The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Netflix Sees Uptick Demand As People Spent More Time at Home

Read MoreThe novel corona virus forces government around the world to implement various mitigation measures to flatten the contagion curve. Some of the popular introduce social distancing where people must stay at home as much as possible. Others introduce stricter measures such as lock down in Italy, where residents can only go out of home for […]

-

Elliott Wave View: Gold Rallying as an Impulse

Read MoreShort Term Elliott Wave View suggests rally in Gold (XAUUSD) from March 16 low is unfolding as a 5 waves impulse Elliott Wave structure. Up from March 16 low, wave ((1)) ended at 1519.57, and pullback in wave ((2)) ended at 1454.90. The precious metal has resumed higher in wave ((3)) towards 1645.5 and wave […]

-

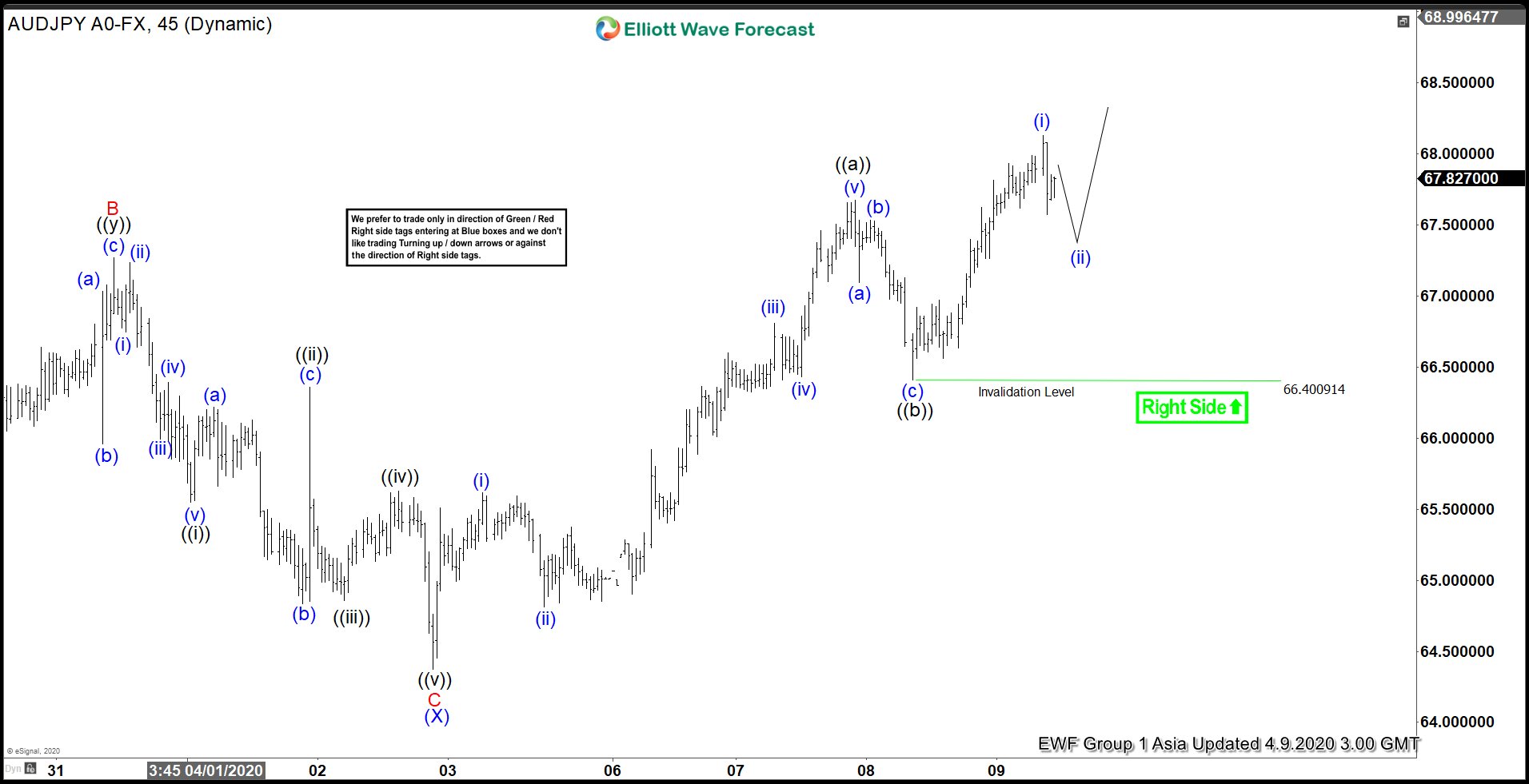

Elliott Wave View: Further Upside in AUDJPY

Read MoreAUDJPY shows incomplete sequence from April 2 low, favoring more upside. This article and video looks at the Elliott Wave path.

-

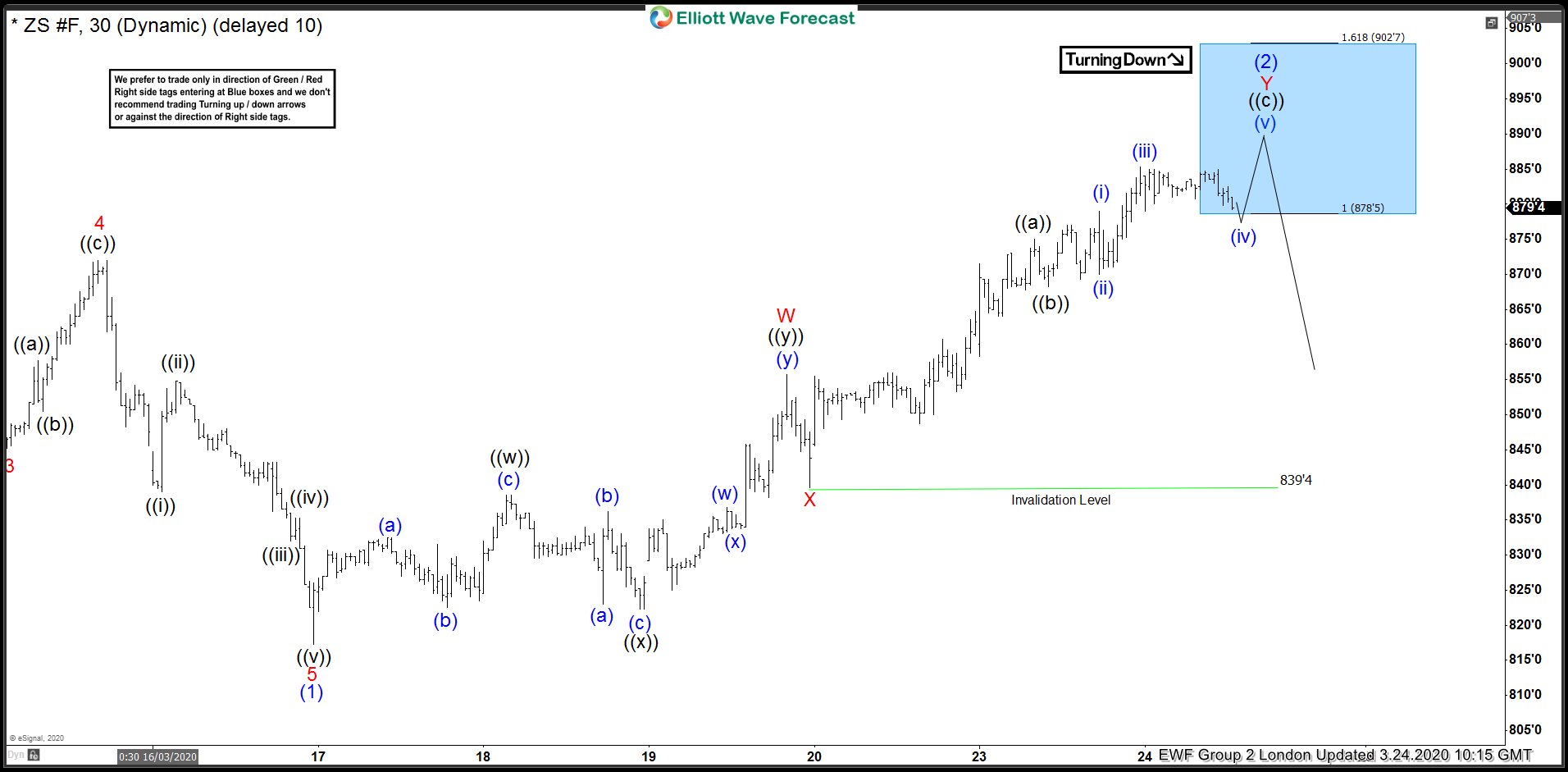

Soybean Elliott Wave View: Reacting Lower From Blue Box Area

Read MoreIn this blog, we take a look at the past performance of 1 hour Elliott Wave charts of Soybean In which our members took advantage of the blue box areas.