Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

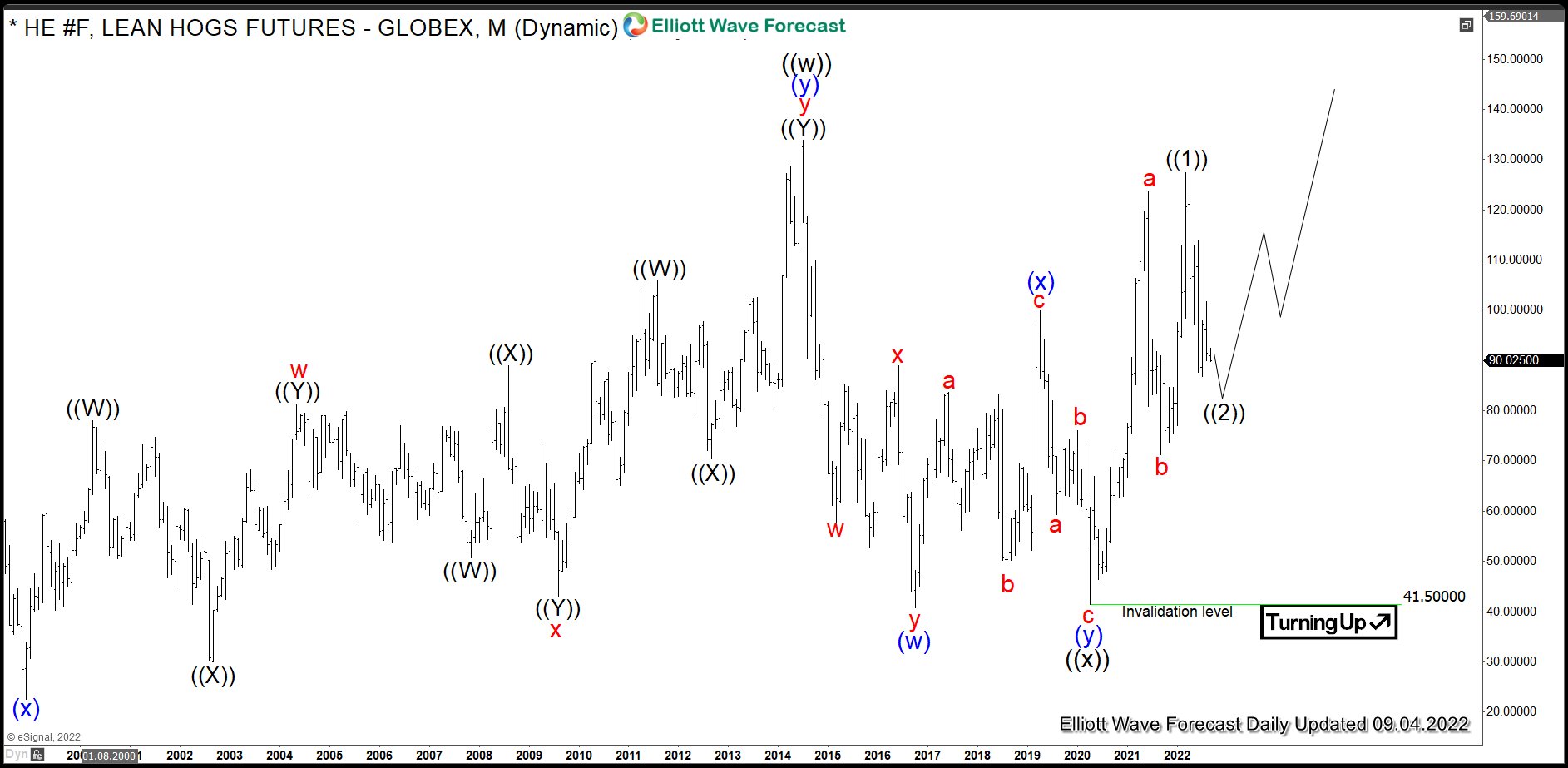

HE #F: Pork Prices to Double as Lean Hogs Prices Rally

Read MoreLean Hogs is a livestock commodity within the agriculture asset class, along with live cattle, feeder cattle and pork cutouts. One can trade Lean Hogs futures at Chicago Mercantile Exchange in contracts of 40’000 pounds each under the ticker HE #F. As a matter of fact, the futures prices are widely used by U.S. pork […]

-

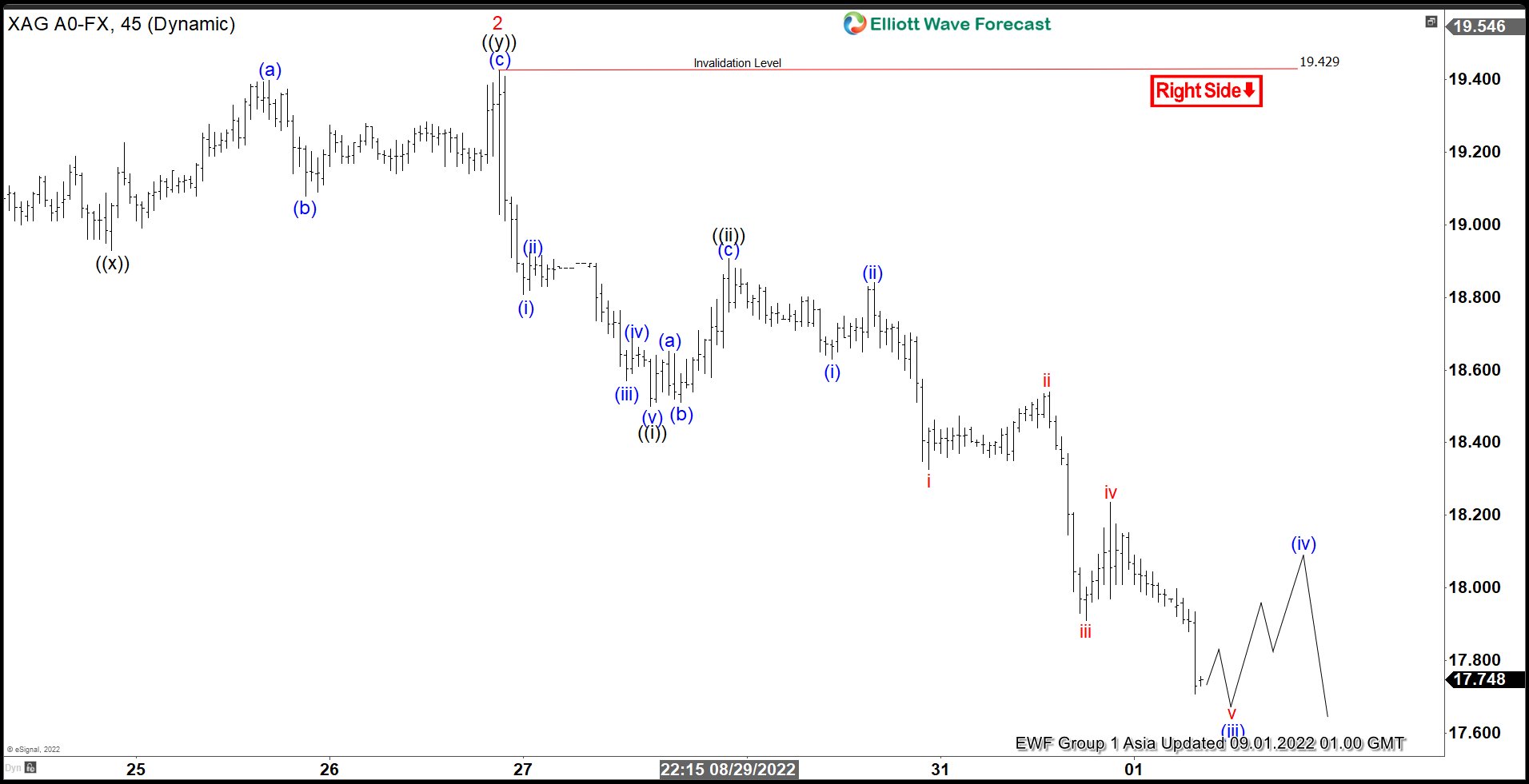

Elliott Wave View: Near Term Further Weakness in Silver

Read MoreShort Term Elliott Wave View in Silver suggests rally to 19.43 ended wave 2. Wave 3 lower is in progress to complete a cycle from August 14th, 2022 high. Internal subdivision of wave 2 unfolded as a double three Elliott Wave structure. Up from wave 1, wave (a) ended at 19.09 and pullback in wave […]

-

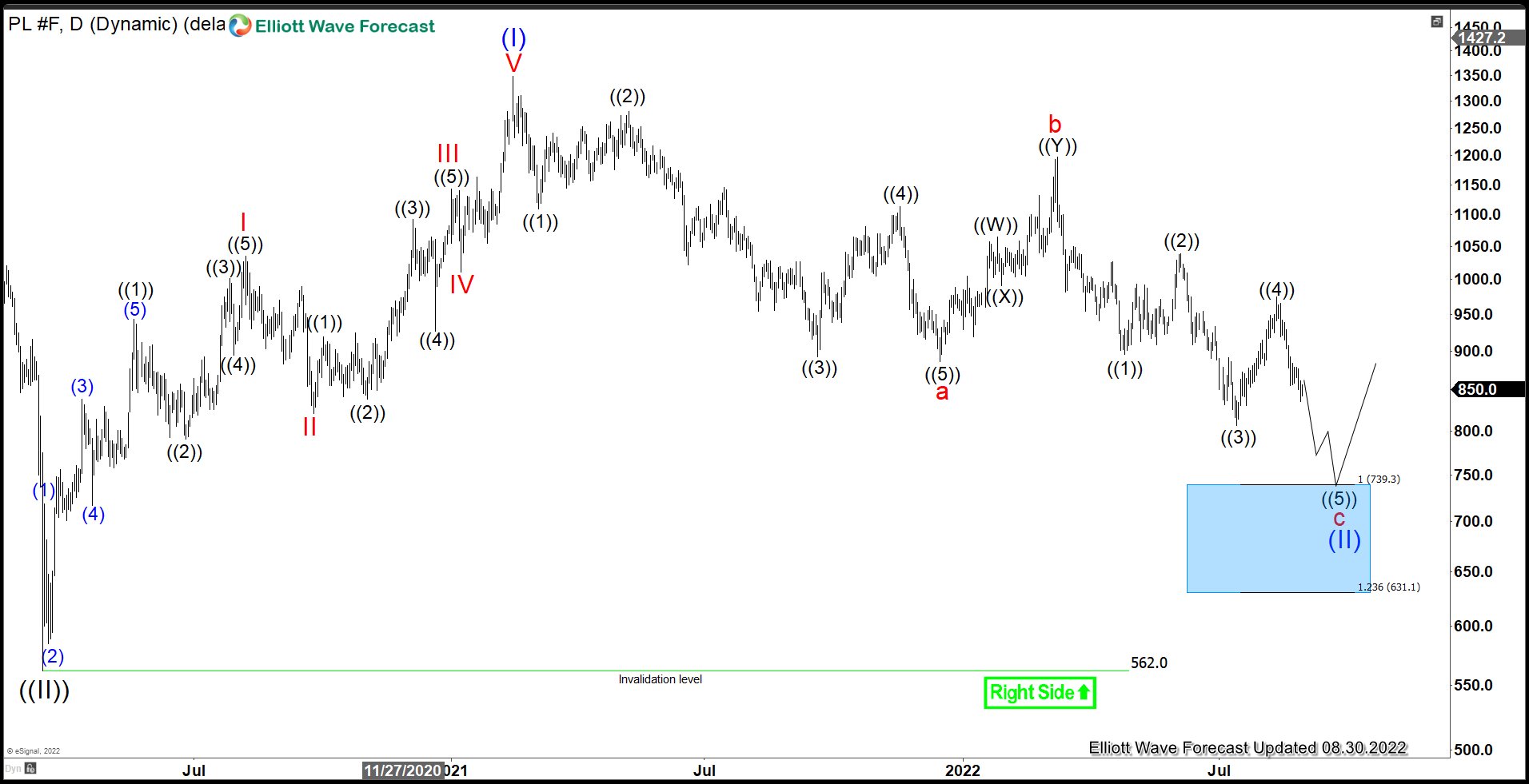

Platinum (PL) Has Resumed Lower

Read MoreIn Jackson Hole speech last Friday, Fed’s governor Jerome Powell indicated that the Fed is serious in fighting inflation and will not pivot early. He also suggested that further hikes are likely as inflation rate continues to be elevated. The pace of change in inflation has started to slow down after a series of hikes […]

-

Elliott Wave View: Gold (XAUUSD) Still Has Scope for Further Downside

Read MoreShort Term Elliott Wave View in XAUUSD suggests rally to 1765.59 ended wave 2. Wave 3 lower is in progress to complete a cycle from August 10th, 2022 high. Internal subdivision of wave 2 unfolded as a double three Elliott Wave structure. Up from wave 1, wave (a) ended at 1743.85 and pullback in wave […]

-

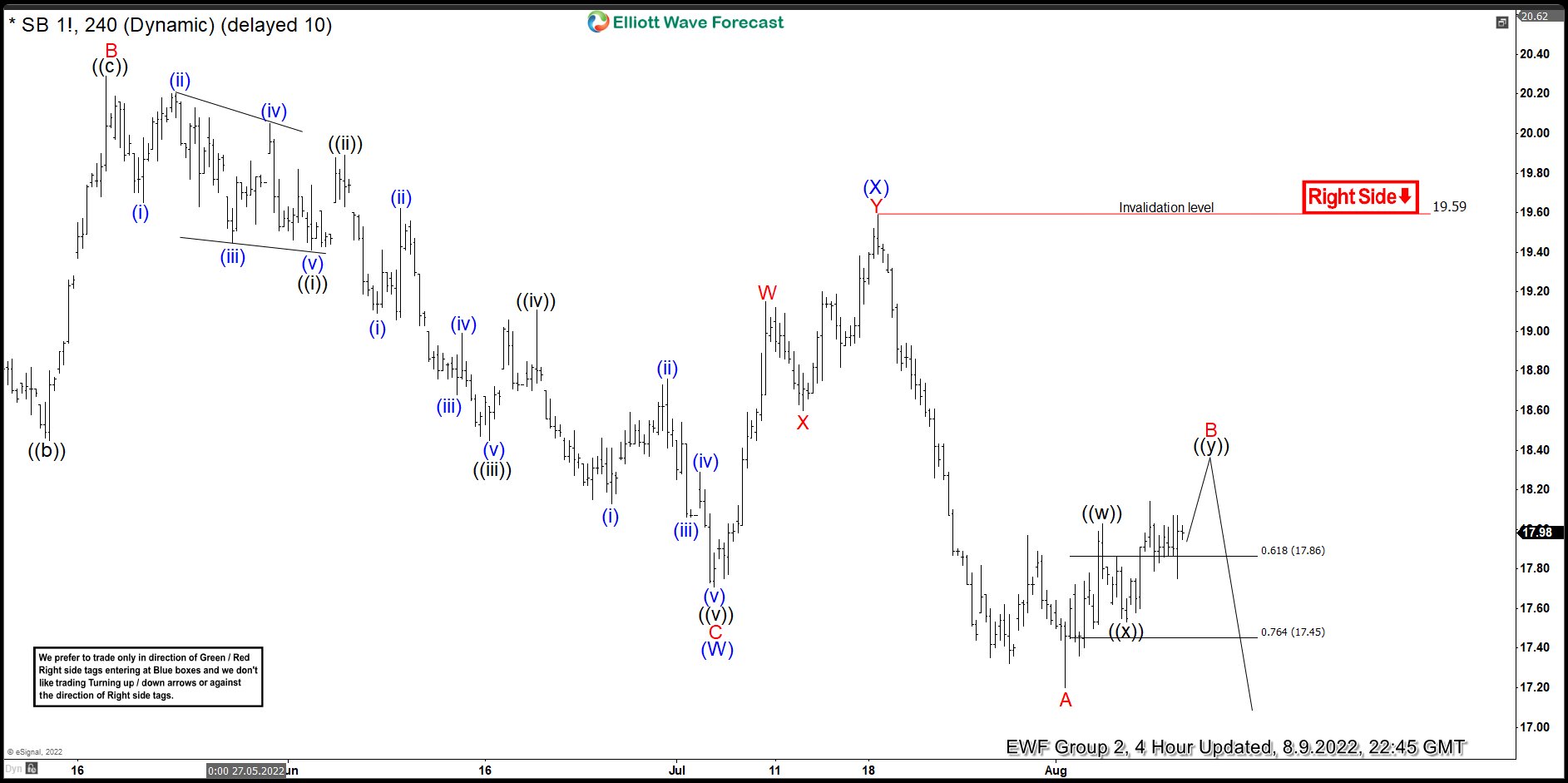

Sugar ($SB_F ) Elliott Wave : Forecasting The path

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of Sugar ($SB_F ). As our members know, Sugar is having bearish sequences in the cycle from the 20.52 peak. Current view is calling for further weakness as far as 19.6 pivot holds. Recently the commodity […]

-

$CC #F: Cocoa Prices Offer a Great Opportunity before Inflation

Read MoreCocoa (or cocoa bean) is one of soft commodities, along with sugar, coffee, orange juice and cotton. The bean is the fully dried and fermented seed, wherefrom cocoa solids and cocoa butter can be extracted. Cocoa beans are the basis of the chocolate. One can trade Cocoa futures at ICE owned New York Board of […]