Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

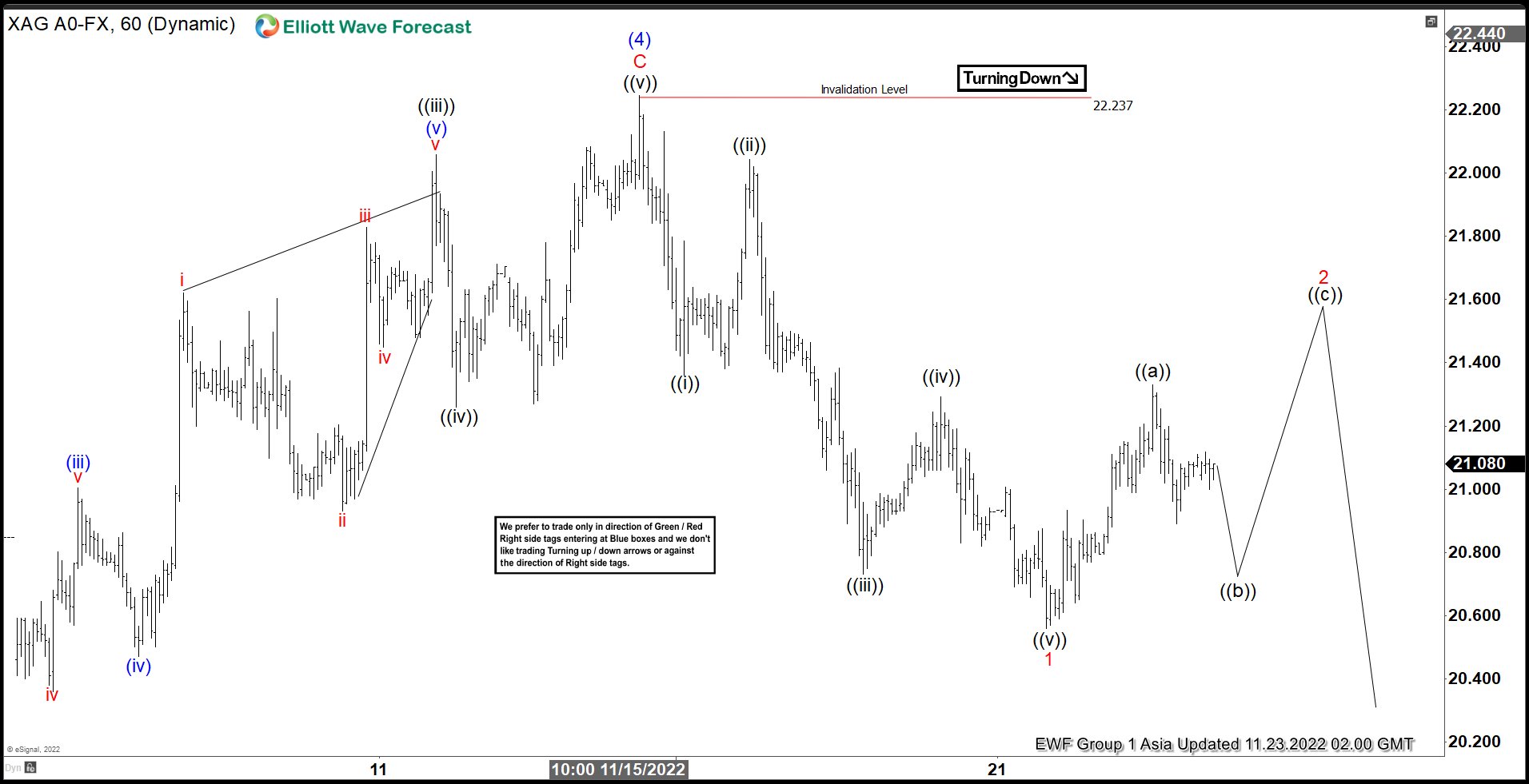

Elliott Wave View: Silver (XAGUSD) 5 Waves Down Suggests Further Downside

Read MoreSilver (XAGUSD) shows 5 waves structure from 11.15.2022 high looking for more downside. This article and video look at the Elliott Wave path.

-

Elliott Wave View: Oil (CL) Has Started New Leg Higher

Read MoreOil (CL) shows a bullish sequence from 9.26.2022 low favoring more upside. This article and video look at the Elliott Wave path.

-

Platinum (PL) Searching for Bottom

Read MorePlatinum (PL) continues to trade sideways and the metal is in the process of forming an important low before the next major bullish cycle starts. The Federal Reserve has aggressively hiked rates multiple times, creating a sideways to lower movement in the commodity sectors. There’s however no doubt that the longer term outlook of commodities […]

-

Elliott Wave View: Gold Could Shine A Bit In Coming Days

Read MoreShort term Elliott Wave view on Gold (XAUUSD) continued with bearish momentum from 10.04.2022 high calling for further downside. Decline from 10.04.2022 high is unfolding in 3 waves to complete a double correction. Down from 10.04.2022 high, wave (i) ended at 1700.00 and rally in wave (ii) ended at 1725.78. Then XAUUSD resumes the drop […]

-

Elliott Wave View: Silver Needs More Downside Before a Pullback

Read MoreShort term Elliott Wave view on Silver (XAGUSD) continued with bearish momentum from 10.04.2022 high calling for further downside. Decline from 10.04.2022 high is unfolding as a 5 waves impulse. Down from 10.04.2022 high, wave ((i)) ended at 19.92 and rally in wave ((ii)) ended at 20.87. Then silver resumes the drop as wave ((iii)). Internal […]

-

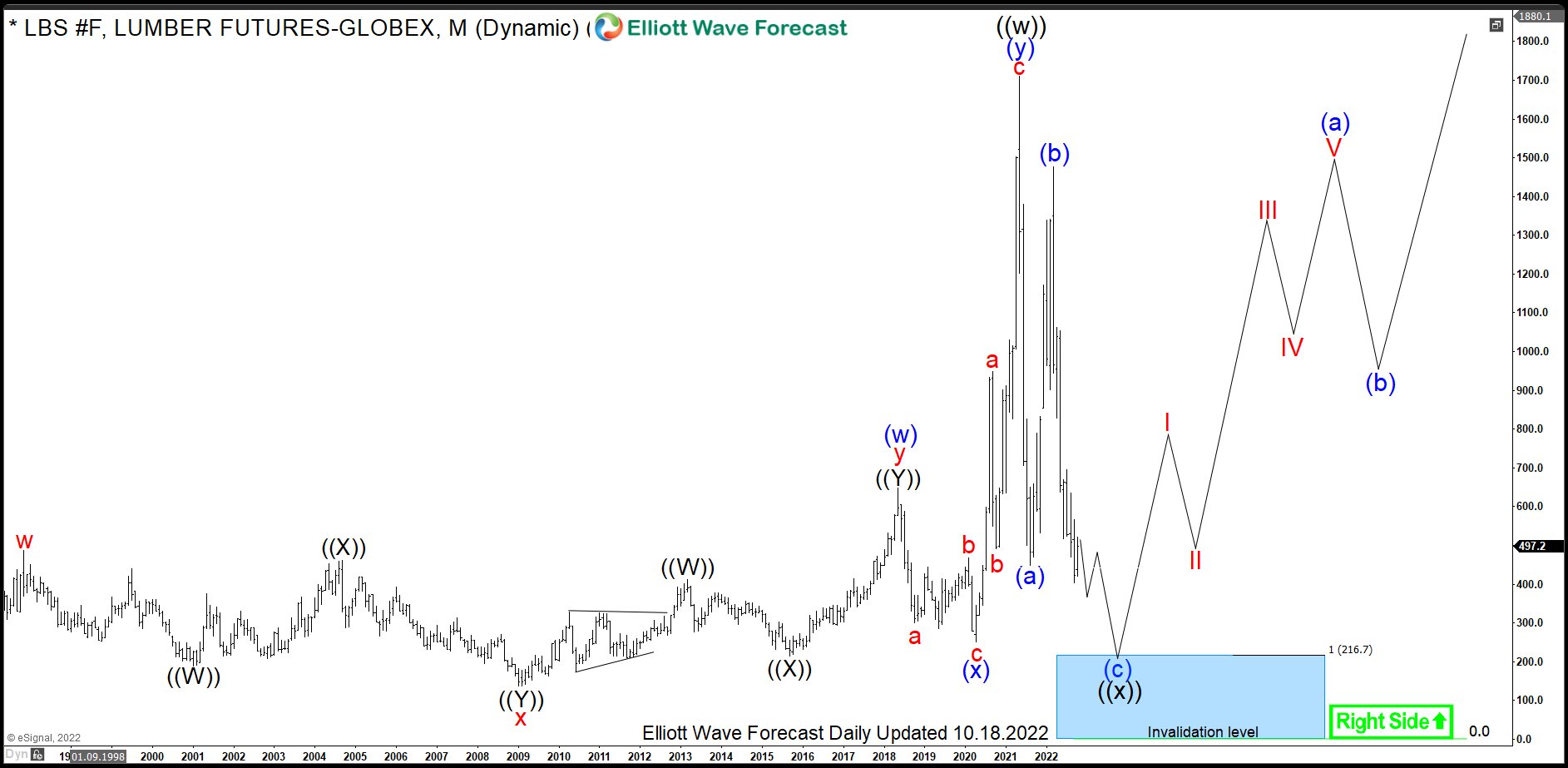

$LBS: Lumber Prices in a Historic Double Correction

Read MoreLumber, also known as timber, is a type of wood that has been processed into beams and planks. One can trade it in form of Random Length Lumber futures and options at Chicago Mercantile Exchange within the agriculture asset class under the ticker $LBS. In 2020, we saw commodities turning higher. Since January 2021, rally […]