Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

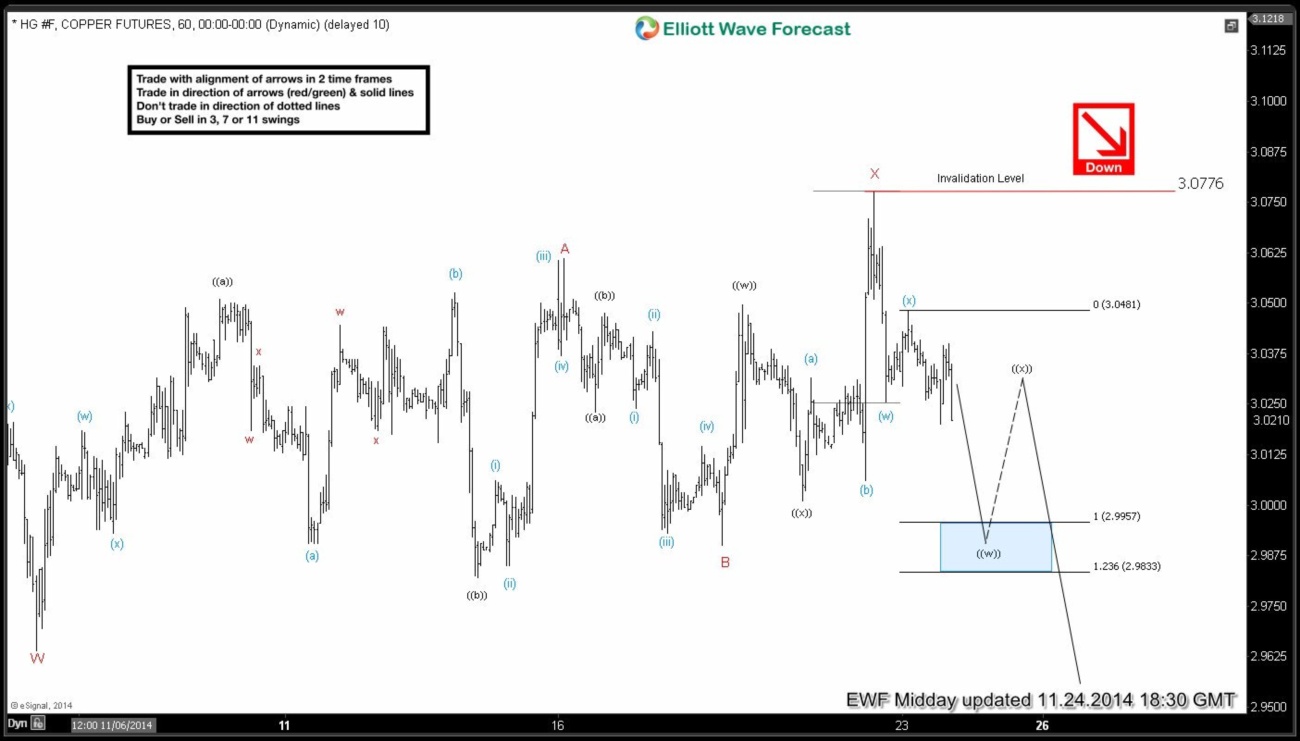

$HG_F (Copper) Short-term Elliott Wave Analysis 11.24.2014

Read More$HG_F (Copper) has been rejected in every rally and we maintain our bearish Elliott Wave view on Copper for at least another extension lower. We think new high & failure seen on Friday completed wave X and next leg lower has started. Near-term focus is on 2.995 – 2.983 area to complete wave (( w )) […]

-

XAU (Gold) Mid-term Elliott Wave Analysis 11.20.2014

Read MoreGold is showing 5 swings down from July peak (1345) which many Elliott wavers are labelling as a 5 wave move but it doesn’t show any divergence between the last 2 lows which negates the idea of a 5 wave impulse and hence we like the idea of a 7 swing structure in progress as […]

-

Educational Video: Gold (5 wave move)

Read MoreWe will talk about a 5 wave move in this Educational Video which doesn’t happen very frequently. When one finishes reading an Elliottwave book, they would try and look for a 5 wave move everywhere. Wave 1 is nothing more than a fight between old trend & a new trend. Wave 2 is when old […]

-

HG_F (Copper) Elliott Wave Video

Read MoreHG_F (Copper) has been trading sideways since 11.5 (2.964) low. We have seen multiple rejections in 50 – 61.8 fib inflection zone (3.0400 – 3.057) as buyers and sellers try to overcome each other. We expect this consolidation to resolve to the downside as far as 3.116 high remains intact. Preferred Elliott Wave view suggests […]

-

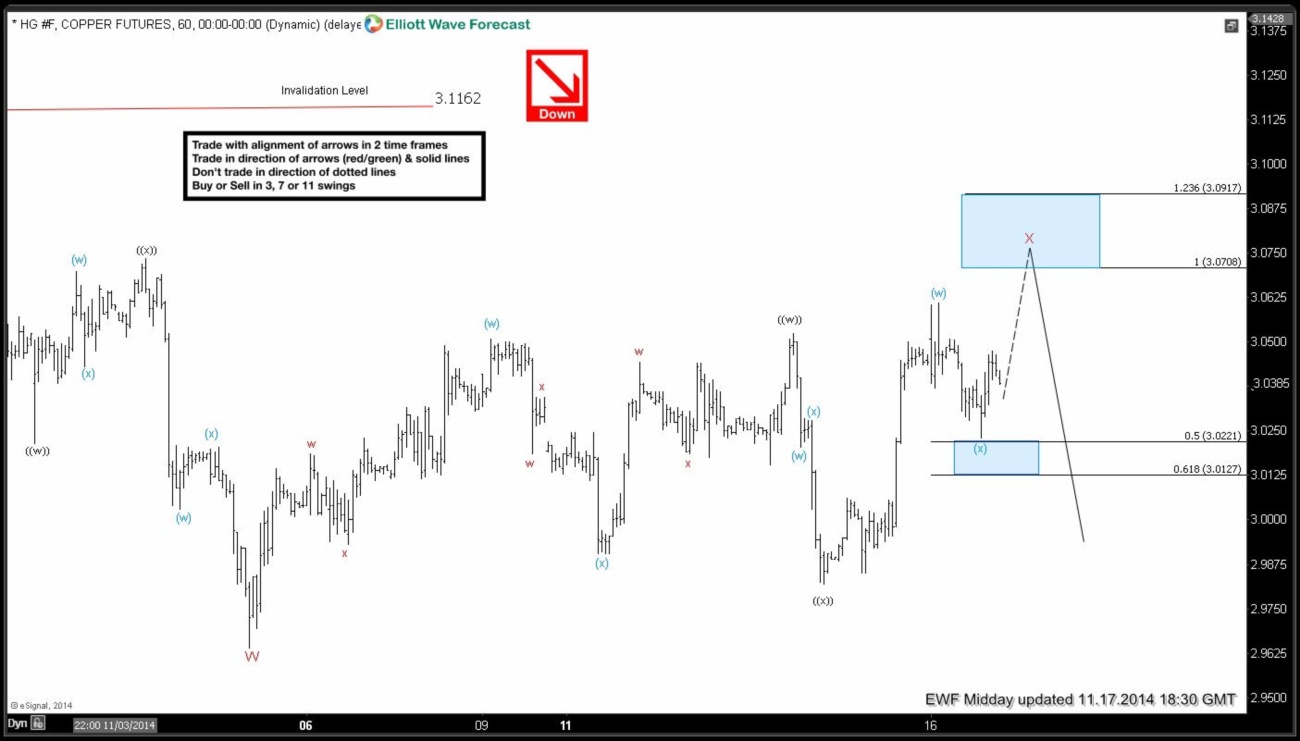

HG_F (Copper) Short-term Elliott Wave Analysis 11.17.2014

Read MoreHG_F (Copper) has been trading sideways since 11.5 (2.964) low. We have seen multiple rejections in 50 – 61.8 fib inflection zone (3.0400 – 3.057) as buyers and sellers try to overcome each other. We expect this consolidation to resolve to the downside as far as 3.116 high remains intact. Preferred Elliott Wave view suggests […]

-

HG_ F (Copper) Elliott Wave Setup Video

Read MoreCopper Futures (HG_F ) are bouncing after completing 7 swings down from 10.29 high but our preferred Elliott Wave count suggests down side is far from over and this is just a corrective bounce. Elliott Wave cycles remain bearish against 3.113 high and we view rallies as a selling opportunity in 3, 7 or 11 swings […]