Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

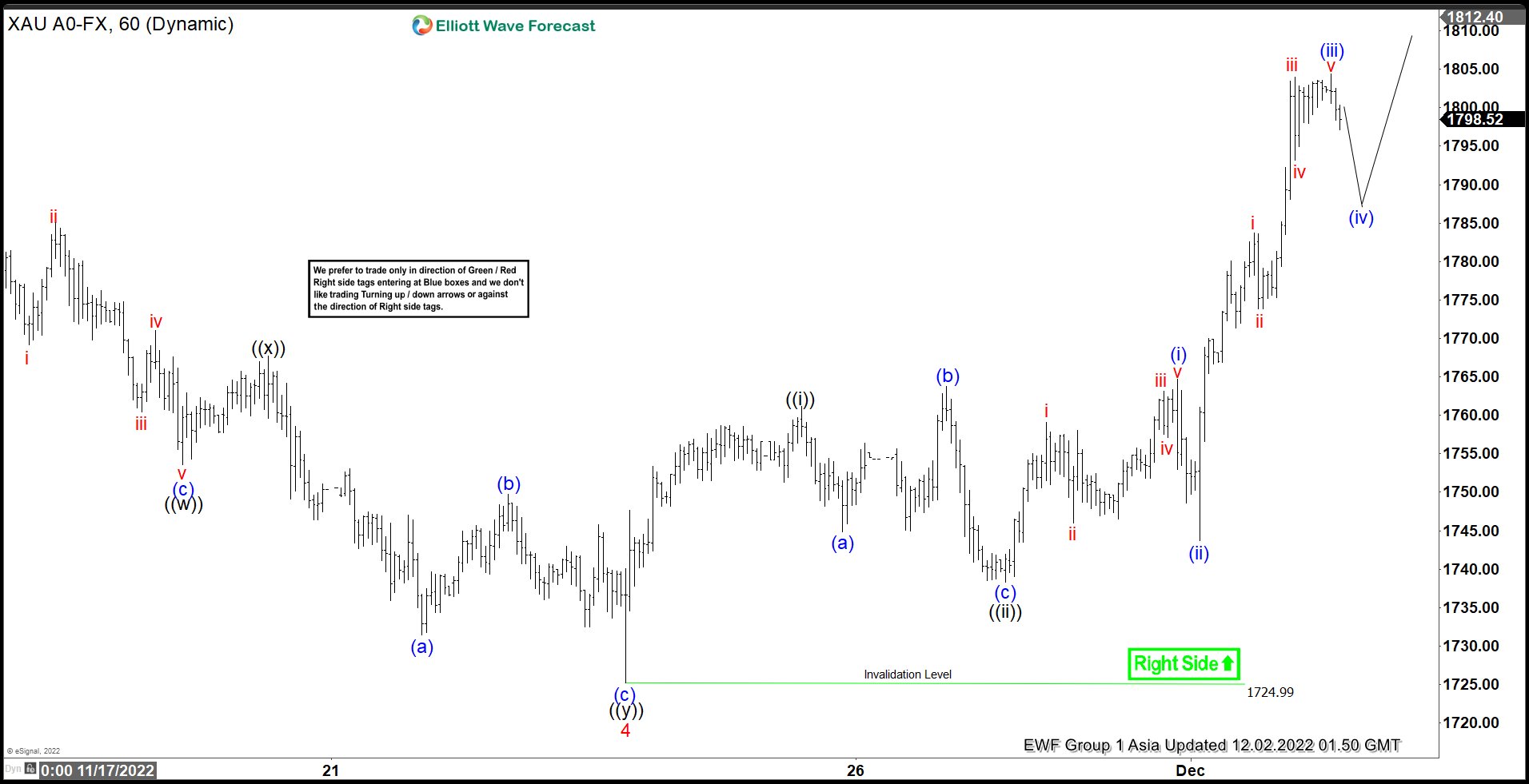

Gold Elliott Wave Impulse Move Near Complete

Read MoreGold cycle from 11.23.2022 low is in progress as an impulse and can see further upside. This article and video look at the Elliott Wave path.

-

Silver in Last Stage of Elliott Wave Ending Diagonal

Read MoreSilver is looking to end cycle from 9.1.2022 low with the final fifth wave as an ending diagonal. This article and video look at the Elliott Wave path.

-

Platinum (PL) Ready to Rally in 2023

Read MorePlatinum (PL) continues to trade sideways and the metal is in the process of forming an important low before the next major bullish cycle starts. The Federal Reserve has aggressively hiked rates multiple times, creating a sideways to lower movement in the commodity sectors. There’s however no doubt that the longer term outlook of commodities […]

-

Elliott Wave View: Silver (XAGUSD) Wave 5 Ending Soon

Read MoreSilver (XAGUSD) rally as impulse from 9.1.2022 low and about to end wave 5. This article and video look at the Elliott Wave path.

-

OIL ($CL_F) Elliott Wave : Forecasting The Decline From Equal Legs Area

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of OIL . As our members know, break of 09/27 low made incomplete bearish sequences in the cycle from the June peak. Consequently we were calling for further extension down within the cycle. Recently the commodity […]

-

Elliott Wave View: Gold Has Turned Bullish

Read MoreGold (XAUUSD) shows impulse structure from 9.28.2022 looking for further upside. This article and video look at the Elliott Wave path.