The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

US Indices made New All Time Highs. Will Russell Follow?

Read MoreIn the recent months, we have seen US Indices like $SPX $NQ_F $YM_F and $ES_F making new all time highs but Russell is the one which has been lagging and has not yet made a new high. It is on par in terms of percentage gains with other US Indices but has not made a […]

-

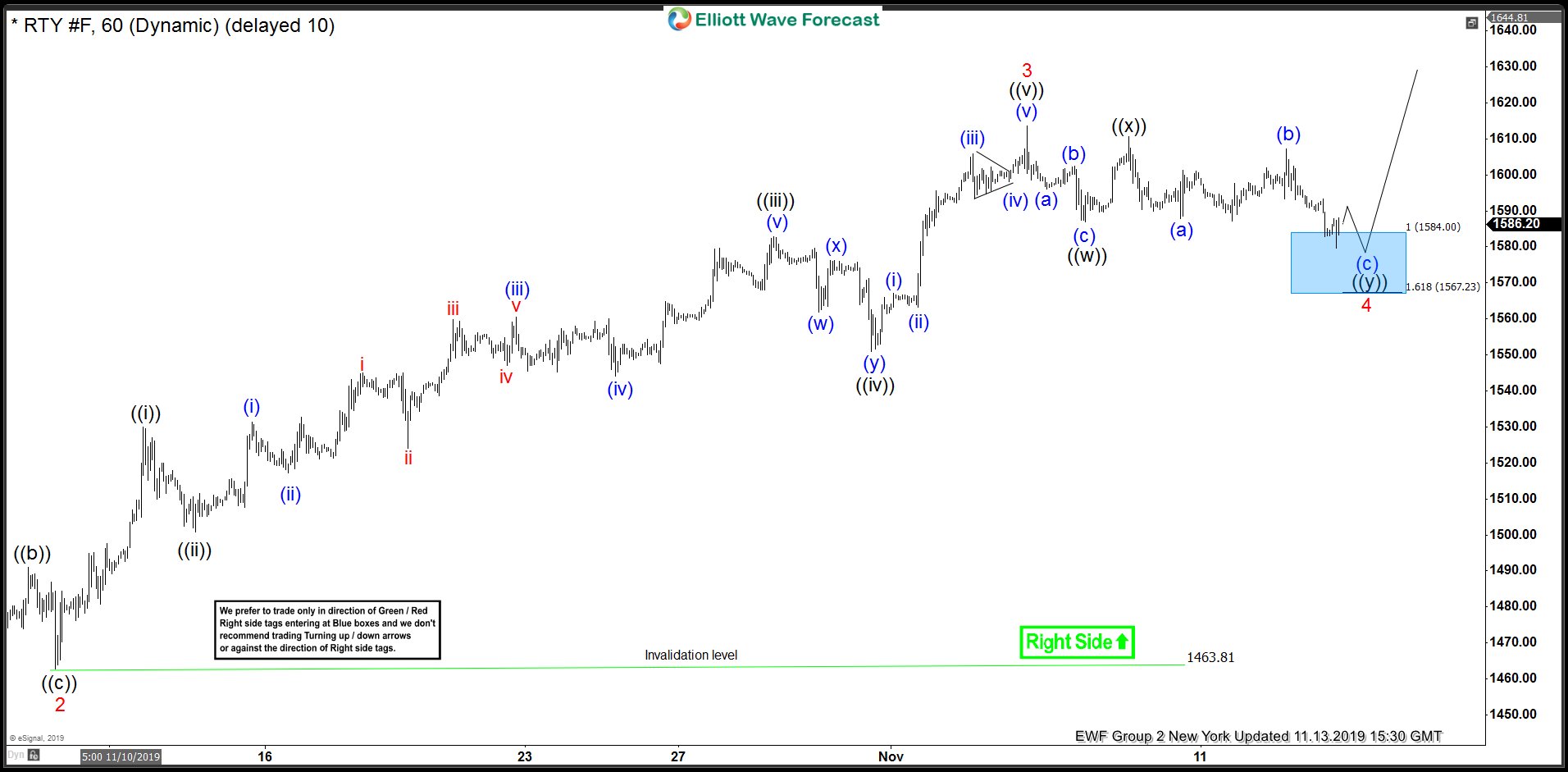

Russell Elliott Wave View: Impulse Rally Calling More Upside

Read MoreRussell is showing 5 swings impulse rally from 10/03/2019 low favoring more upside to take place. This article and video show the next Elliott Wave path.

-

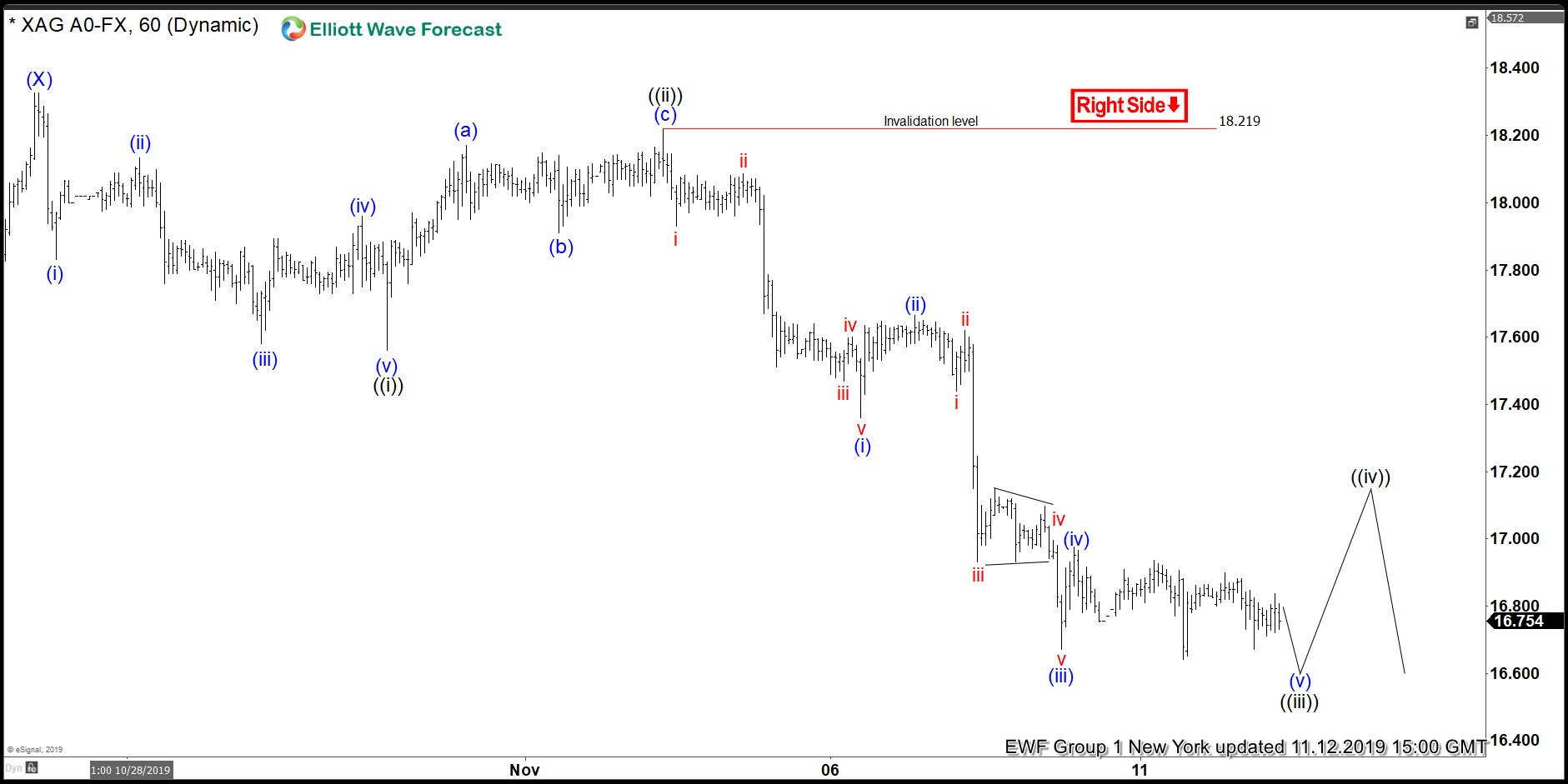

Silver Elliott Wave View: Incomplete Sequence Calling More Downside

Read MoreSilver is showing 5 swings incomplete sequence from 9/04/2019 peak ( $19.64) favoring more weakness. This article and video show the next Elliott Wave path.

-

Gold Suffered Biggest Weekly Drop in 3 Years on Trade Prospect

Read MoreGold hit a three-month low last Friday as the metal loses its luster with increasing prospect of US-China phase 1 trade deal. Spot Gold was down 3.7% last week, its biggest weekly drop since November 2016. A risk on market caused dollar to surge and US equities to break to all-time high. Earlier last week, […]