Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

Copper Looking for Bullish Breakout

Read MoreSince bottoming in January 2016 low at $1.93, Copper has traded in a narrow range between $1.9 – $3.3. Earlier this year, the red metal collapsed to the lowest in more than 4 years at $1.9725. This happened due to the Covid-19 breakout around the world which dampens global growth. However, despite the extremely challenging […]

-

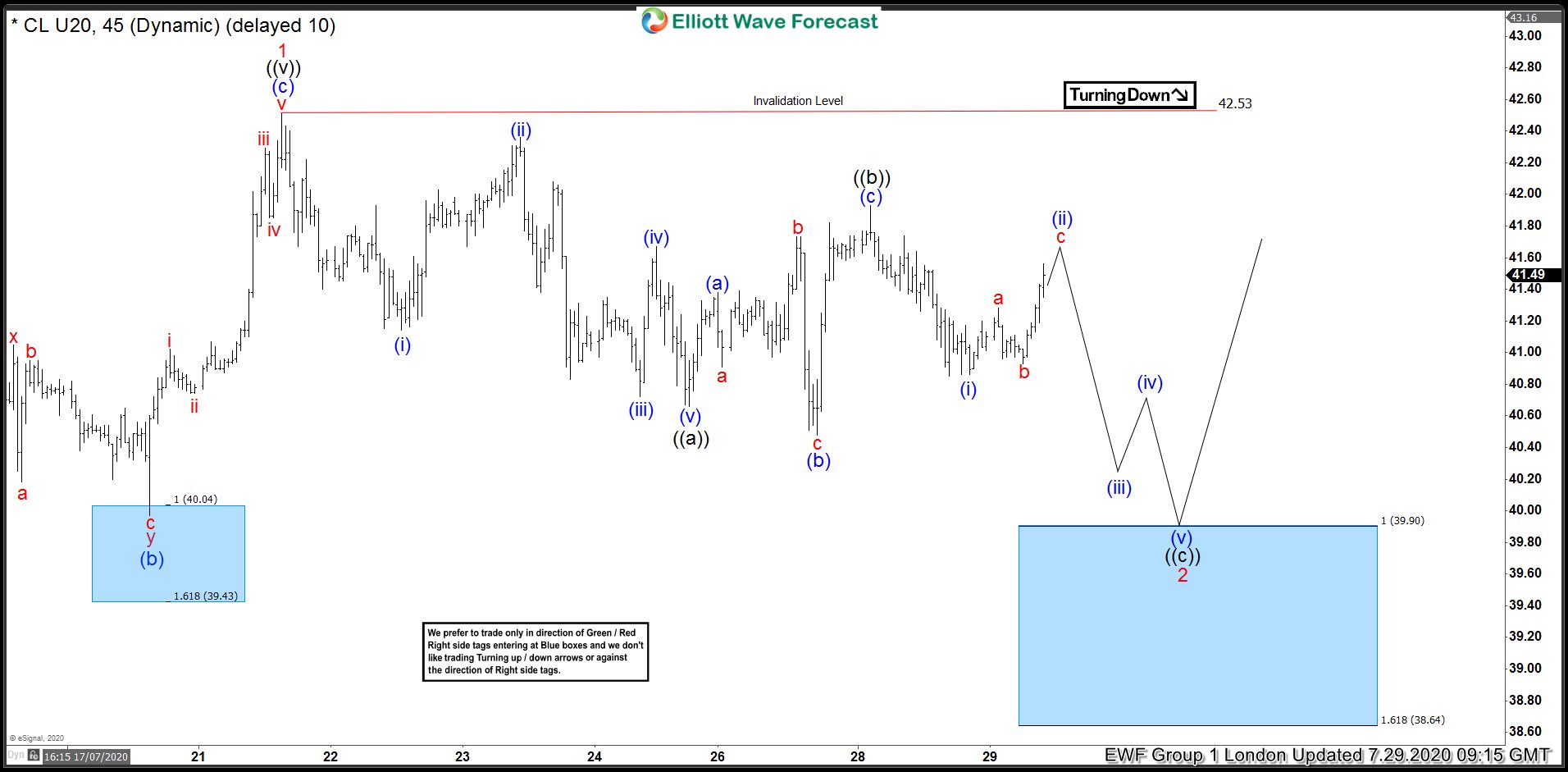

OIL ( $CL_F) Forecasting The Rally From The Blue Box Area

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of OIL , published in members area of the website. As our members know, commodities have been giving us nice profits recently. OIL is another commodity that has given us rally from the Blue Box area. […]

-

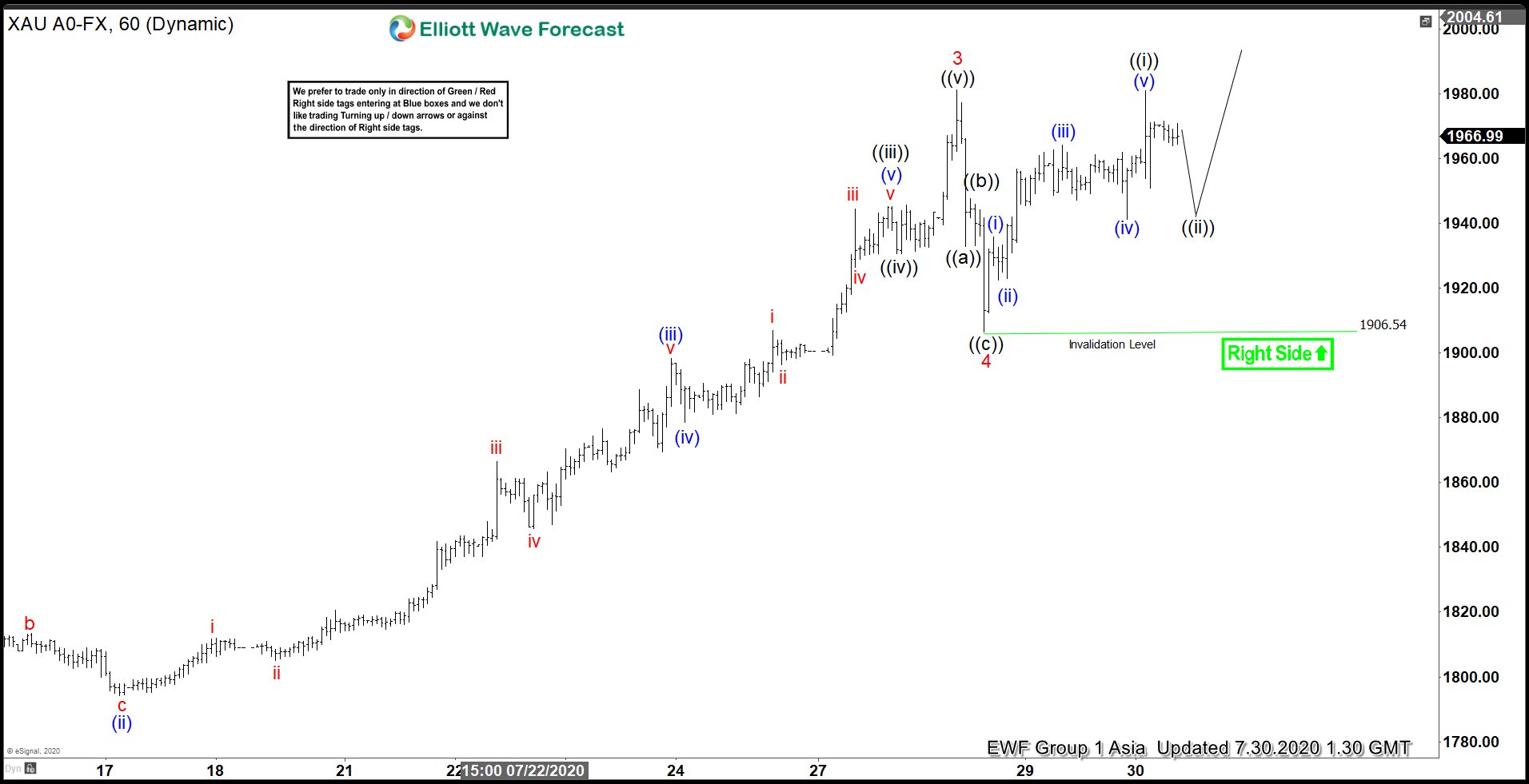

Elliott Wave View: Break to Record High in Gold Confirms Bullish Market

Read MoreGold broke above September 2011 high. While above July 28 high, expect dips in 3,7 or 11 swings to find support for further upside later.

-

Break to New All-Time High in Gold Confirms Bullish Market

Read MoreGold has made a new all-time high suggesting the next leg higher has started. This article discusses potential target for Gold using Elliott Wave.

-

Elliott Wave View: Silver Has Room for More Upside

Read MoreSilver extended higher from July 14 low. While above that low, expect dips in 3,7 or 11 swings to find support for further upside.

-

OIL Reacting Higher Perfectly From Elliott Wave Blue Box Area

Read MoreIn this blog, we take a look at the past performance of 1 hour Elliott Wave charts of OIL In which our members took advantage of the blue box areas.