The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Eurostoxx Buying Dips in Blue Boxes and Forecasting The Rally

Read MoreBack in September 2019, we said Eurostoxx break above July 25 2019 created an incomplete bullish sequence from December 27, 2018 low. This called for extension higher toward 3849 – 3993 area to complete the sequence from December 27, 2018 low. Let’s take a look at the chart we shared in our public social media […]

-

BABA Forecasting The Rally From The Blue Box

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of BABA Stock published in members area of the Elliottwave-Forecast . As our members know, BABA is showing incomplete sequences in the cycle from the December 2018 low (129.61). Break above 3rd May peak made higher […]

-

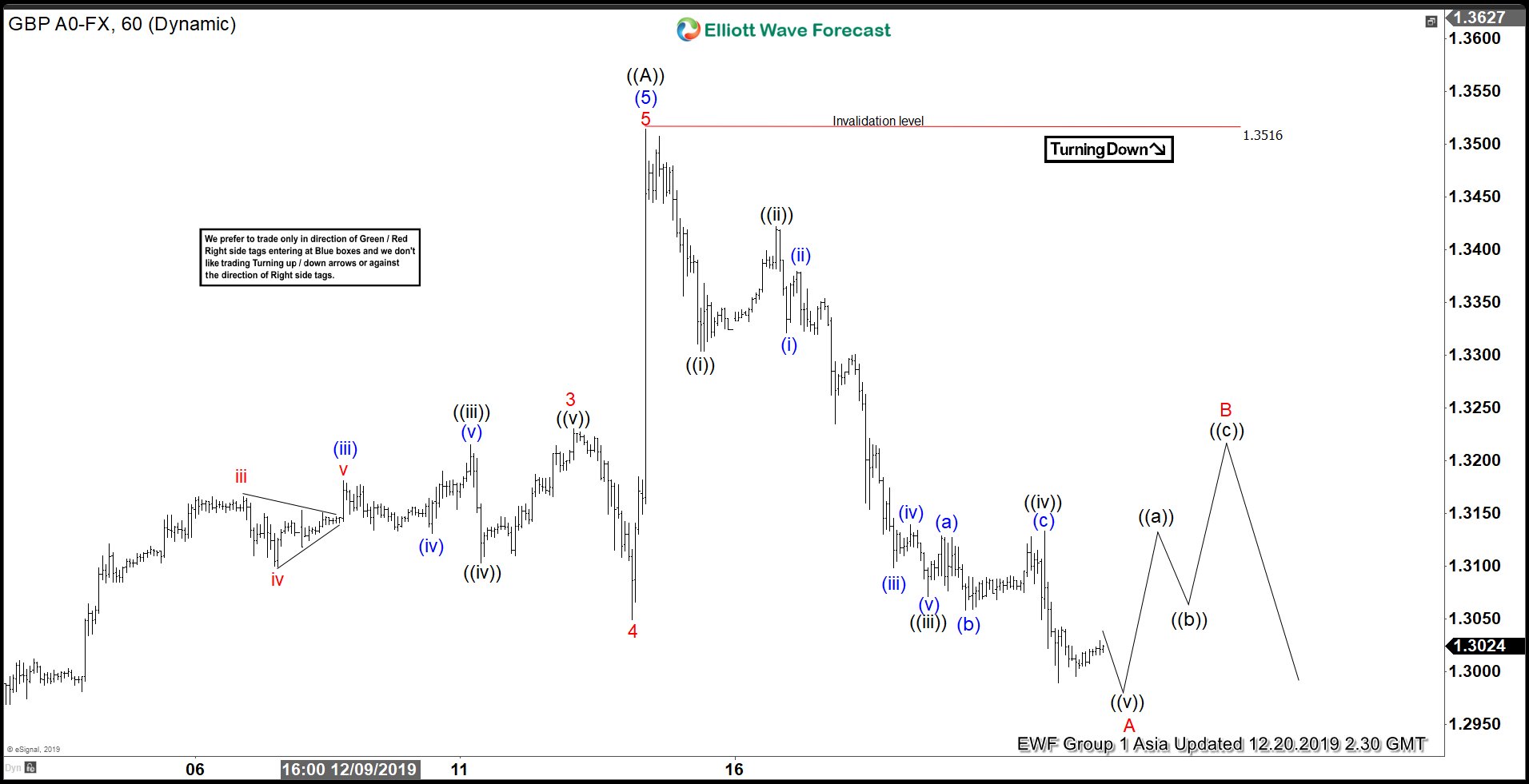

Elliott Wave View: GBPUSD Impulsive Decline Suggests More Downside

Read MoreGBPUSD decline from Dec 13, 2019 high is unfolding as Elliott Wave impulse structure and while bounce stays below there, pair can see more downside.

-

USDSEK Forecasting The Decline using Elliott Wave

Read MoreIn this blog, we will take a look at the recent price action of USDSEK since we published the short-term view for this pair in Chart of the day on 12.6.2019 Pair was showing an incomplete sequence down from 10.9.2019 (9.964) peak against 11.13.2019 (9.765) and was calling for more downside toward 9.3527 – 9.2549 […]