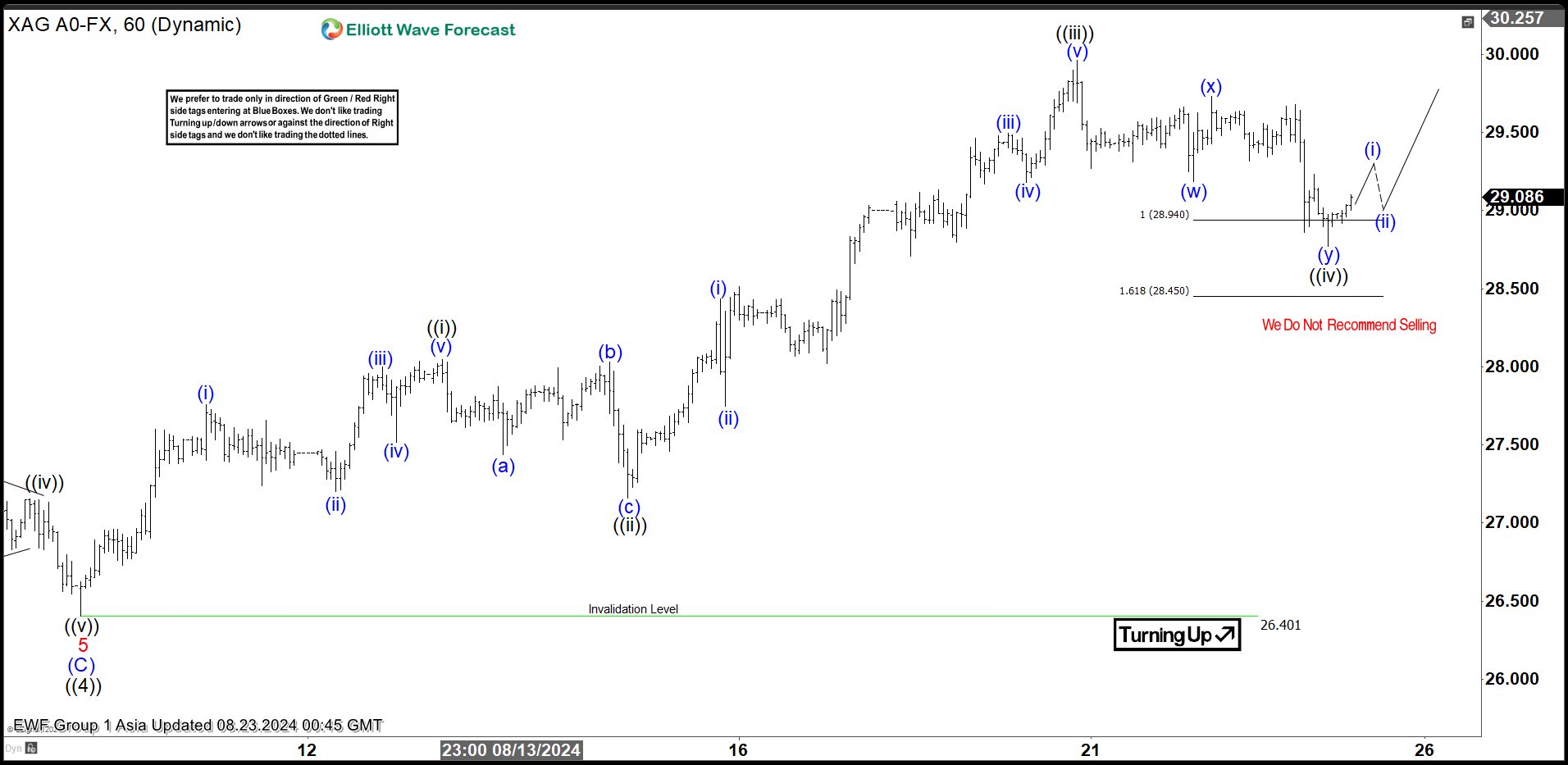

Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

Elliott Wave View on Light Crude Oil (CL) Favoring More Downside

Read MoreLight Crude Oil (CL) looks to resume to the downside. This article and video look at the Elliott Wave path for the commodity.

-

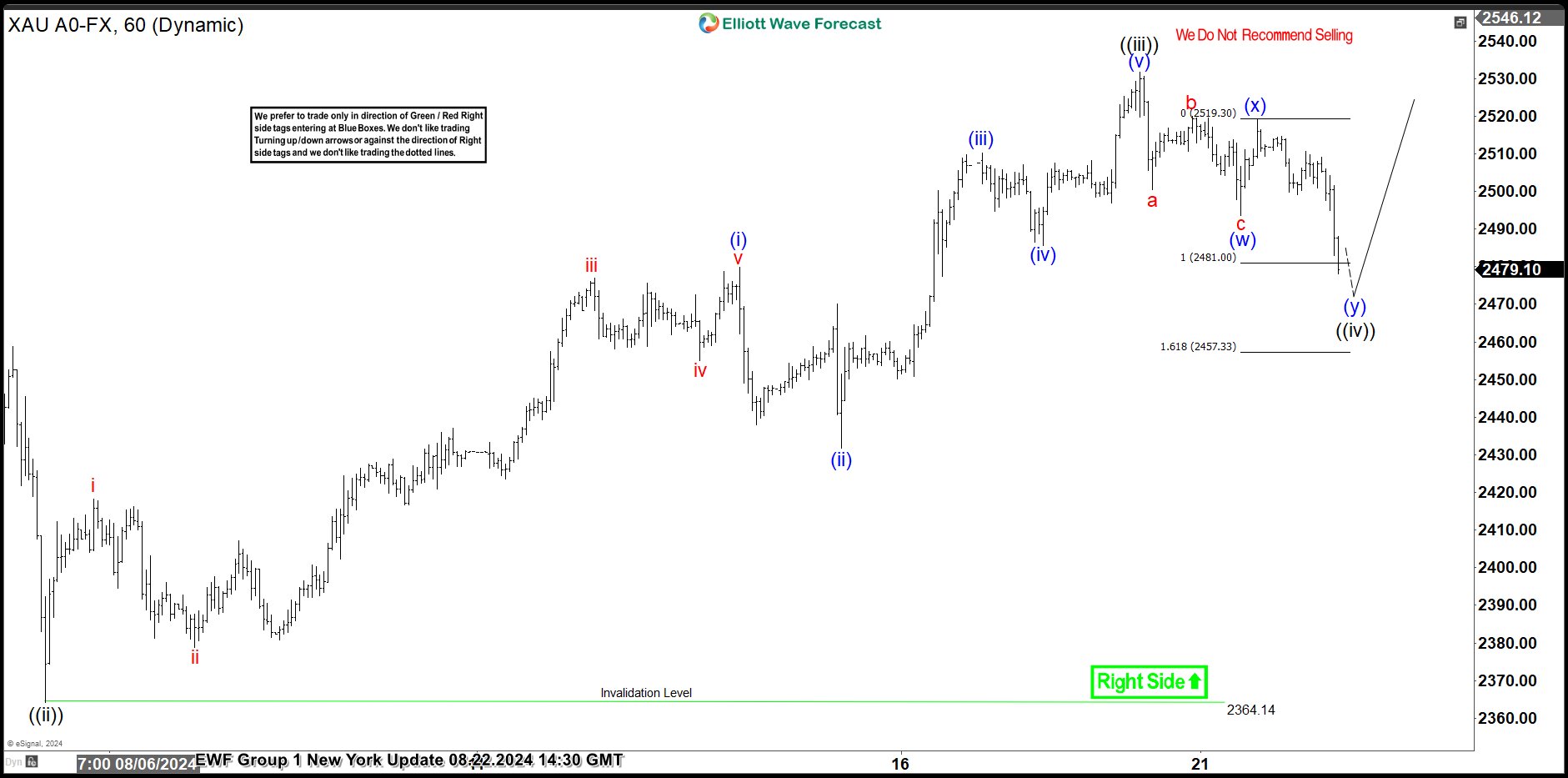

Gold Continuing To Find Support Into The Pullbacks

Read MoreIn this blog, we take a look at the past performance of Gold charts. In which, the gold continue to find support into the pullbacks.

-

Elliott Wave Favors Bullish Bias in Silver (XAGUSD)

Read MoreSilver (XAGUSD) is looking to extend higher after finding support at the extreme area. This article and video look at the Elliott Wave path.

-

Elliott Wave Intraday Analysis on Silver (XAGUSD) Looking to Find Buyers

Read MoreShort Term Elliott Wave View in Silver (XAGUSD) suggests that pullback to 28.58 low ended a wave (A). The metal turned higher again in wave (B) ended at 31.75 high. The market resuming lower from wave (B) high breaking below 28.58 low to rule a larger correction. It means, Silver is developing a wave (C) […]

-

The Future of Copper and a Look Back – Trading Review

Read MoreCopper has been a hot commodity, only to fall rapidly. If we look at Copper ‘s price action history on the daily chart, there is a giant spike from the 3.57 to 5.19 area in just a few months. After that, HG (Copper Futures) has crashed back down to just 3.95 today shown here. What […]

-

Oil (CL) Should Continue Lower to Build an Impulsive Structure

Read MoreShort Term Elliott Wave View in Oil (CL) suggests that cycle from 4.12.2024 high is in progress as a 5 waves impulse Elliott Wave structure. Down from 4.12.2024 high, wave (1) ended at 72.48 and rally in wave (2) ended at 84.55. The commodity has turned lower in wave (3) with internal subdivision as another […]