The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

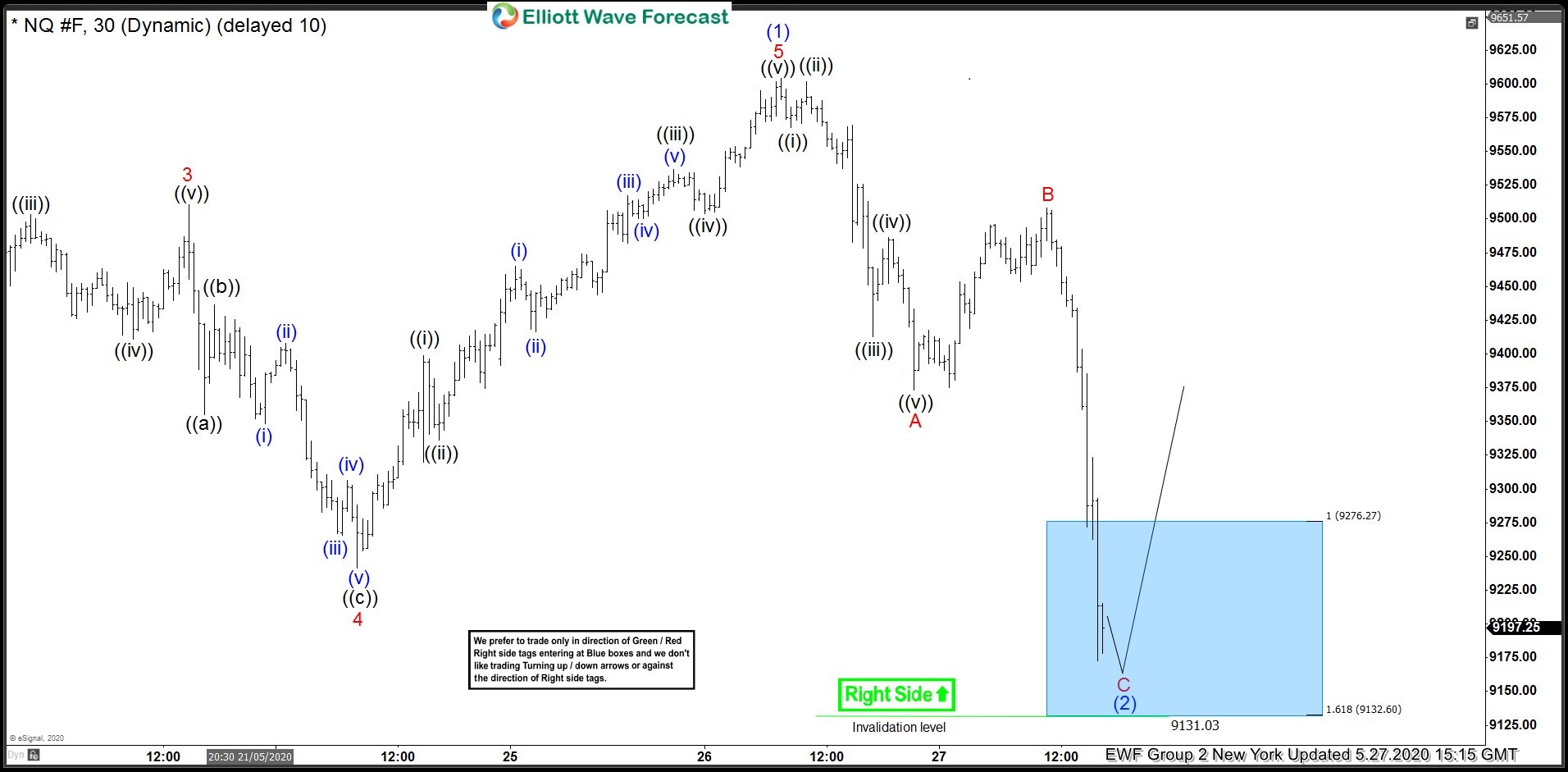

Nasdaq Futures: Buying dips in Elliott Wave Blue Box

Read MoreNasdaq Futures made a sharp decline yesterday before reacting higher strongly into the closing for the day. In this article, we would take a look at the charts we presented to clients yesterday and the blue box area we highlighted for 3 waves decline to end and buyers to appear for the rally to resume […]

-

Elliott Wave View: Further Upside in Nikkei

Read MoreNikkei (NKD_F) rally from May 14 low as an impulsive structure favoring more upside. This article and video look at the Elliott Wave path.

-

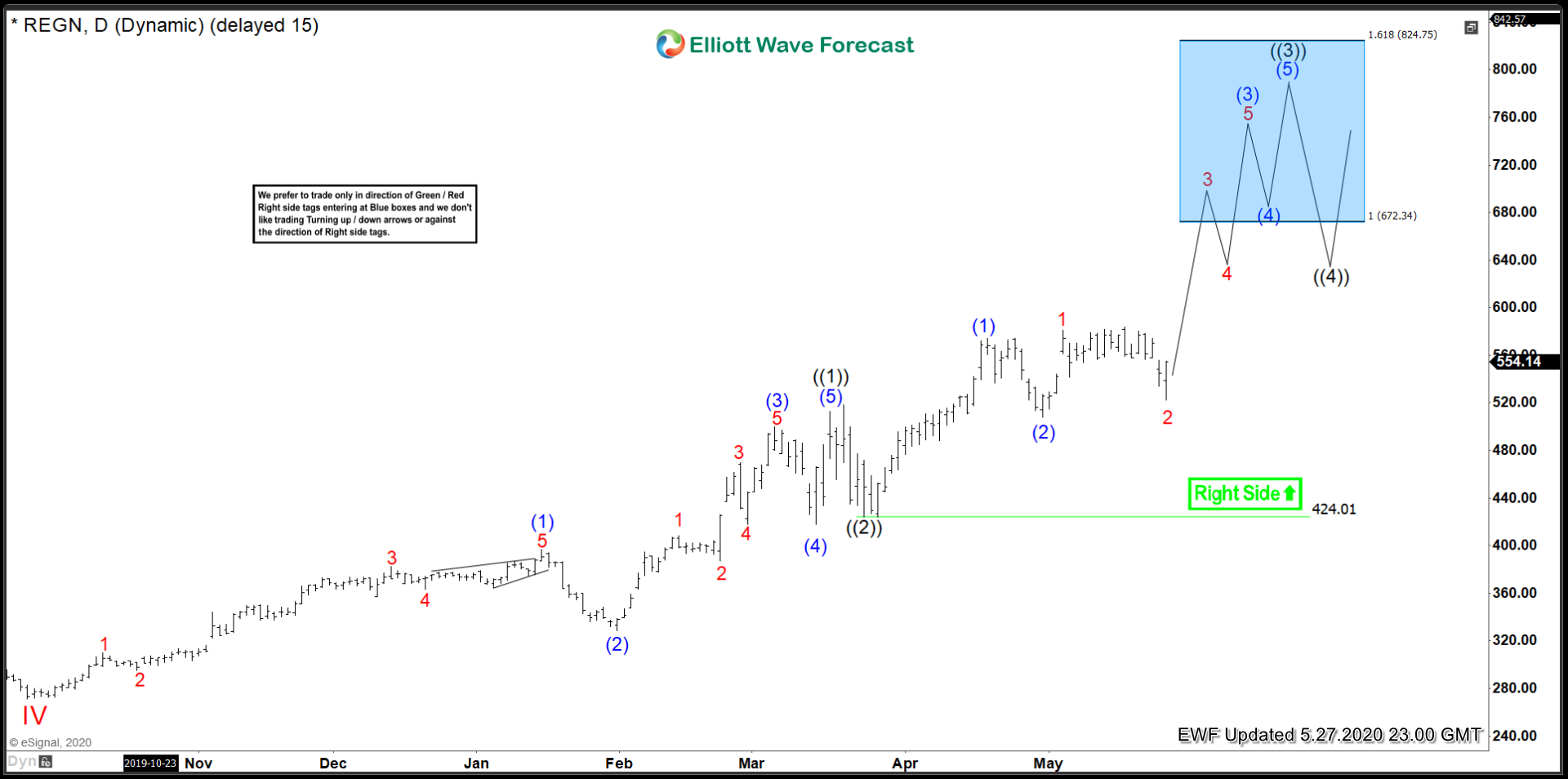

Regeneron Pharmaceuticals Inc ($REGN) More Upside In Store

Read MoreThe next entry in the theme of Corona Virus stocks is Regeneron Pharmaceuticals Inc. Regeneron is a Nasdaq-100 component, and has been one of the blue chips of Biotech for some time. However, the outbreak has really given Regeneron the boost it needs to break out and continue its long term trend. It remains very […]

-

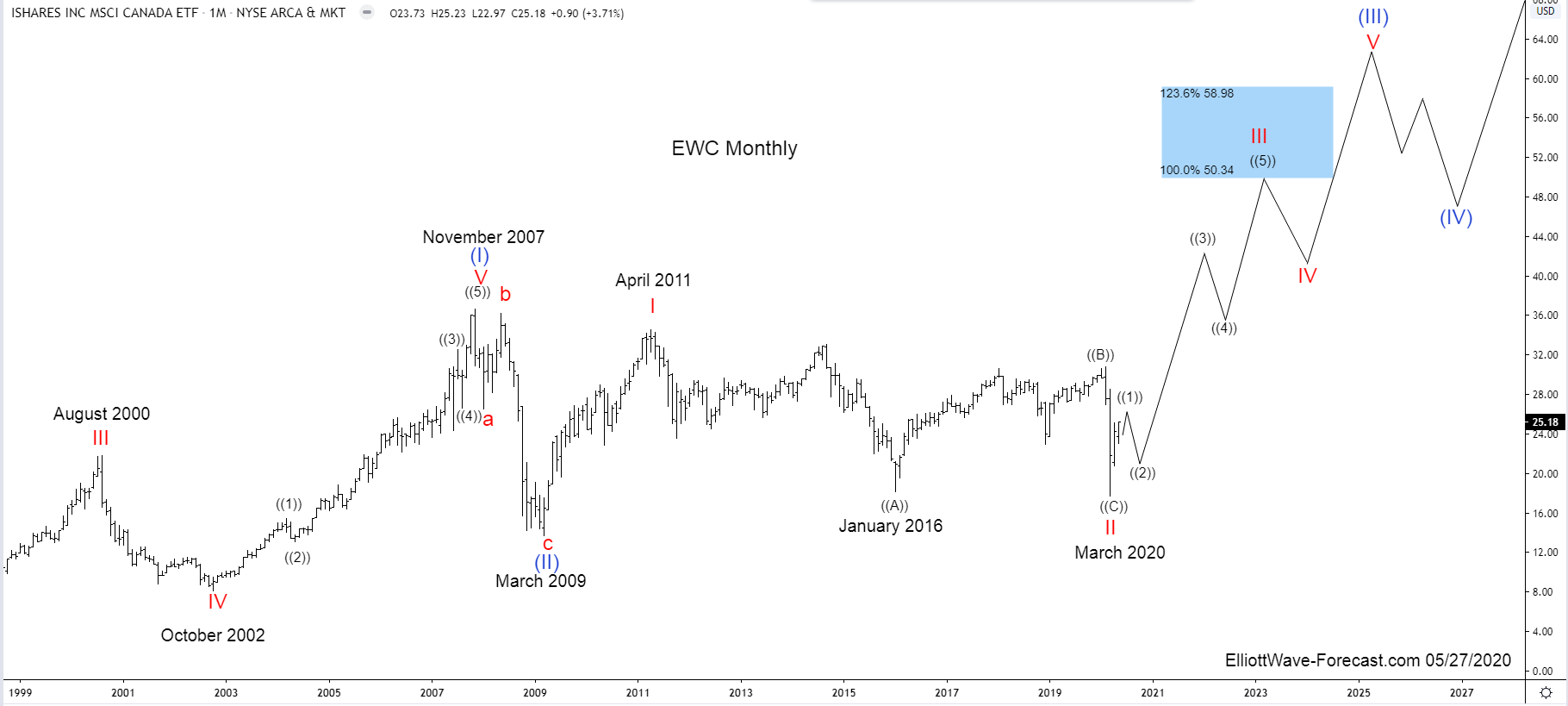

$EWC iShares MSCI Canada ETF Elliott Wave & Long Term Cycles

Read More$EWC iShares MSCI Canada ETF Elliott Wave & Long Term Cycles Firstly the EWC instrument inception date was 3/12/1996. The iShares MSCI Canada ETF seeks to track the investment results of an index composed of large and mid-sized companies in Canada. This is of course reflected in the price. The best Elliott Wave reading of the […]