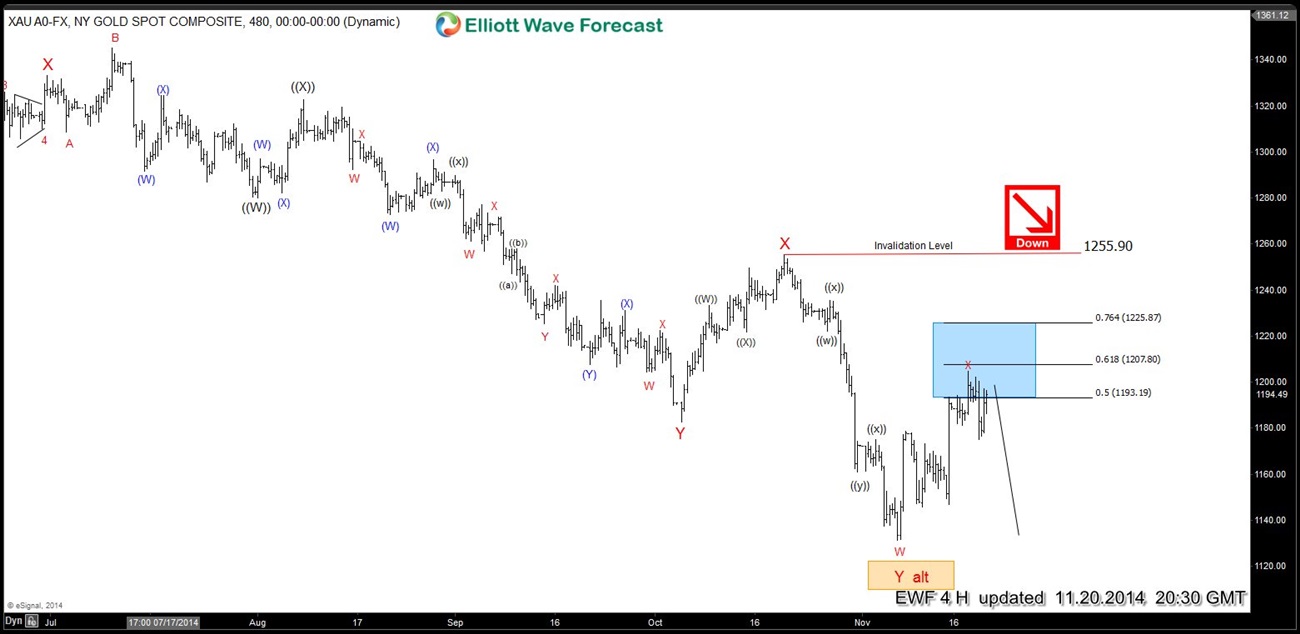

Gold is showing 5 swings down from July peak (1345) which many Elliott wavers are labelling as a 5 wave move but it doesn’t show any divergence between the last 2 lows which negates the idea of a 5 wave impulse and hence we like the idea of a 7 swing structure in progress as far as pivot at 1255 high remains intact in our system. If the pivot at 1255 high gives up in our system that would suggest Gold decline from July peak (1345) was a triple three structure and it would still remain bearish against this level. Let’s concentrate on the primary view which shows Gold to be correcting the decline from 1255 peak, we have already seen a test of equal legs up from 1131 low and hit 50 fib retracement level at 1193 and decline is now expected to resume for new lows below 1131. If 1204 high breaks, then 1207 – 1224 would be next area for sellers. We don’t like buying Gold & continue to favour more downside against 1255 pivot.

We do Elliott Wave Analysis of 26 instruments in 4 time frames (Weekly, Daily, 4 Hour and 1 Hour) with 1 hour charts updated 4 times a day so clients are always in loop for the next move. Please feel free to come visit around the website and click Here to Start your Free 14 day Trial (No commitments, Cancel Anytime)

Back