The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: Impulsive Rally in 10 Year Notes (ZN_F)

Read MoreShort Term Elliott Wave view on Ten Year Notes (ZN_F) suggests that the decline to 128 ended wave w. Wave x bounce is unfolding as a zigzag Elliott Wave structure. Wave ((A)) of x remains in progress with internal subdivision of a 5 waves impulse. Up from 128, wave (1) ended at 128.18 and pullback […]

-

Elliott Wave View: Further Downside in Exxon Mobil

Read MoreExxon Mobil shows an incomplete sequence from April 23, 2019 high favoring further downside. This video looks at the Elliott Wave path.

-

Elliott Wave View: DAX Resumes Higher

Read MoreCycle from Dec 27, 2018 low remains incomplete and can see further upside. This article and video look at the Elliott Wave path.

-

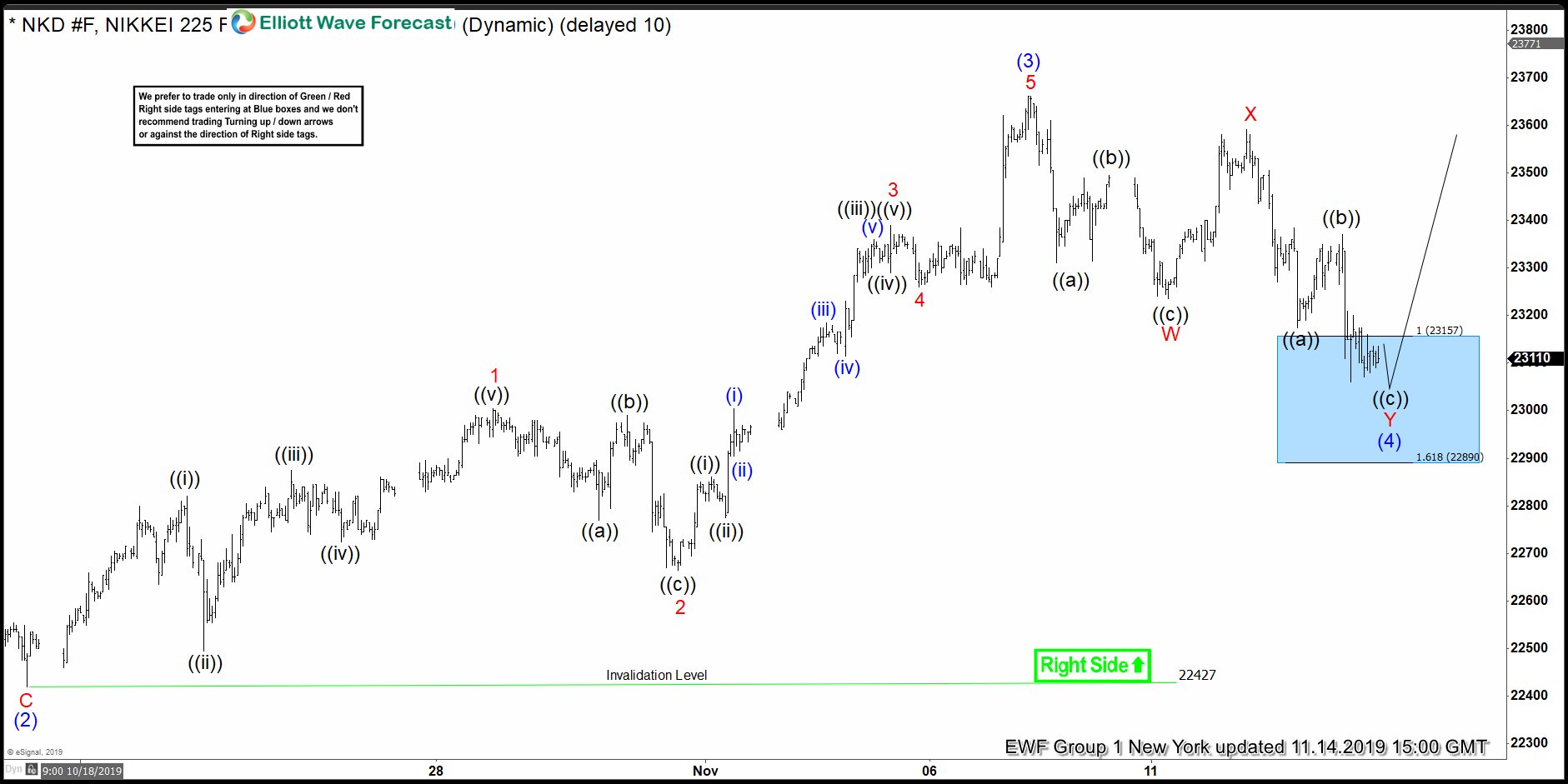

NIKKEI ( $NKD_F ) Made Bounce From The Blue Box

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of NIKKEI published in the membership area of the elliottwave-forecast . As our members know, NIKKEI ended cycle from the 22427 low as 5 waves structure. We got 3 waves pull back , when the price reached Equal Legs […]