Hello fellow traders. In this technical blog we’re going to take a quick look at the charts of COFFEE Futures (KC#F) . In further text we’re going to explain the Elliott Wave structure, forecast and trading strategy.

As our members know, KC#F has had incomplete bearish sequences in H4 cycle according to Sequence Report. Consequently , we knew that short term bounces should ideally find sellers in 3,7,11 swings sequences. We advised clients to avoid buying the commodity keep on selling the rallies whenever get chance. Now let’s take a look at the short term Elliott Wave forecasts

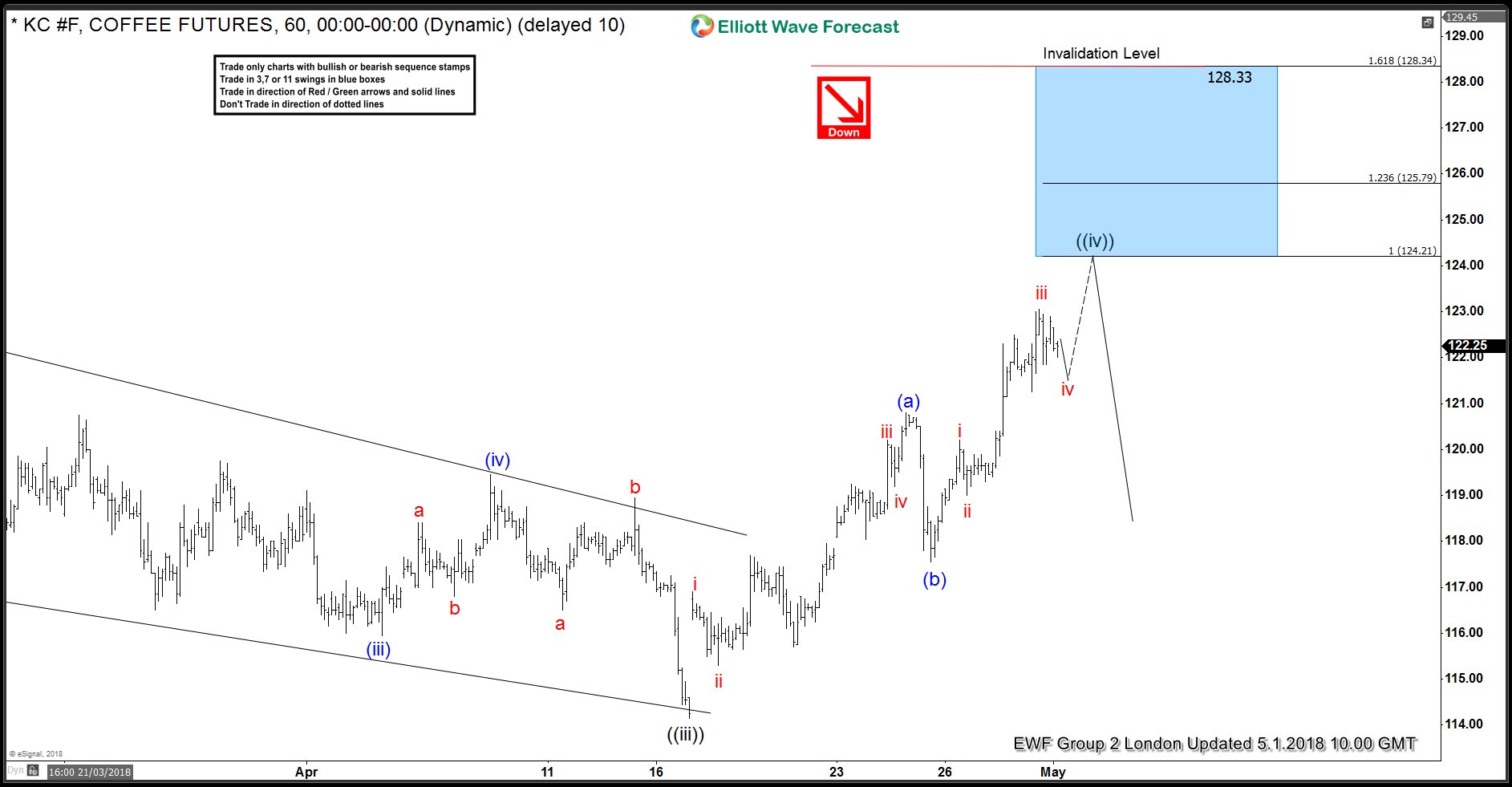

COFFEE KC#F Elliott Wave 1 Hour Chart 5.1.2018

As we can see at the charts below, COFFEE is doing wave ((iv) recovery. Proposed short term bounce seems to be unfolding as a Elliott Wave Zig Zag pattern when we’re in wave iv of (c). As short term cycle from the 114.27 is incomplete to the upside, we’re calling for another leg toward 124.21-125.79 area ( potential sell zone). We don’t know for sure if COFFEE is going to make new low from that area. However due to incomplete bearish sequences in H4 cycle, we’re pretty sure it has to make a 3 wave pull back at least. We don’t recommend buying it. Strategy is waiting for the price to reach 124.21-125.79 area before selling the commodity. Stop Loss of the trade is break above 1.618 Fibonacci extension ( 128.33). As soon as the price reaches 50 Fibonacci Retracement against the (b) blue low, we will make our Sell positions Risk Free.

COFFEE KC#F Elliott Wave 1 Hour Chart 5.1.2018

COFFEE has made proposed leg up and reached sell zone at 124.21-125.79. It has found sellers and gave us the decline from the blue box inflection area as expected with the actual high coming at 125.85 high. Structure has now changed and we are calling wave X completed at 125.85 which means next leg down can be bigger than previously thought. Any short positions should be risk free and members are now enjoying the profits. Currently the price is showing 5 waves from the mentioned peak. We can get 3 wave bounce soon and expect price ideally to stays below 125.85 high for proposed view. Note: Keep in mind not every char is Trading Signal. Best instruments to trade are those having incomplete bullish or bearish swings sequences. We put them in Sequence Report and best among them are shown in the Live Trading Room.

Elliott Wave Forecast

We cover 78 instruments in total. We present Official Trading Recommendations in Live Trading Room. If not a member yet, Sign Up for Free 14 days Trial now and get access to new trading opportunities. Through time we have developed a very respectable trading strategy which defines Entry, Stop Loss and Take Profit levels with high accuracy.

Back