In this technical blog we’re going to take a quick look at the Elliott Wave charts of OIL published in members area of the website. As our members know, we have been favouring the long side, suggesting everyone to avoid selling. Finally on April 11th , we got break of March 26th peak and commodity has confirmed further extension to the upside.

Let’s take a look at the past charts and explain the forecast.

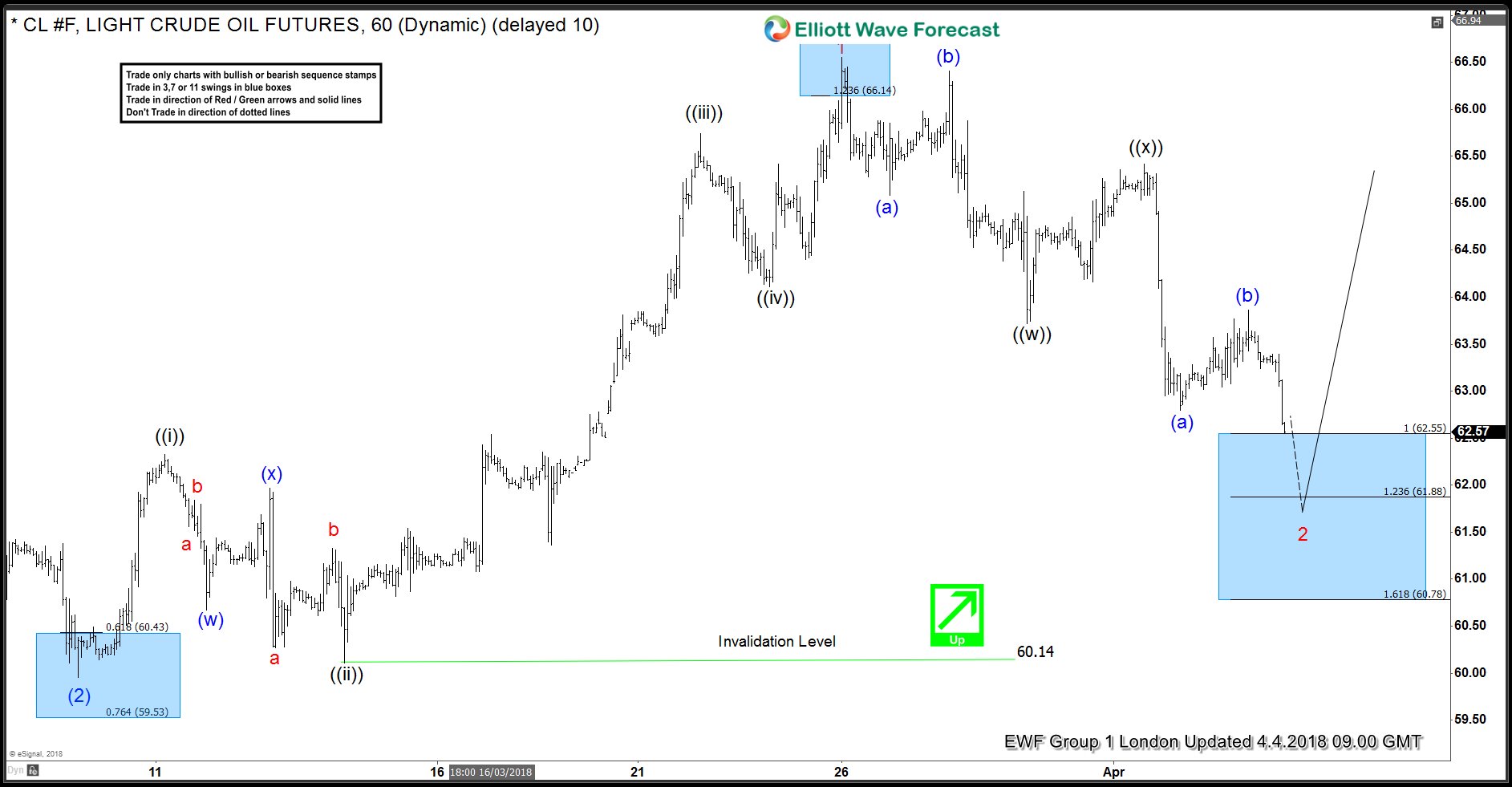

OIL 1 Hour Elliott Wave Analysis 4.4.2018

OIL is correcting the cycle from 57.93 low. Proposed pull back is labeled as wave 2 red and it’s unfolding as Elliott Wave Double Three pattern, also known as 7 swings structure. We’re currently in last swing in wave (c) of ((y)). Although equal legs has been already reached at 62.55, we assume OIL can extend little bit lower still as last leg ((y)) inner structure looks incomplete. We expect OIL to extend toward 1.236 Fibo extension : 61.88. There it should ideally find buyers for further rally or 3 wave bounce alternatively.

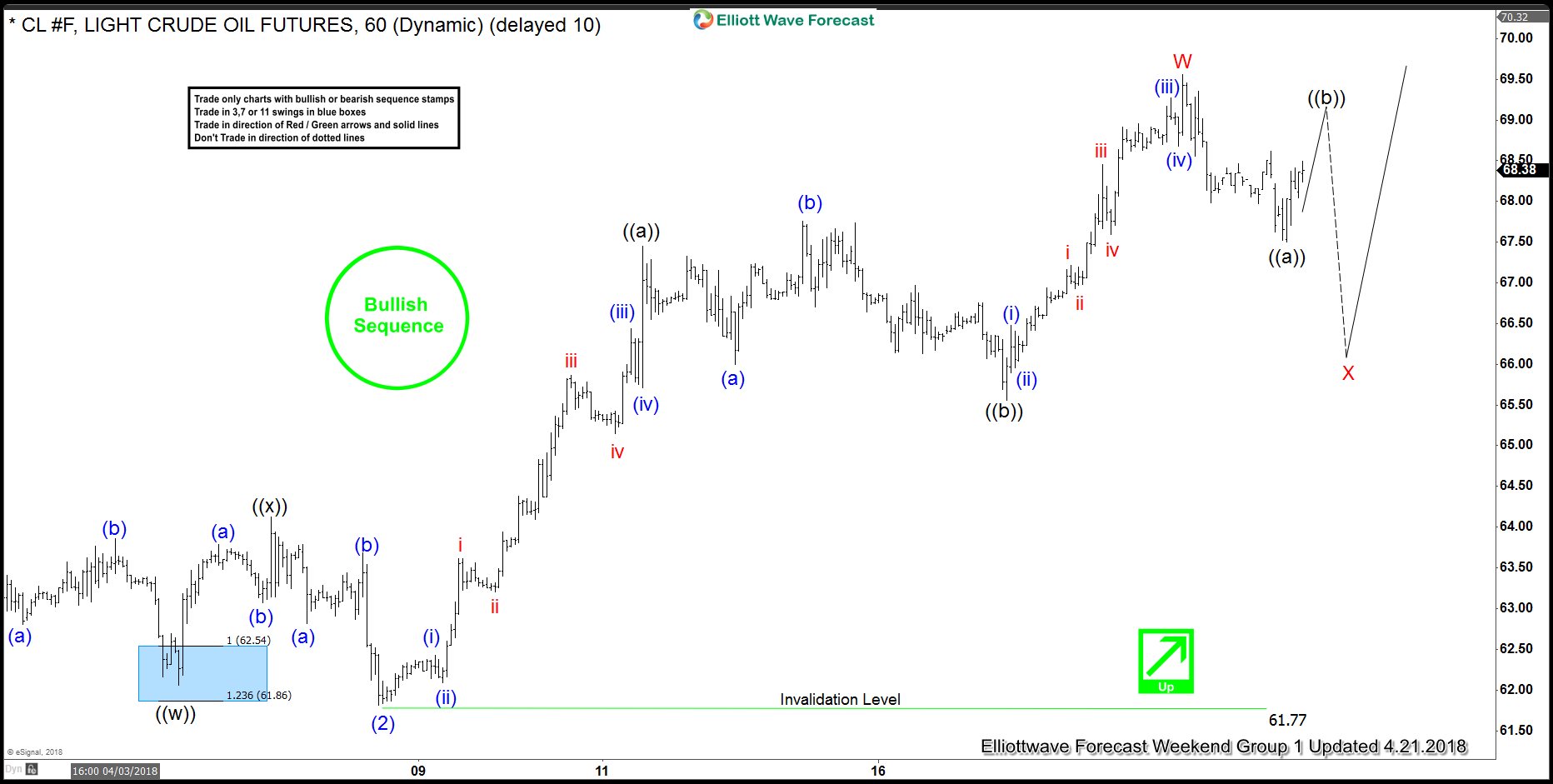

OIL 1 Hour Elliott Wave Analysis 4.21.2018

Pull back has ended at 61.81 low and as a result we got nice rally. With break of wave (1) peak ( 03/26), commodity has made incomplete bullish sequences in 1 Hour cycle. Now it’s targeting 70.43+ area according to Sequence Report. OIL is bullish against the 61.81 low and should ideally find buyers in dips in 3,7,11 swings against that pivot. Wave B red pull back is unfolding as a irregular FLAT structure.

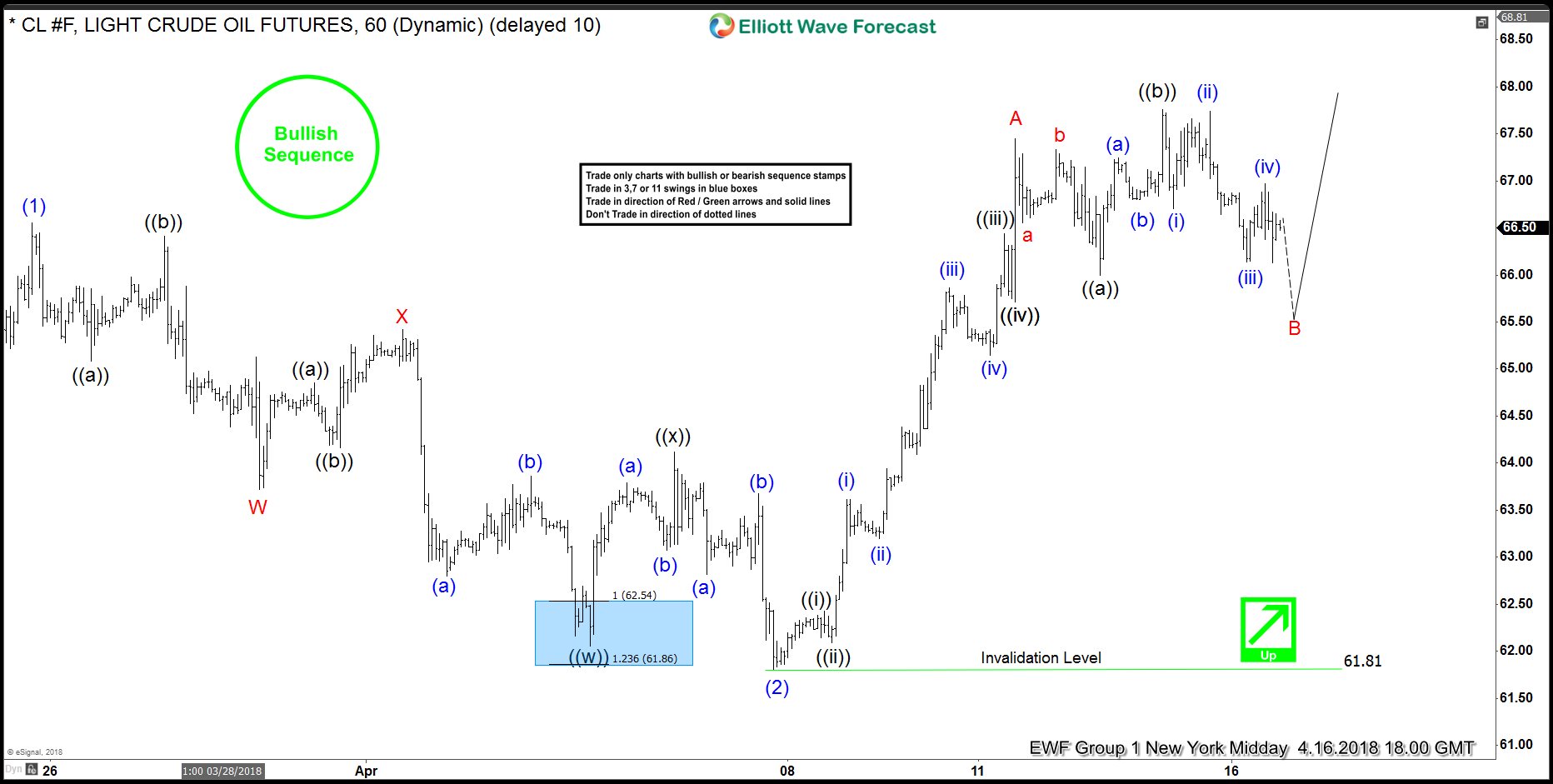

OIL 1 Hour Elliott Wave Analysis 4.16.2018

Proposed pull back has ended as FLAT, and we got new high. Now , as far as the price stays below W red peak, wave X red is in progress. We expect to see at least another leg lower to complete proposed pull back against the 61.77 low. Keep in mind the market is very dynamic and short term view could have changed or not be valid any more when you look at this chart. Best instruments to trade are those having incomplete bullish or bearish swings sequences. We put them in Sequence Report and best among them are shown in the Live Trading Room.

Elliott Wave Forecast

We cover 78 instruments in total, but not every chart is trading recommendation. We present Official Trading Recommendations in Live Trading Room. If not a member yet, Sign Up for Free 14 days Trial now and get access to new trading opportunities. Through time we have developed a very respectable trading strategy which defines Entry, Stop Loss and Take Profit levels with high accuracy.

Back