The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

GOLD (XAUUSD) Elliott Wave: Forecasting the Rally from the Equal Legs Area

Read MoreHello fellow traders, In this technical article, we are going to present Elliott Wave charts of GOLD (XAUUSD) . As our members know we are long in GOLD from previous equal legs area. As a result, members are enjoying profits in risk-free positions. Recently ,the commodity completed its intraday correction at the Equal Legs zone. […]

-

Elliott Wave Outlook: Gold (XAUUSD) Signals Bullish Trend Resumption

Read MoreGold (XAUUSD) has likely resumed the bullish trend. This article and video discusses the Elliott Wave path of the metal in the shorter cycle.

-

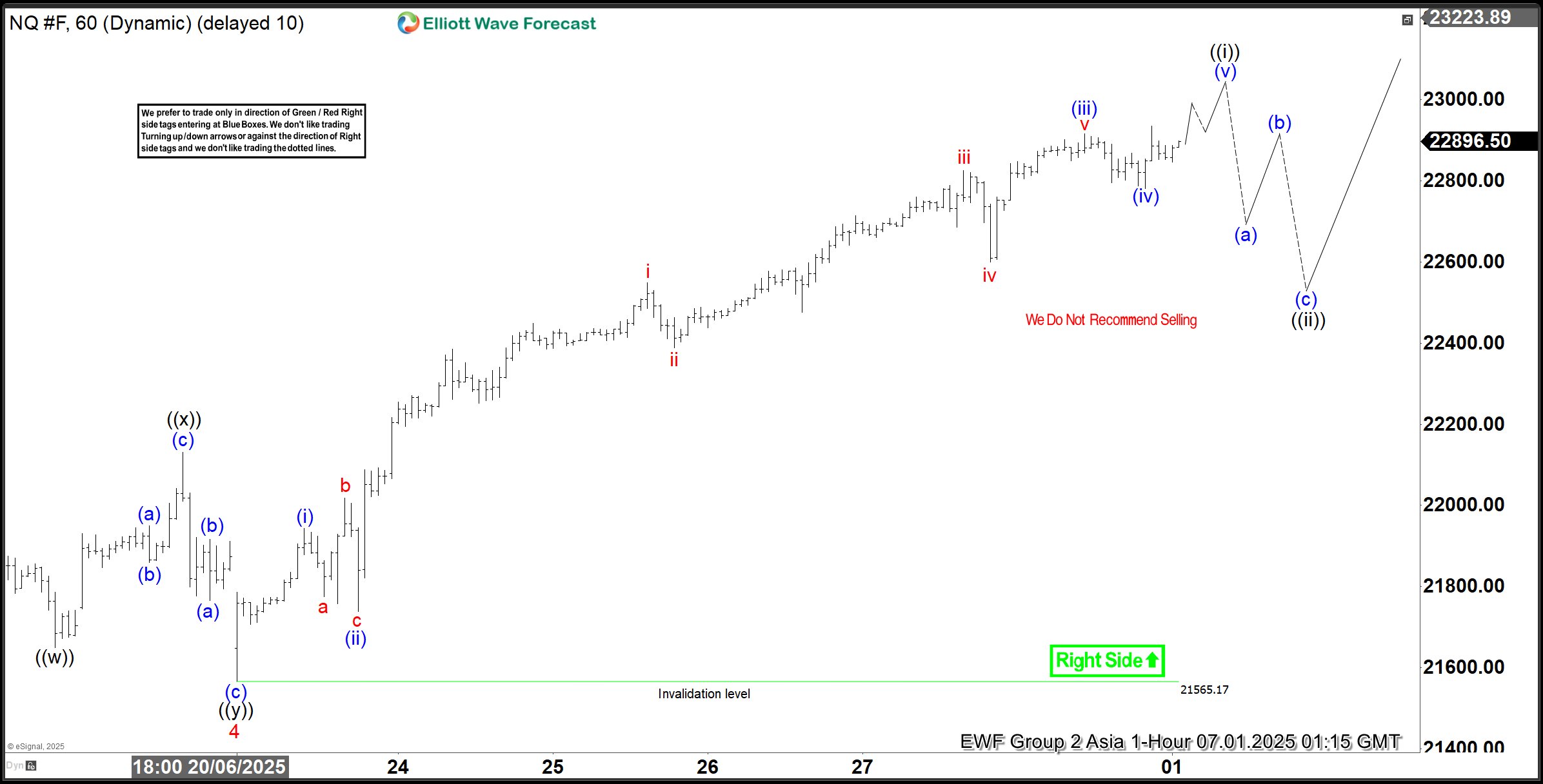

Elliott Wave Analysis: Nasdaq (NQ) Continues Bullish Cycle, Reaching New All-Time High

Read MoreNasdaq (NQ) extends to new all-time high, affirming the bullish trend. This article and video look at the Elliott Wave path of the Index

-

Royal Bank of Canada (RY) Hits New Highs – What’s Next?

Read MoreRoyal Bank of Canada., (RY) operates as diversified financial service company worldwide. It operates through personal finance, commercial banking, wealth management & Insurance segments. It comes under Financial services sector & trades as “RY” ticker at NYSE. RY is trading at all time high & pullback in 3, 7 or 11 swings should provide buying […]