Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

Elliott Wave View: Further Downside to End Gold Correction

Read MoreGold still has scope to extend lower to reach the extreme area from August 7 high before buyers appear. This article and video look at the Elliottwave path.

-

Wheat Continued Rally Higher After Zigzag Correction

Read MoreIn this blog, we are going to take a look at the Elliott Wave chart of Wheat Futures (ZW_F). The 4 hour chart update from September 9 shows that wheat has ended the cycle from August 12 low as wave 3 at 568.4 high. A 3 waves pullback in wave 4 is expected to unfold […]

-

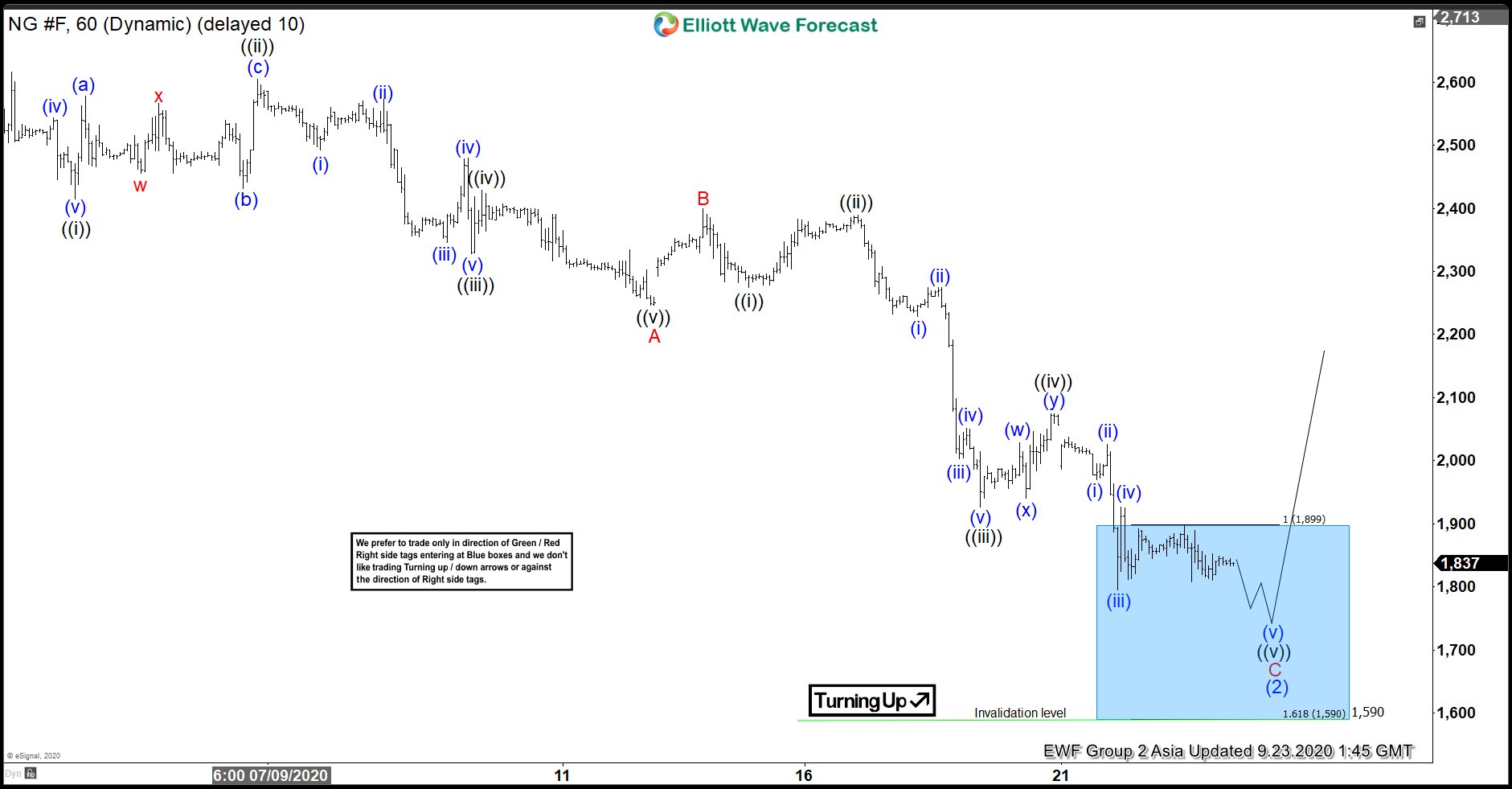

Natural Gas: Elliott Wave Hedging Called For A Minimum 3 Waves Reaction At Minimum

Read MoreIn this blog, we take a look at the past performance of 1hr Elliott Wave charts of Natural Gas, In which our members took advantage of the blue box areas.

-

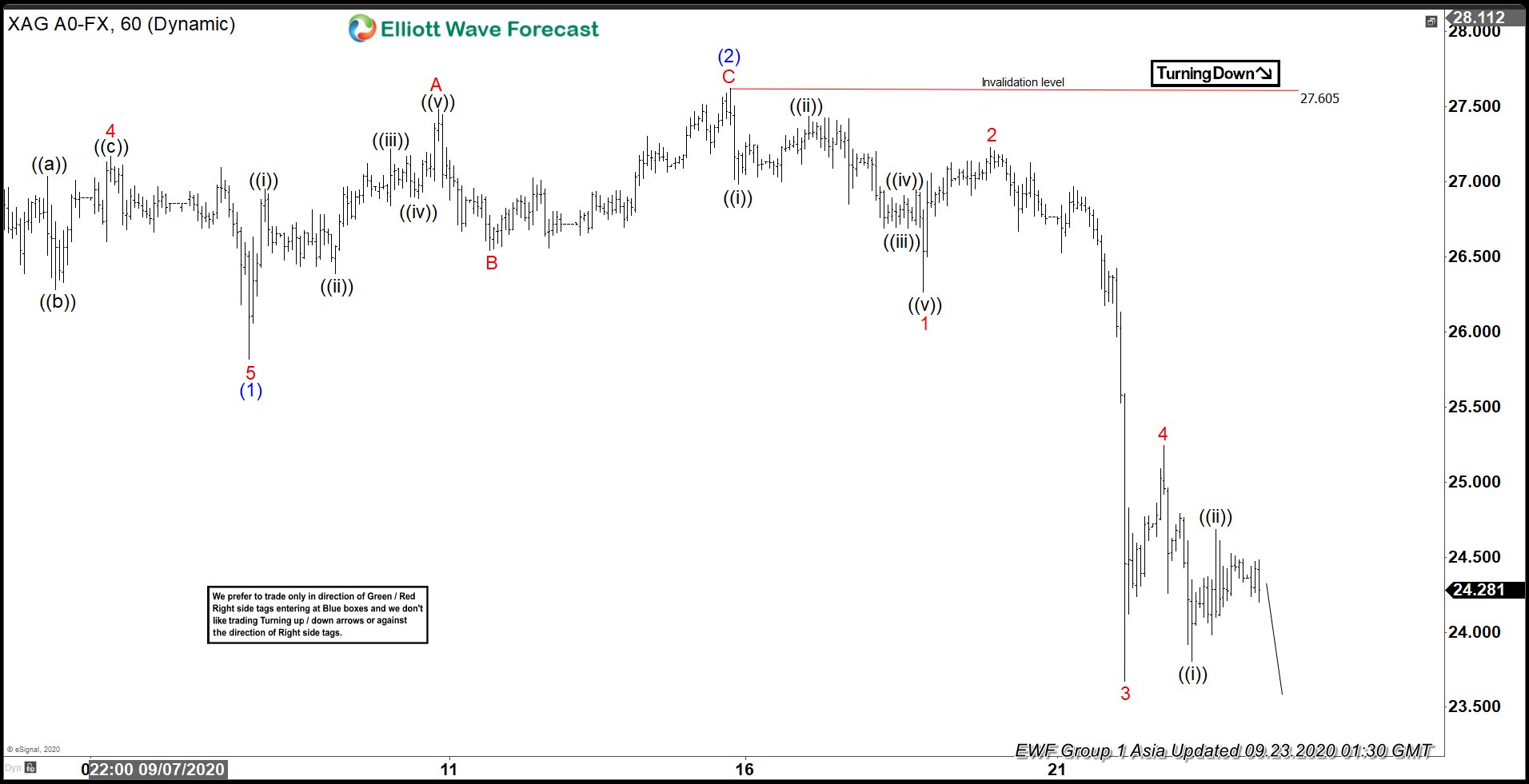

Elliott Wave View: Support Area for Silver

Read MoreSilver extended lower from 8/7 high. While below 9/15 high, silver can see more downside. However, the metal can see support at the equal leg from 8/7 high.

-

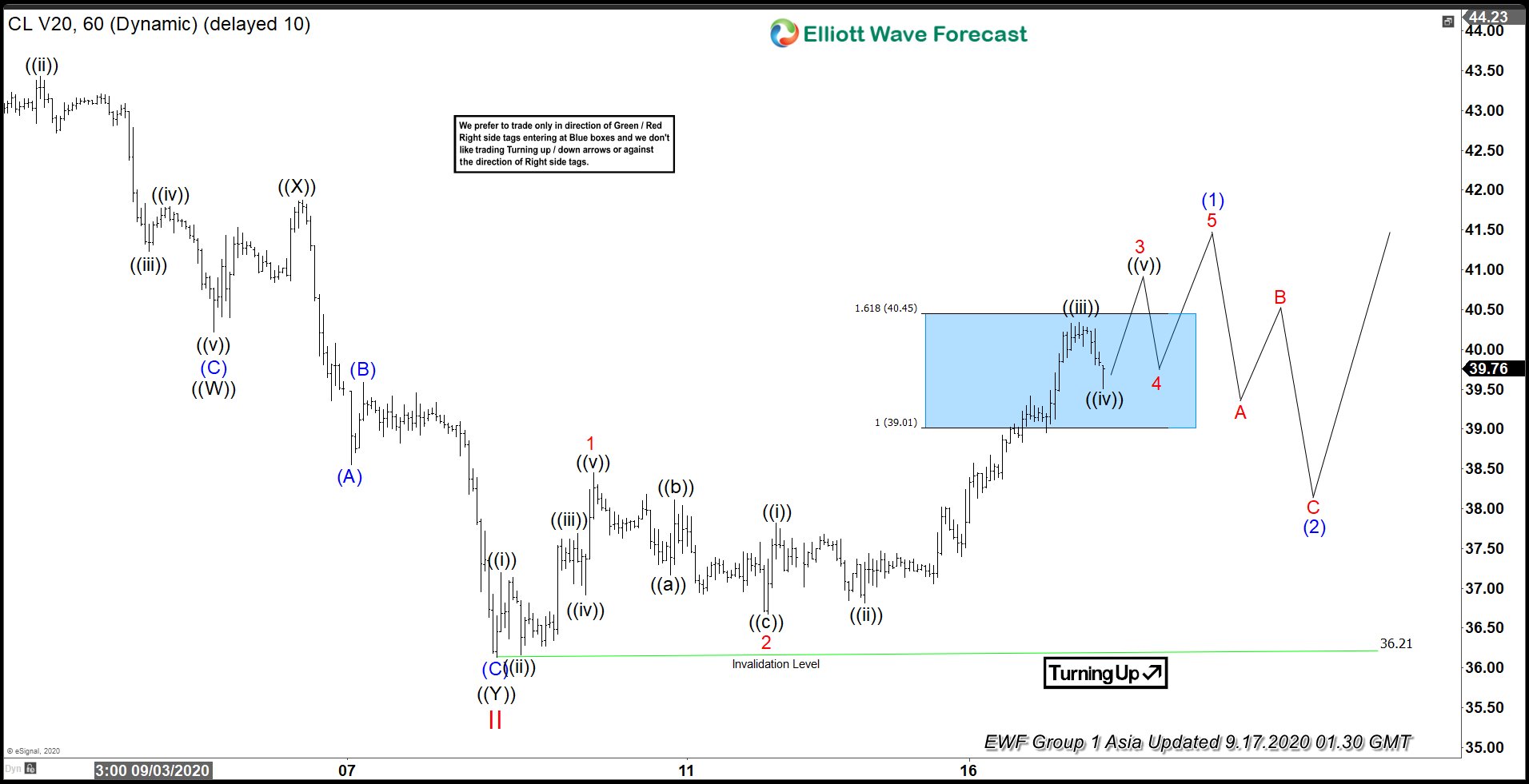

Elliott Wave View: Correction in Oil Completed

Read MoreOil ended the correction from August 26 high. While above September 8 low, expect dips in 3,7,11 swings to find support for more upside.

-

Forecasting The Rally Higher For Palladium

Read MoreIn this blog, we are going to take a look at the Elliott Wave chart of Palladium (PA_F). The 1 hour NY Midday chart update from September 3 shows that wheat has ended the cycle from August 12 low as wave (3) at 2415 high. Elliott Wave theory dictates that 3 waves pullback should happen afterwards […]