GDXJ ETF, also known as the VanEck Vectors Junior Gold Miners ETF, is an exchange-traded fund that tracks the performance of small-cap companies involved in the gold mining industry. The ETF is designed to provide investors with exposure to junior gold mining companies. Typically these companies are smaller in size and are involved in the exploration, development, and production of gold. Below we will take a look at the latest Elliott Wave outlook for the ETF.

GDXJ Daily Elliott Wave View

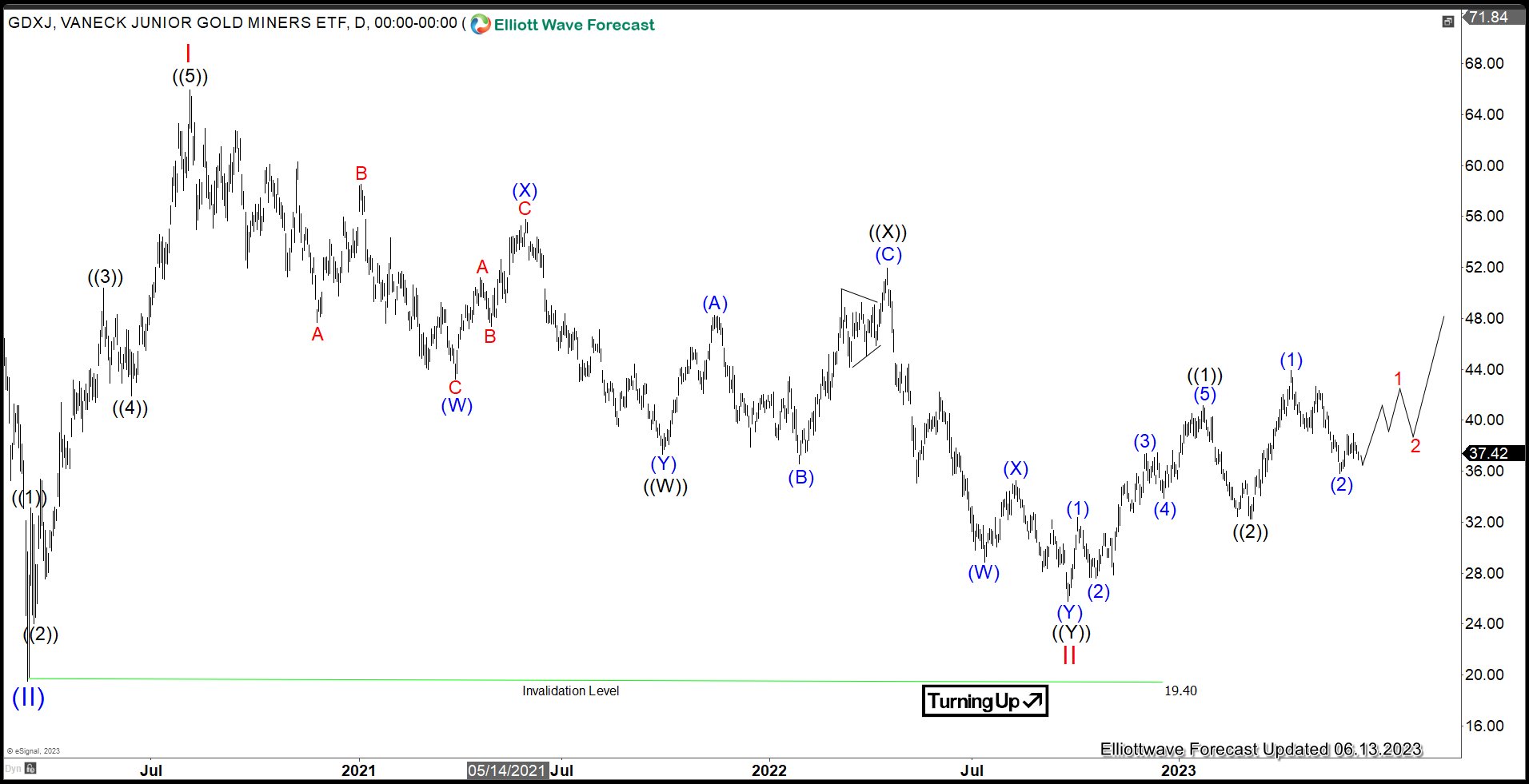

Daily Elliott Wave Chart of Gold Miners Junior (GDXJ) shows Gold Miners Junior is looking to rally higher in wave III. Up from wave II, wave ((1)) ended at 41.16 and pullback in wave ((2)) ended at 32.25. The ETF rallies higher in wave ((3)) with internal subdivision as another 5 waves in lesser degree. Up from wave ((2)), wave (1) ended at 43.89 and pullback in wave (2) ended at 35.79. Expect the ETF to find a bottom soon and turn higher.

GDXJ 4 Hour Elliott Wave View

4 Hour Elliott Wave Chart of GDXJ suggests that the ETF can see further downside in wave 2 to retest 5.26.2023 low at 35.79. While dips stay above the level, and more importantly above 32.18, expect the ETF to turn higher again.

We do not cover GDXJ as part of our regular service, but we cover GDX, Gold, and other commodities, stocks, forex, and crypto currencies. If you’d like to check our service, you can take our 14 days trial here –> 14 days Trial

Back