The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: Microsoft (MSFT) Cycle from March Low Still In Progress

Read MoreMicrosoft Corporation ( MSFT ) is currently still extending higher from 3.23.2020 low. The stock reached all time high on 6.11.2020 and ended wave ((3)) at 198.52 high. From there, MSFT did a pullback in wave ((4)) as a Double Three Elliott Wave structure. Down from 6.11.2020 high, wave (W) ended at 186.07 low. The […]

-

Blue Apron Holdings ($APRN) Looking To Rally

Read MoreThe next entry in the theme of Corona Virus stocks is Blue Apron Holdings Inc ($APRN). Biotech and software are not the only sectors benefitting greatly from the COVID-19 outbreak. The food delivery services are also making large gains since the lows. Blue Apron has had an unbelievable run, let’s take a look at the […]

-

Elliott Wave View: EURJPY Can See More Downside

Read MoreEURJPY decline from 6/5 high is unfolding as an impulse and can see further downside while below 6/16/2020 high.This article looks at the Elliott Wave path.

-

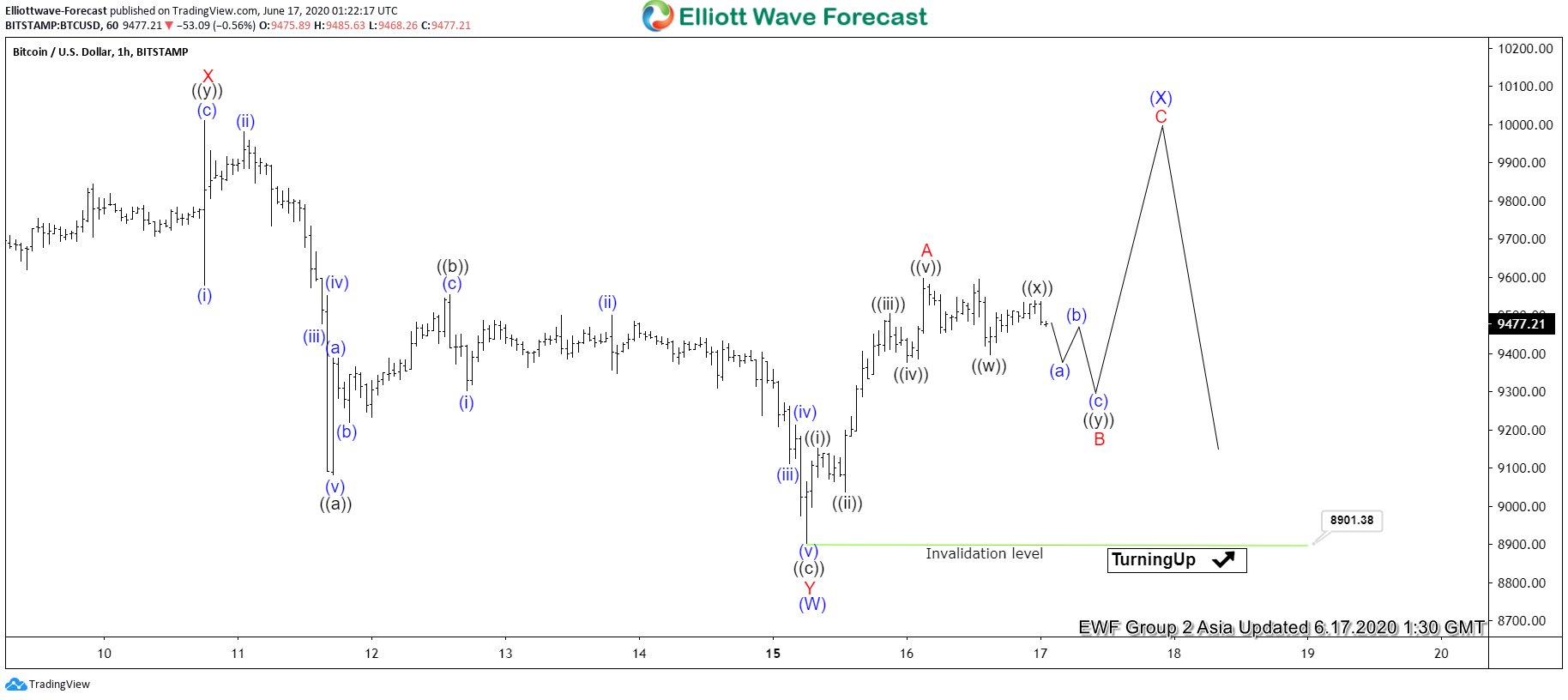

Elliott Wave View: Bitcoin shows short term impulse up

Read MoreBitcoin (BTC/USD) is currently correcting the cycle from 3.13.2020 low. The instrument has just ended cycle from 6.1.2020 high (10429) as a double three structure. Down from 6.1.2020 high, wave W ended at 9135 low. The bounce in wave X ended at 10011 high. From there, the instrument extended lower and ended wave Y at […]