Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

Copper (HG) Low Likely in Place with 5 Waves Rally

Read MoreCopper (HG) rally from 5.24.2023 low as an impulse suggesting further upside. This article and video look at the Elliott Wave path.

-

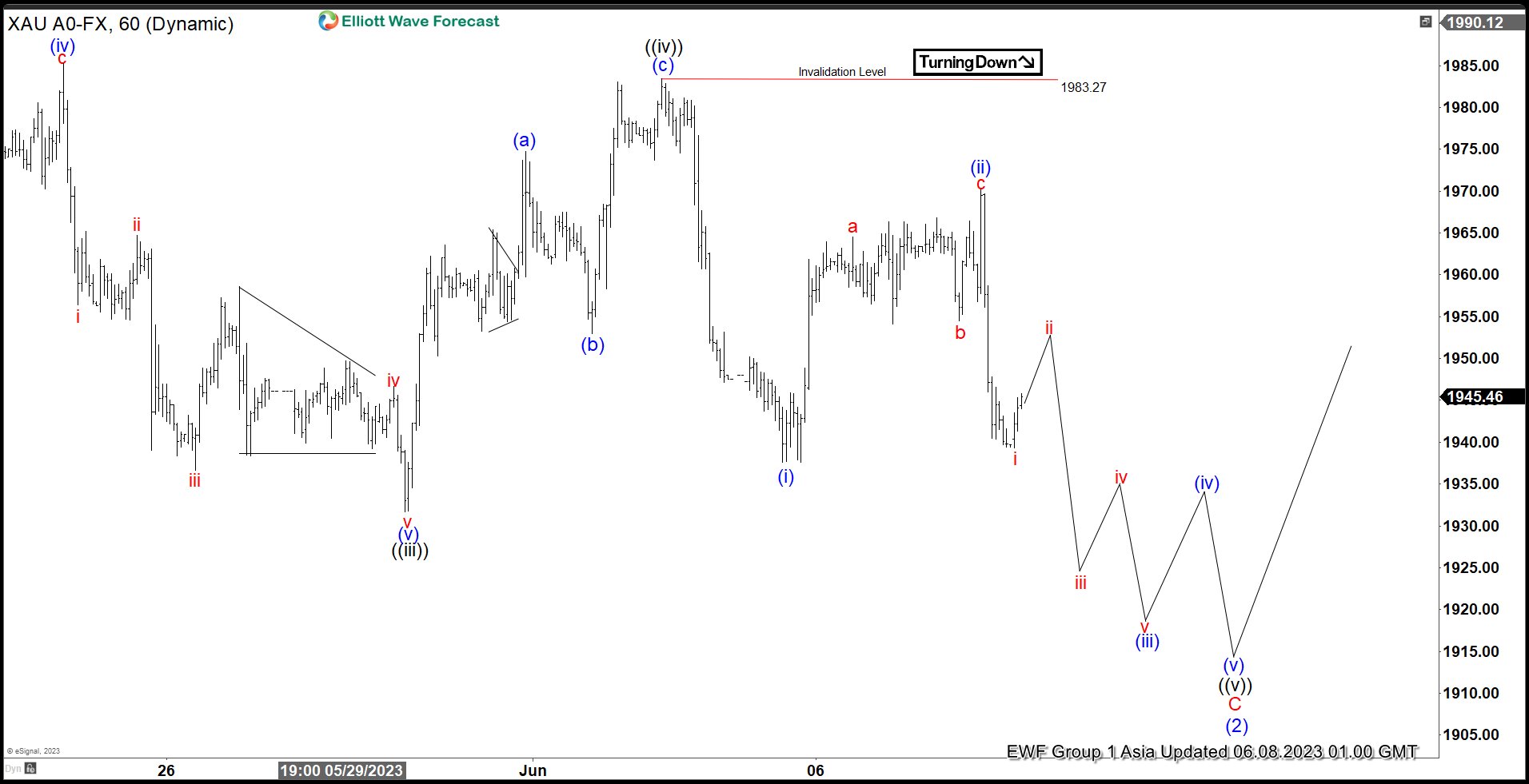

Elliott Wave View: Gold (XAUUSD) Looking to End Wave 5

Read MoreGold (XAUUSD) is looking to end 5 waves impulse down from 5.4.2023 high. This article and video look at the Elliott Wave path.

-

![[Webinar Recording] Metals: What Is The Next Move?](https://elliottwave-forecast.com/wp-content/uploads/2023/06/Metals-What-Is-The-Next-Move-1.png)

[Webinar Recording] Metals: What Is The Next Move?

Read MoreWe conducted a Free Webinar on Friday, 2nd June 2023 with the title “Metals: What Is The Next Move” In this webinar, we will delved into the fascinating world of precious metals, examined their recent corrections and explored whether they reached a bottom, signalling a potential significant upswing. Using the Elliott Wave technique, our expert analysed […]

-

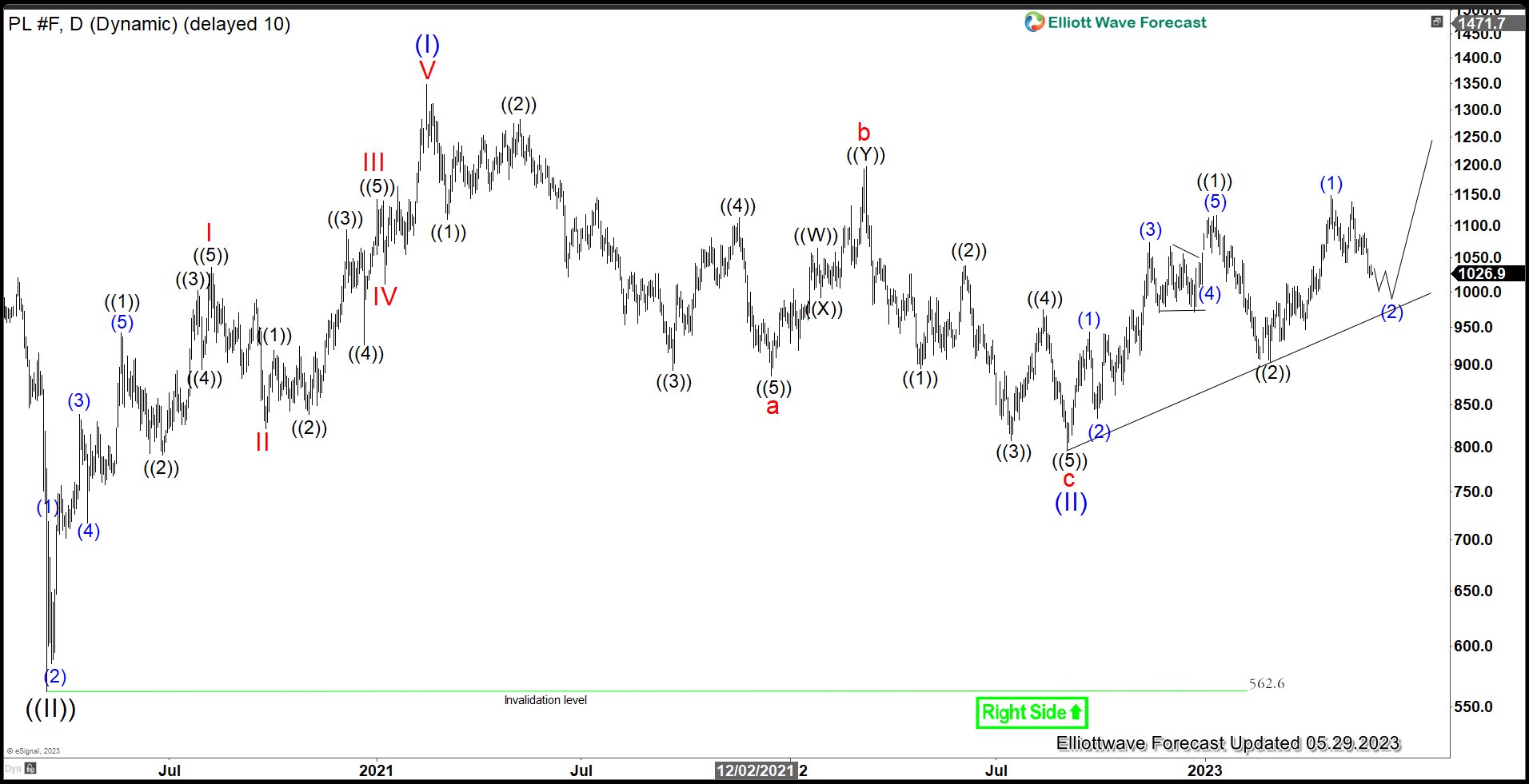

Platinum (PL) Correction in Progress

Read MorePlatinum (PL) shows a higher high (bullish sequence) from 9.1.2022 low favoring further upside. Since forming the intermediate top at 1148.9 on April 21, the metal has corrected cycle from 2.27.2023 low at 903.9. The correction can still extend lower in the near term but it should end above 903.9 before the next leg higher […]

-

Equity vs Commodity: Top 5 Differences & Trading Tips

Read MoreEquity and Commodities both are different types of asset classes that are used by investors to earn profits. However, there are certain differences between the two that make them provide different returns to investors. Therefore, it is important to understand the differences between the two to identify which is a better investment for you. What […]

-

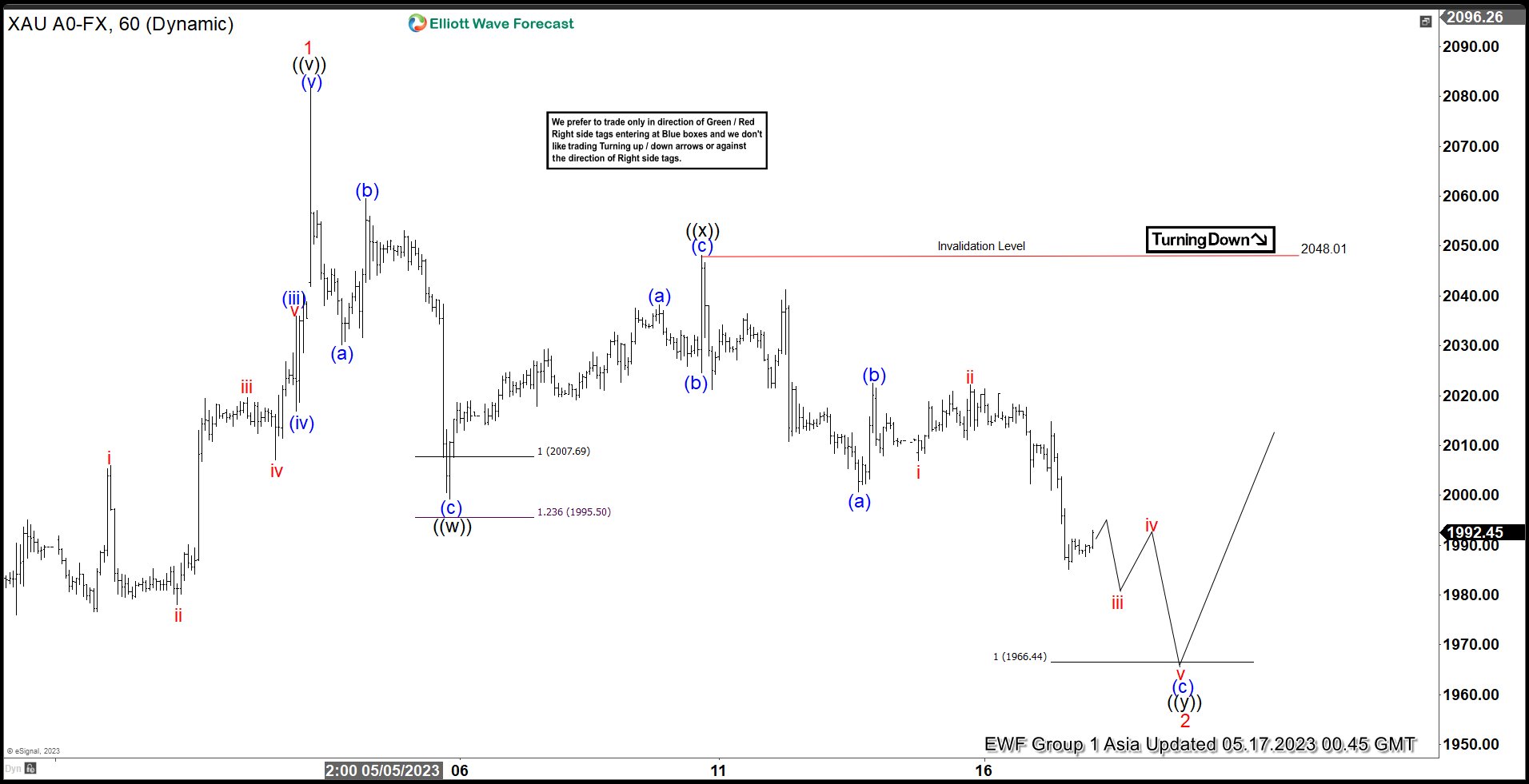

Gold (XAUUSD) Short Term Elliott Wave Support Area

Read MoreGold (XAUUSD) is correcting cycle from 2.28.2023 low in a double three Elliottwave structure. This article and video look at the support area for Gold.