Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

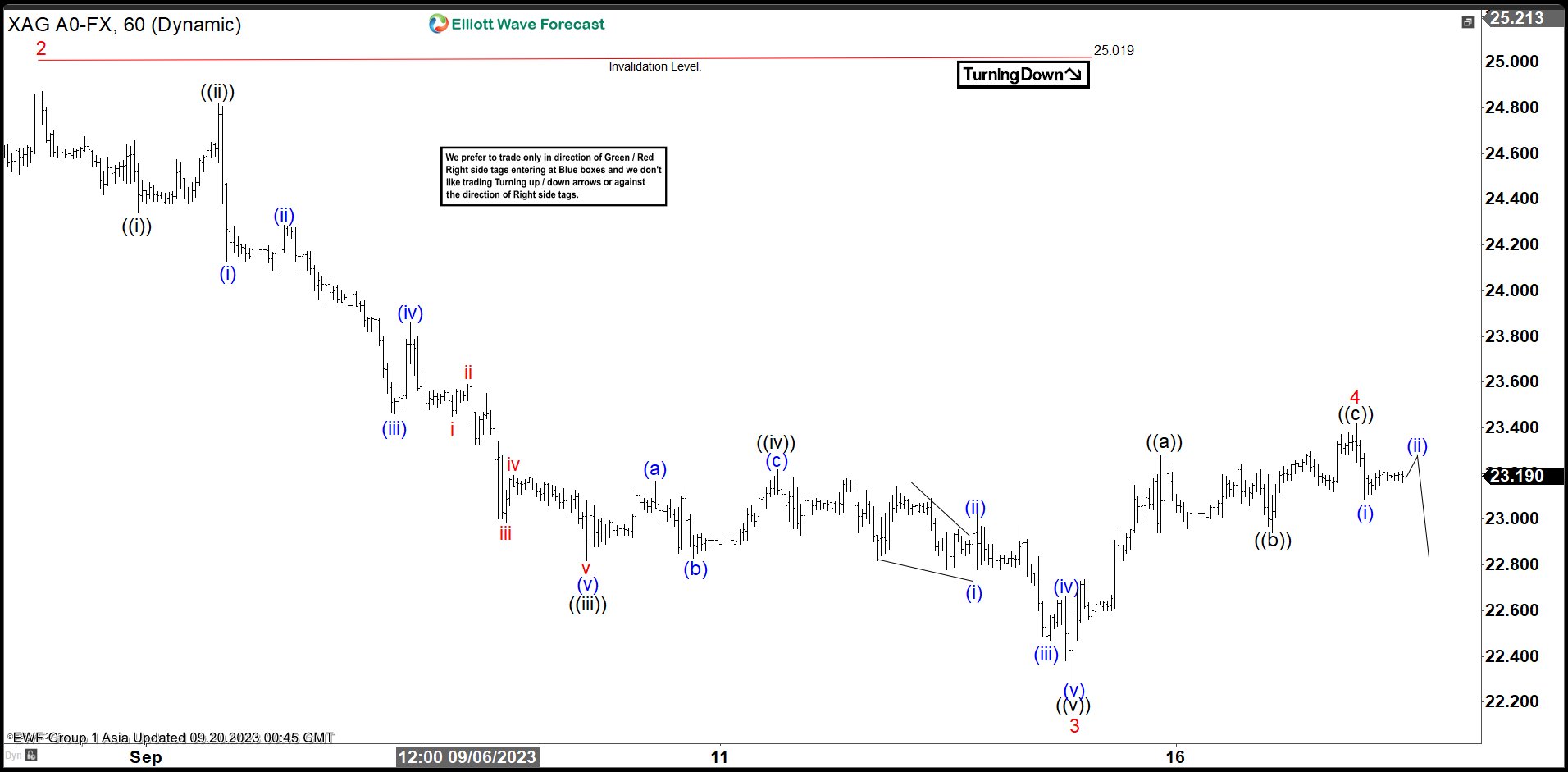

Elliott Wave View: Silver (XAGUSD) Has Scope for Further Downside

Read MoreSilver (XAGUSD) is looking to end wave 5 from 7.20.2023 high and has scope for more downside. This article and video look at the Elliott Wave path.

-

Oil (CL) Should Extend Higher in Impulsive Structure

Read MoreRally in Oil (CL) is in progress as an impulse and should extend higher. This article and video look at the Elliott Wave path.

-

Platinum (PL) Pullback Should Find Buyers

Read MorePlatinum (PL) is still correcting cycle from 9.1.2022 low and the correction is unfolding as a double three. In this article, we will update the longer term Elliott Wave outlook for Platinum. We also present an alternate view if the pivot at September 2022 low (803) fails, which suggests a bigger correction against March 2020 […]

-

Gold (XAUUSD) Is at Area Where It Can Pullback

Read MoreShort Term Elliott Wave structure in Gold (XAUUSD) suggests the drop in Gold on August ended wave A at 1884.16 low. The metal now is extending higher in 3 swings to end a wave B correction. Up from 8.17.2023 low, wave (i) ended at 1904.50 and wave (ii) pullback ended at 1889.02. Rally from wave (ii), […]

-

Gold-to-Silver Ratio (AUG) Close to Breakout

Read MoreIn our previous blog, we said that Gold-to-Silver ratio has resumed to the downside. In this article and video today, we will update the Elliott Wave outlook of the ratio. It’s been pretty sideways in the last few months, but it is likely to break sooner or later. To refresh, when the ratio goes lower, […]

-

FCOJ: Buying Pullbacks in Frozen Concentrated Orange Juice

Read MoreIn the previous articles from March, November 2021 and October 2022, we have discussed the price action and the outlook for the Frozen Concentrated Orange Juice. As it has been expected, the soft commodities have advanced or they are nesting higher. In particular, we saw cocoa rallying. Others, like sugar, coffee and cotton are nesting before acceleration higher should take place. Hereby, […]