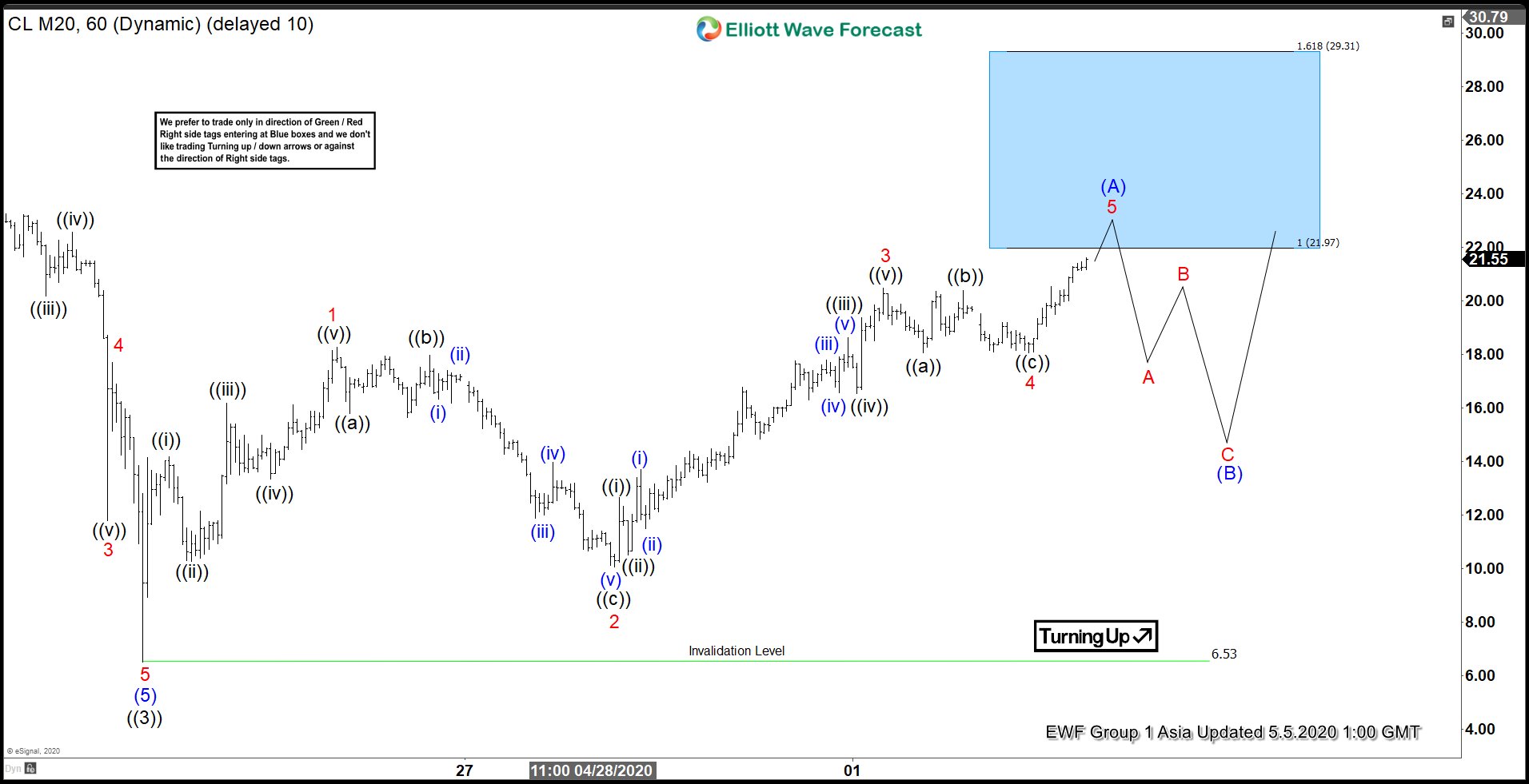

Elliott Wave View: Leading Diagonal in Oil

Read MoreOil shows 5 waves rally from 4.22.2020 low as a leading diagonal, favoring more upside. This article & video looks at the Elliott Wave path.

-

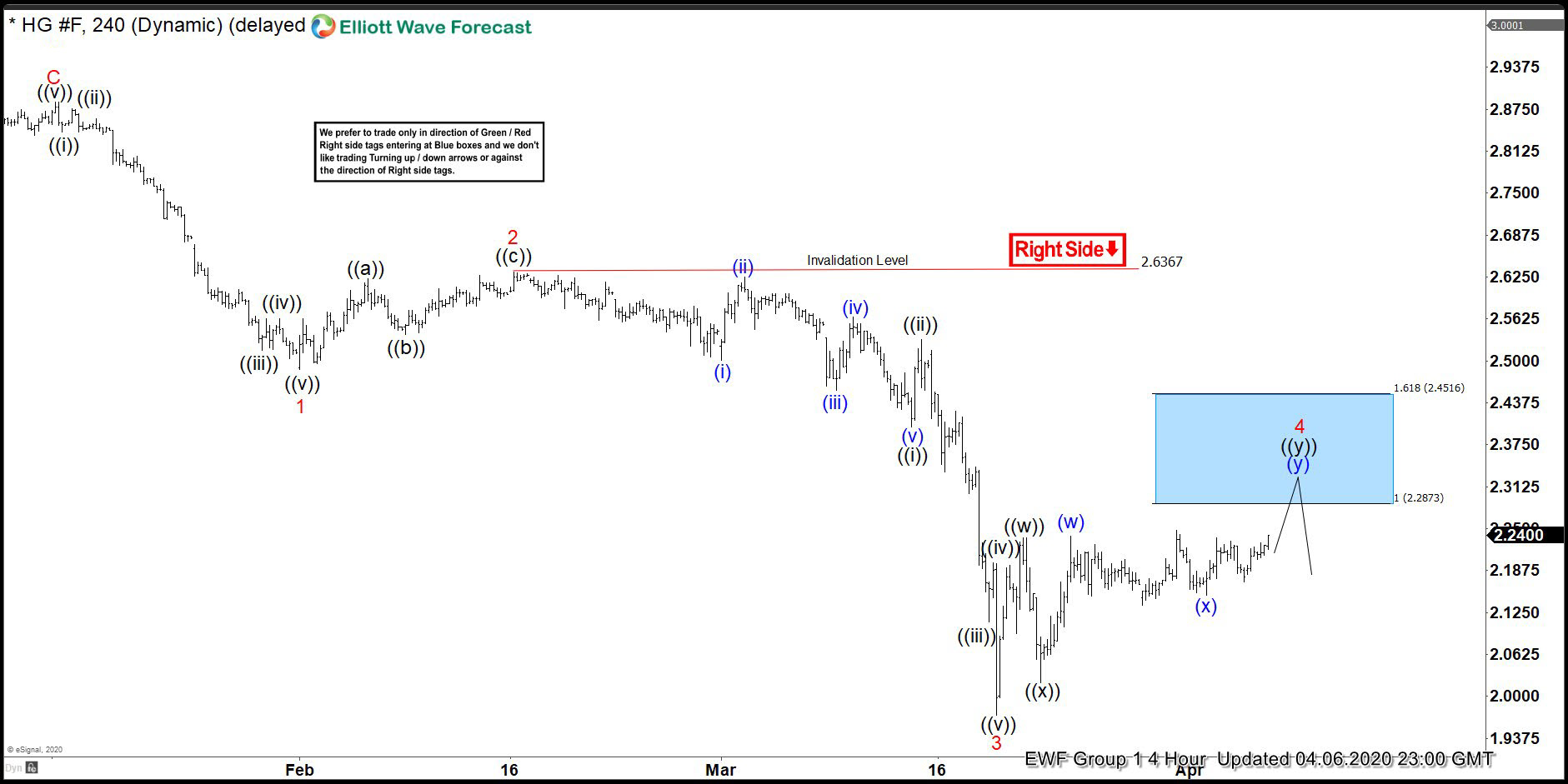

COPPER ( $HG_F ) Forecasting The Decline From The Blue Box Area

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the charts of COPPER ( $HG_F ) published in members area of the website. As our members know, COPPER has given us recovery against the January 16th peak that unfolded as Elliott Wave Double Three Pattern. We advised clients to […]

-

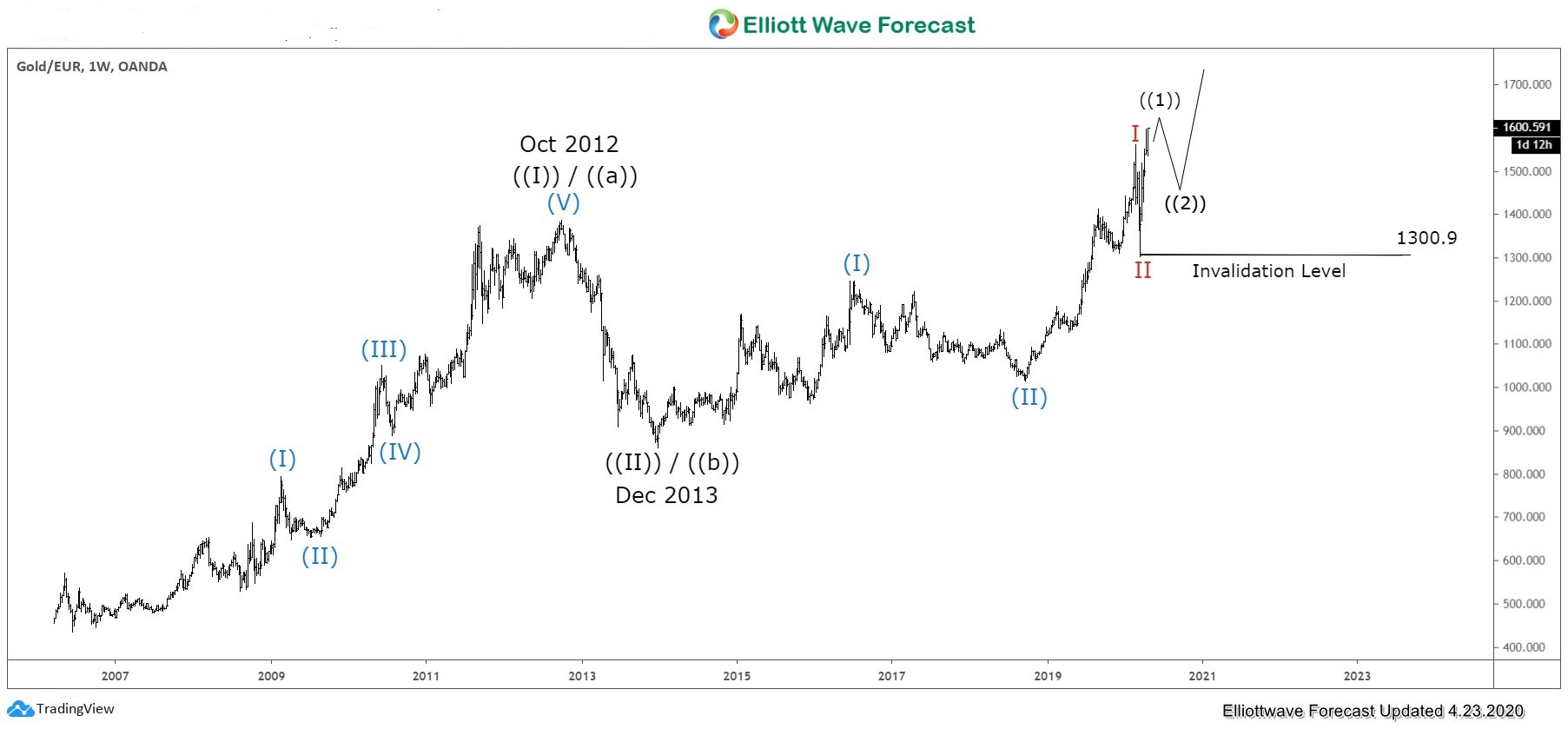

Gold against Euro Dollar (XAUEUR) Running to All-Time High

Read MoreIMF (International Monetary Fund) projects the European nations will experience a 7.5% GDP contraction this year. EU nations have been some of the hardest hit by Covid-19. Even before the pandemic, the European economy is already sluggish. The NIRP (Negative Interest Rate Policy) and ZIRP (Zero Interest Rate Policy) have not produced better results. These […]

-

Elliott Wave View: Crude Oil (CL_F) Sellers Remain In Control

Read MoreDecline from April 23, 2019 high in Oil (CL_F) remains in progress as a 5 waves impulse. Down from April 23, 2019 high, wave (1) ended at 50.6 and wave (2) bounce ended at 65.65. Oil then resumed lower in wave (3) to 19.46, and wave (4) bounce ended at 29.21. Short term chart below […]

-

Corn Futures Incomplete Elliott Wave Sequence Favours More Downside

Read MoreCorn Futures have been trade lower for the last couple of months so today we would take a look at how we called the decline in Corn Futures based on the initial decline from June 2019 being in 5 waves and incomplete sequence from October 2019 peak. Let’s take a look at the daily chart […]

-

Elliott Wave View: Gold Rallying as an Impulse

Read MoreShort Term Elliott Wave View suggests rally in Gold (XAUUSD) from March 16 low is unfolding as a 5 waves impulse Elliott Wave structure. Up from March 16 low, wave ((1)) ended at 1519.57, and pullback in wave ((2)) ended at 1454.90. The precious metal has resumed higher in wave ((3)) towards 1645.5 and wave […]