The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: EURUSD in Impulsive Rally

Read MoreEURUSD shows an impulsive rally from 5.14.2020 low and dips should be supported. This article and video look at the Elliott Wave path.

-

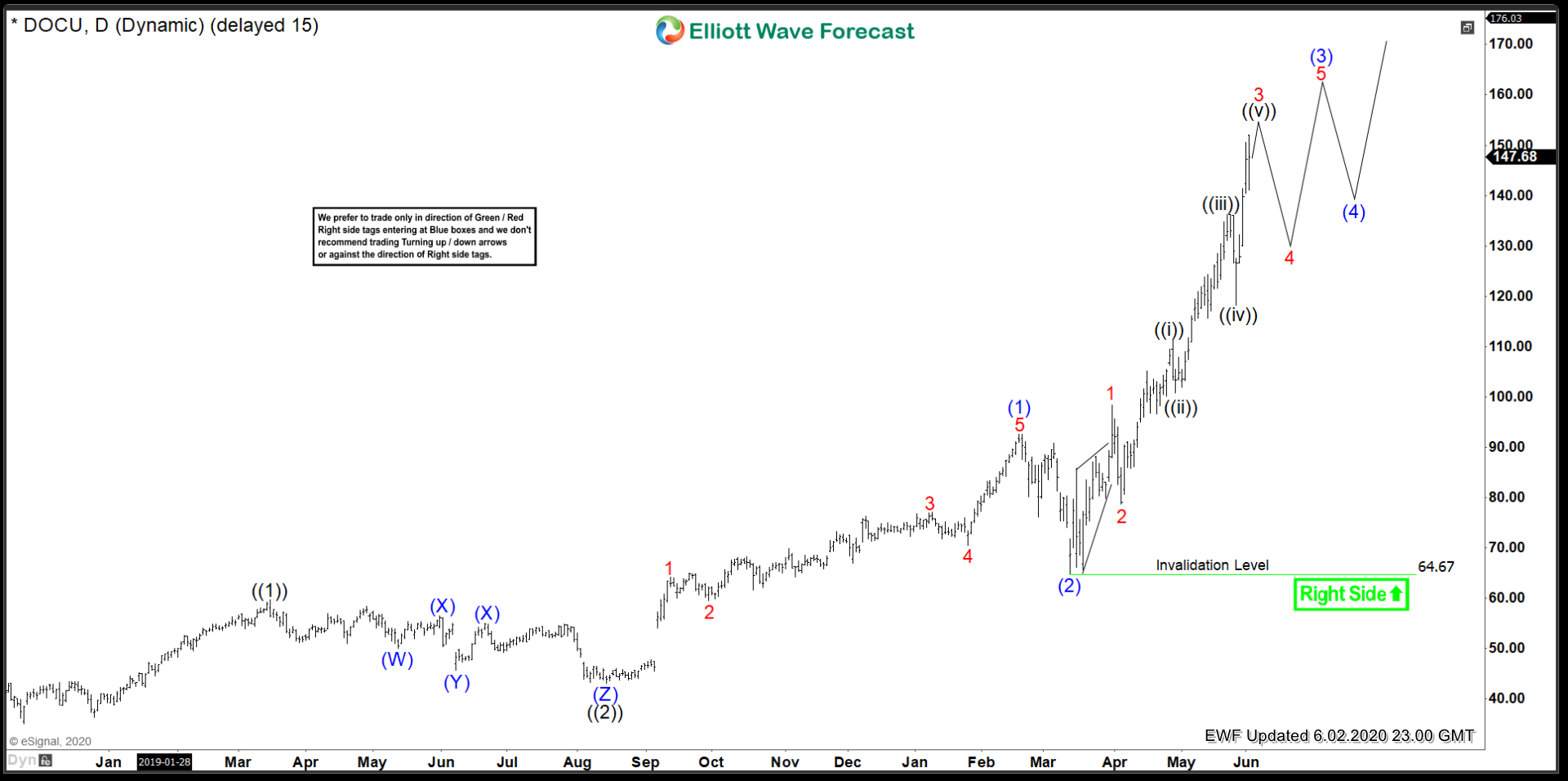

DocuSign ($DOCU) Bulls In Control

Read MoreThe next entry in the theme of Corona Virus stocks is DocuSign. Biotech is not the only sector benefitting greatly from the COVID-19 oubreak, software is also making huge gains in some stocks. I am finding new software companies every single day that are making new All Time Highs. $DOCU has been on a monster […]

-

USDJPY: Forecasting the Rally Based on Elliott Wave Structure

Read MoreUSDJPY extended the rally this week and exceeded the peak seen on 20th May 2020. In this article, we would look at the forecast from start of the week and how we called it higher. We will show some charts presented to clients this week and explain the reason for calling the extension higher and […]

-

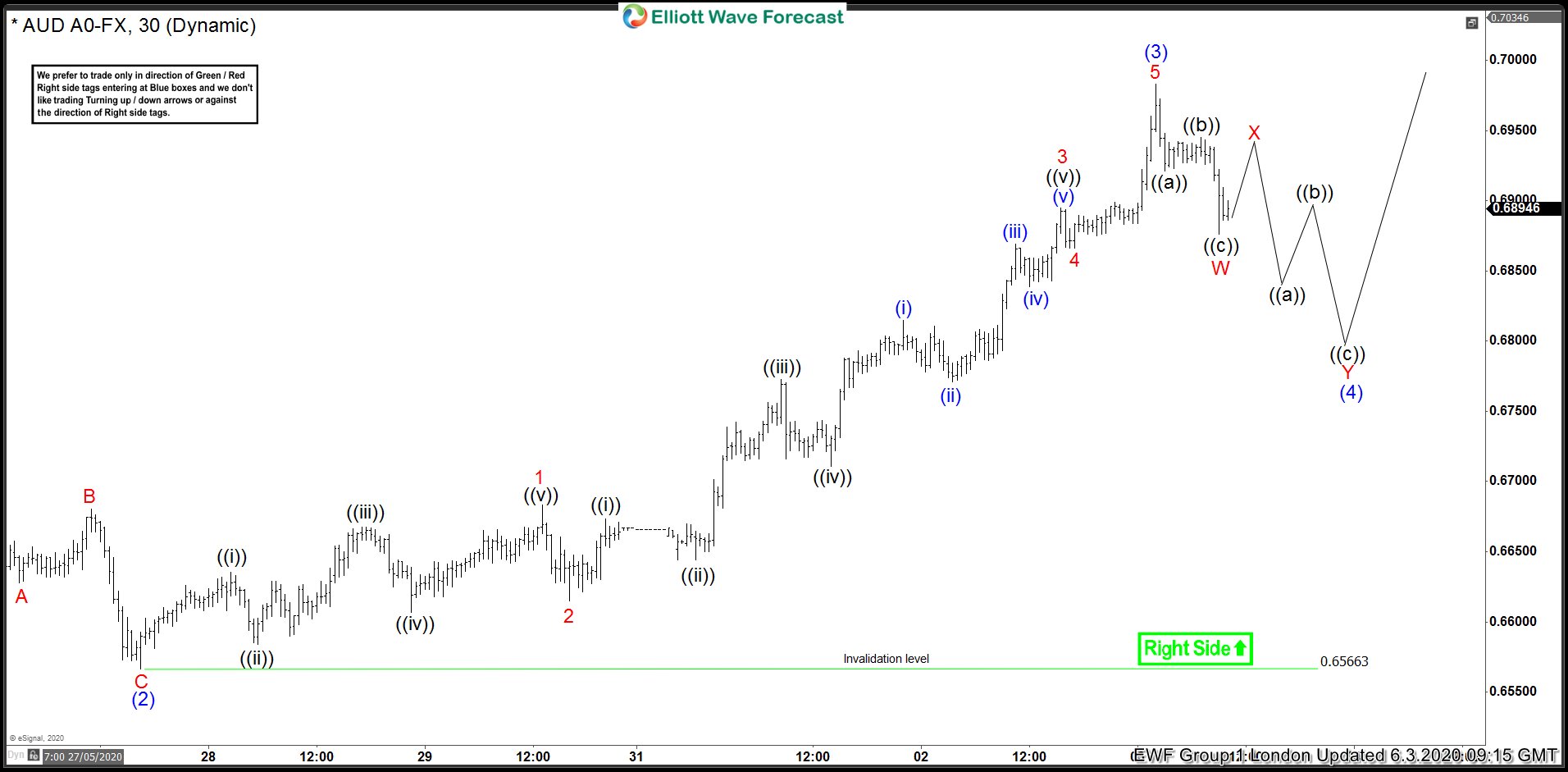

Elliottwave View: Incomplete Bullish Sequence in AUDUSD

Read MoreAUDUSD shows an impulsive rally from 5.22.2020 low and dips should continue to find support. This article & video look at the Elliott Wave path.