The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

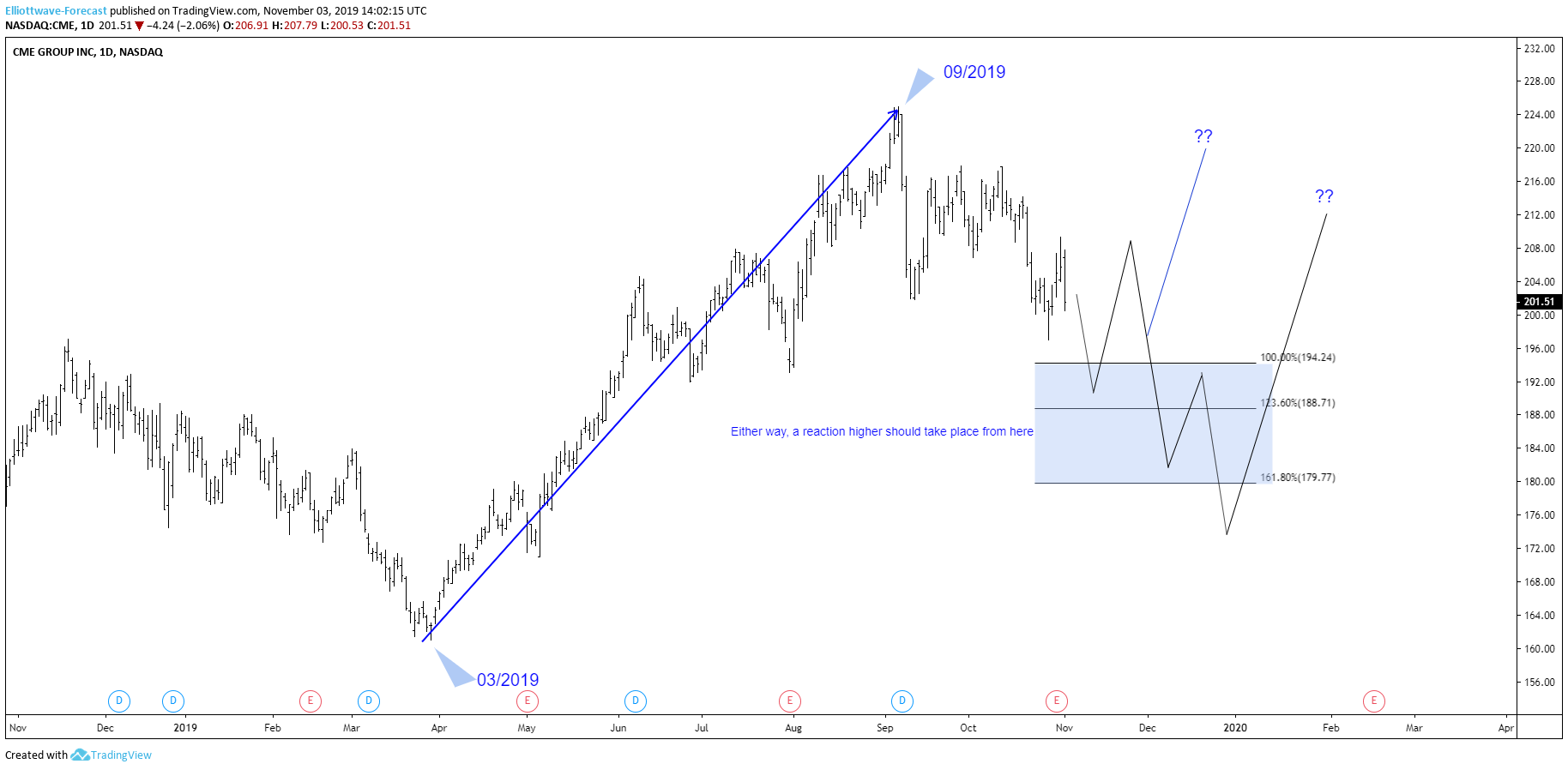

CME Group Daily Analysis: More Upside To Come

Read MoreHello fellow traders. In today’s blog, we will have a look at the CME stock. The stock is listed in the Eurostoxx SPX 500. The CME Group is an abbreviation and stands for the Chicago Mercantile Exchange, which is a global market company. While holding the largets derivatives and options exchanges in Chicago. the CME group […]

-

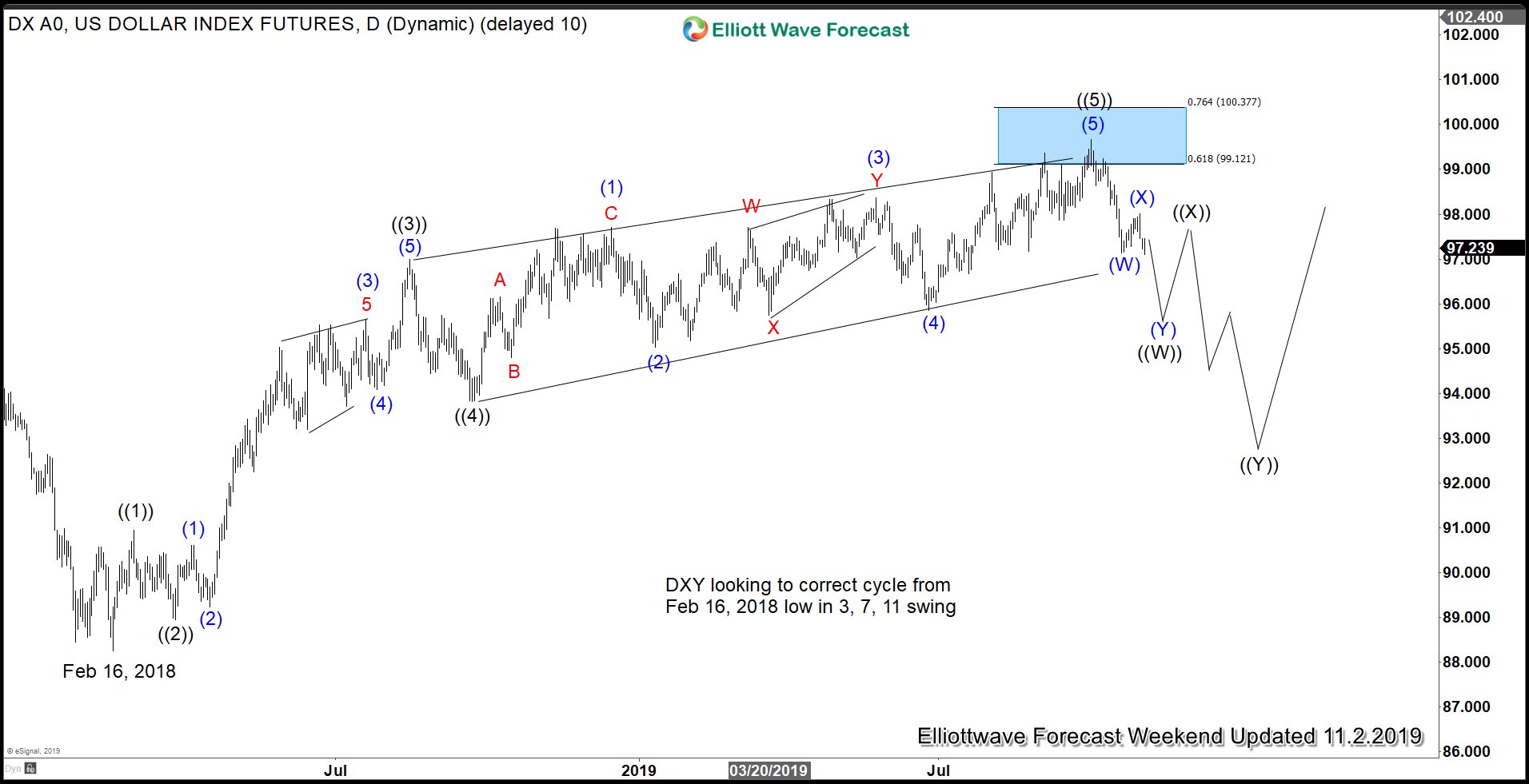

Is US Dollar Topping?

Read MoreThe Fed’s monetary stance has turned 180 degree this year. Recall last year the Fed talked about shrinking the balance sheet on auto pilot and raising interest rate. The QT (Quantitative Tightening) of $50 billion a month, according to former Fed Chair Janet Yellen, should be boring like watching paint dry. By July this year, […]

-

CORN ( $ZC_F ) Found Buyers At The Blue Box Area

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of CORN ( $ZC_F) published in members area of the elliottwave-forecast . As our members know, CORN ended cycle from the 352’3 low as 5 waves structure. We got 3 waves pull back , when the price reached Equal […]

-

Elliott Wave View: Nike Looking for Further Correction

Read MoreNike decline from Oct 23 high looks impulsive and the stock can see more downside. This article & video looks at the Elliott Wave path.