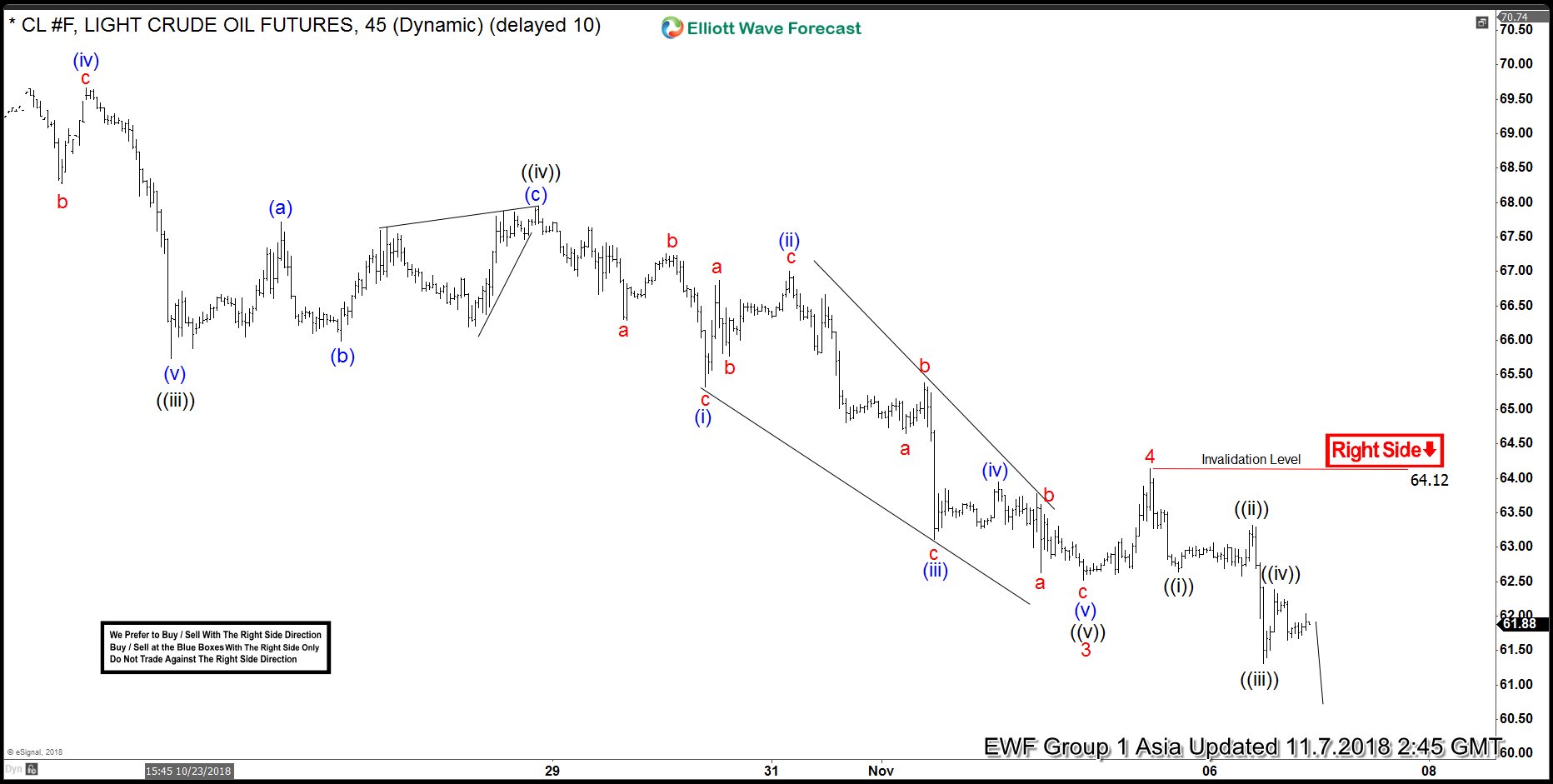

Oil (CL_F) short-term Elliott wave analysis suggests that the decline from Oct 3rd high is unfolding as a 5 waves impulse structure. In an impulse structure, the internals of wave 1, 3, and 5 also subdivide in another 5 waves of lesser degree. We propose Minor wave 3 ended at $62.52 , Minor wave 4 ended at $64.12, and Minor wave 5 is still in progress as 5 waves of lesser degree.

Looking at the internal of Minor wave 3, a clear 5 waves subdivision can be observed. Minute wave ((i)) ended at $70.51, Minute wave ((ii)) ended at $72.70, Minute wave ((iii)) ended at $65.74, Minute wave ((iv)) ended at $67.95 and Minute wave ((v)) ended at $62.52. After a relatively shallow bounce to $64.12, Oil has extended lower again which we think is the last Minor wave 5 from Oct 3 high.

Internal of Minor wave 5 is unfolding as another 5 waves of lesser Minute degree. Near term, while bounces stay below $64.12, Oil still can extend a bit lower towards $59.4 – $60.3 area before ending Minor wave 5. Once Minor wave 5 completes, expect the commodity to at least rally in 3 waves to correct the decline from Oct 3rd peak.