Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

CL – WTI Crude Futures – Trade Plan Reviewed

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily from 12:30 PM EST (5:30 PM BST), join Dan there for more insight into these proven methods of trading. CL […]

-

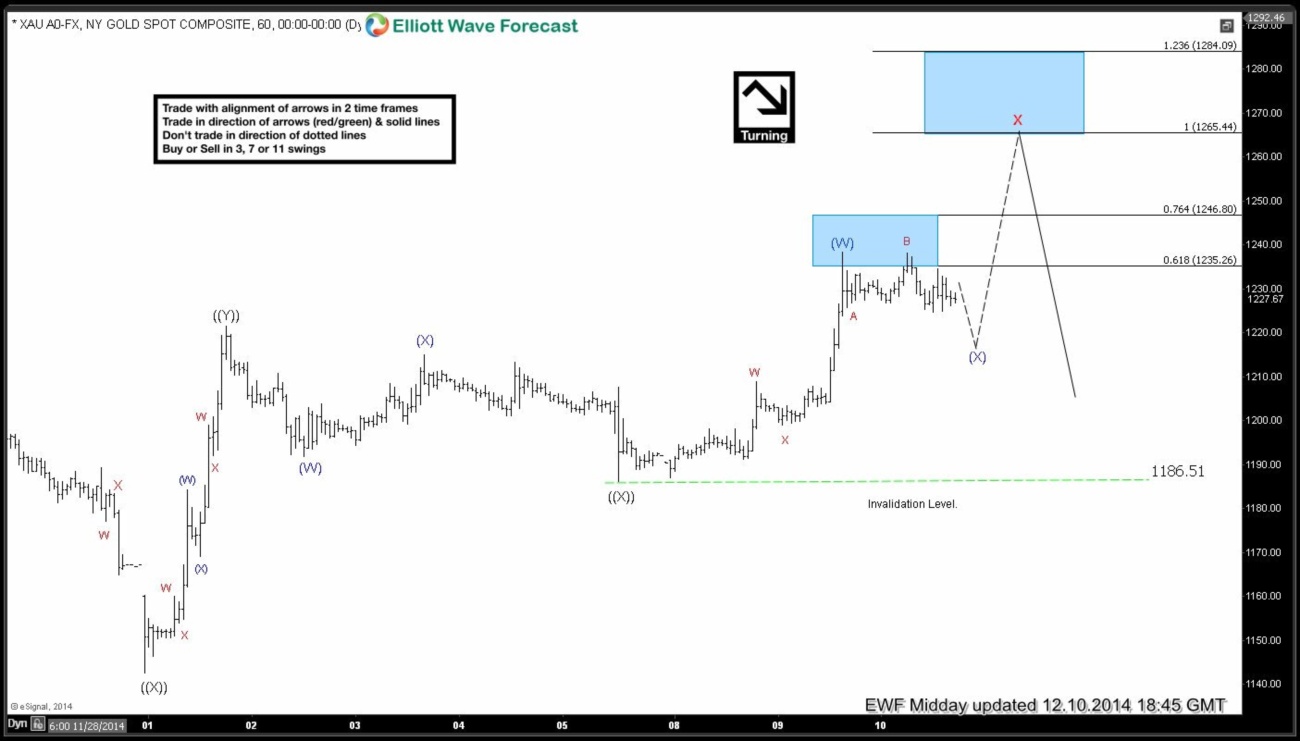

Gold Short-term Elliott Wave Analysis 12.10.2014

Read MoreWe think the yellow metal is in a triple three structure higher from 1131 low when wave (( Y )) ended at 1221. 2nd wave (( X )) ended at 1186 and as pull back holds above 1186 low, preferred Elliott Wave view suggests, metal could trade as high as 1265 to complete wave X correction […]

-

HG_F (Copper) : Elliott Waves calling the move lower

Read MoreThe video below was posted at Elliottwave-forecast.com on November 25. In the video we explain to the world that HG (Copper) will continue lower according to our analysis and we also recommended to SELL Copper on the bounce with invalidation level at 3.0776 Now take a look at the charts below from our members […]

-

Gold: Elliott Wave Hedging

Read MoreGold dropped at start of the week and then rallied sharply. Let’s take a look at where the yellow metal stands right now. We know commodities are in the process of ending big cycles but there is no confirmation that the cycles has ended. Decline from July peak in Gold is not a 5 wave […]

-

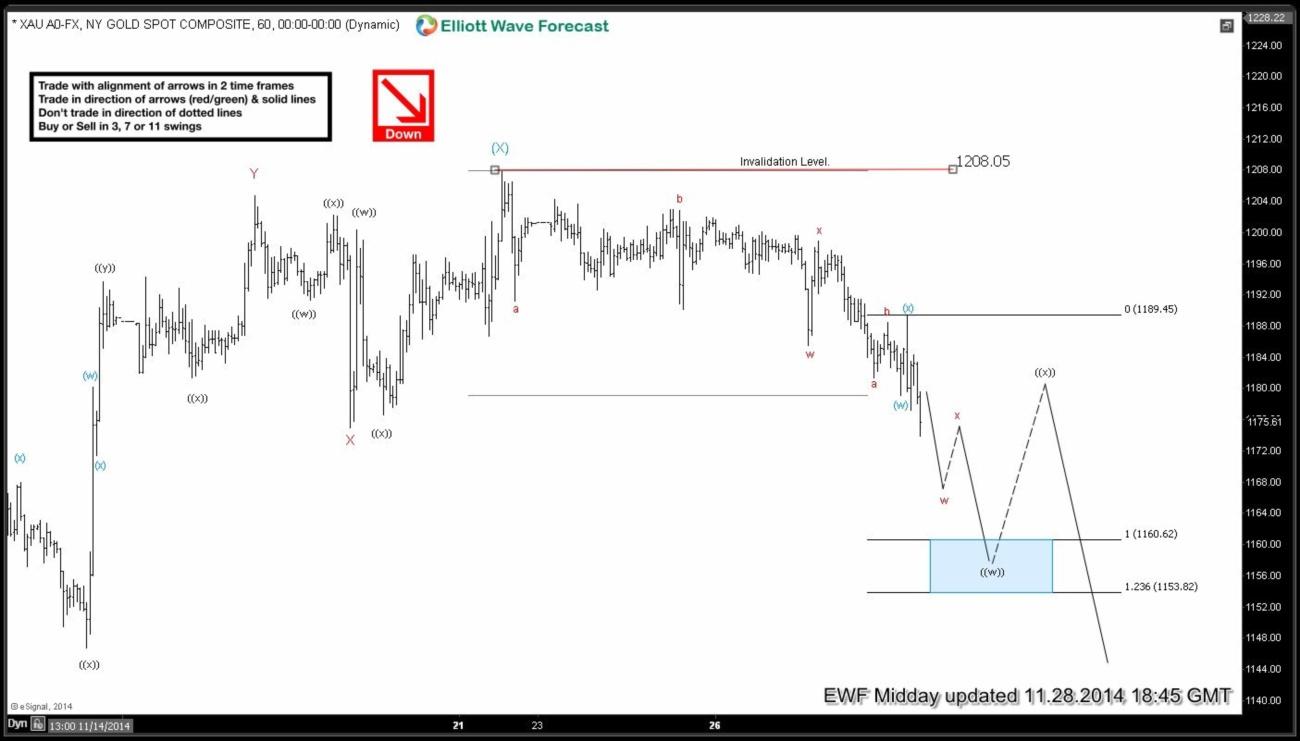

$XAUUSD (Gold) Short-term Elliott Wave Analysis 11.28.2014

Read MoreYellow metal has resumed the decline as expected and yesterday our system confirmed that cycle from 1131 low had ended and that wave ( X ) high should have been in place at 1208.We are beginning to see more confirming price action for that today. We think we have seen a short-term connector wave (x) […]

-

$HG_F (Copper) Elliott Wave Video

Read More$HG_F (Copper) has been rejected in every rally and we maintain our bearish Elliott Wave view on Copper for at least another extension lower. We think new high & failure seen on Friday completed wave X and next leg lower has started. Near-term focus is on 2.995 – 2.983 area to complete wave (( w )) […]