The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

What Nasdaq (NQ) is saying about the Right Side of Market

Read MoreTechnology is the strongest sector in the current bullish trend in World Indices. Nasdaq (NQ) which has a lot of technology stocks naturally is one of the best performing Indices. We had some pullback in the Indices last week. As always, with every pullback, many traders and analysts start to speculate if major top is […]

-

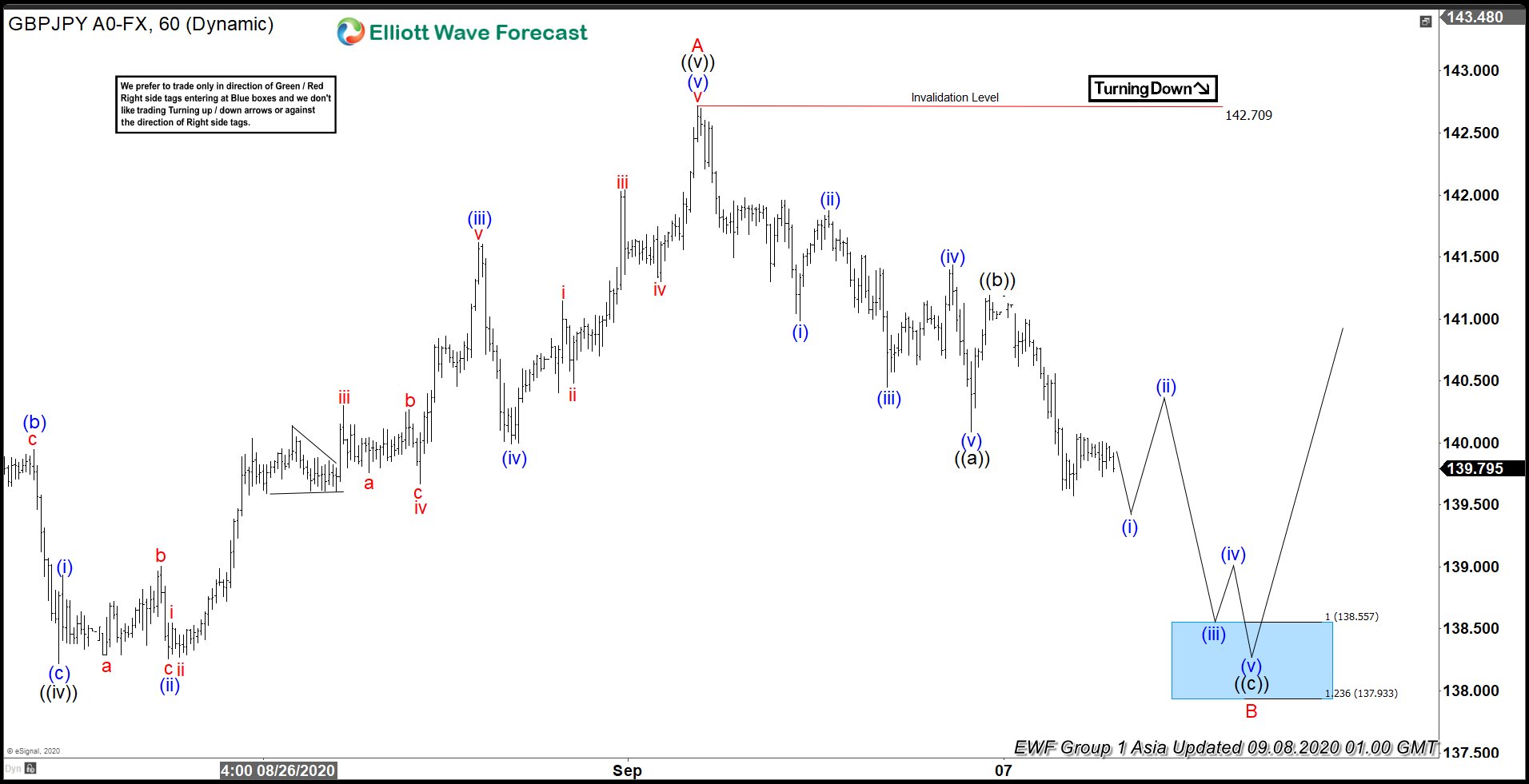

Elliott Wave View: GBPJPY Zigzag Correction in Progress

Read MoreGBPJPY ended cycle from June 21 low. Pullback is currently unfolding and could reach blue box area soon, where pair can see 3 waves bounce at least.

-

Sea Ltd ($SE) A Top Is In Sight

Read MoreGaming is one of the sectors that has really taken the spot light since COVID-19 hit the world by storm. Some companies in this sector have vastly outperformed the marketplace since the March 2020 low. Sea Ltd. is one of those stocks that have had explosive upside since the low that printed in March 2020. […]

-

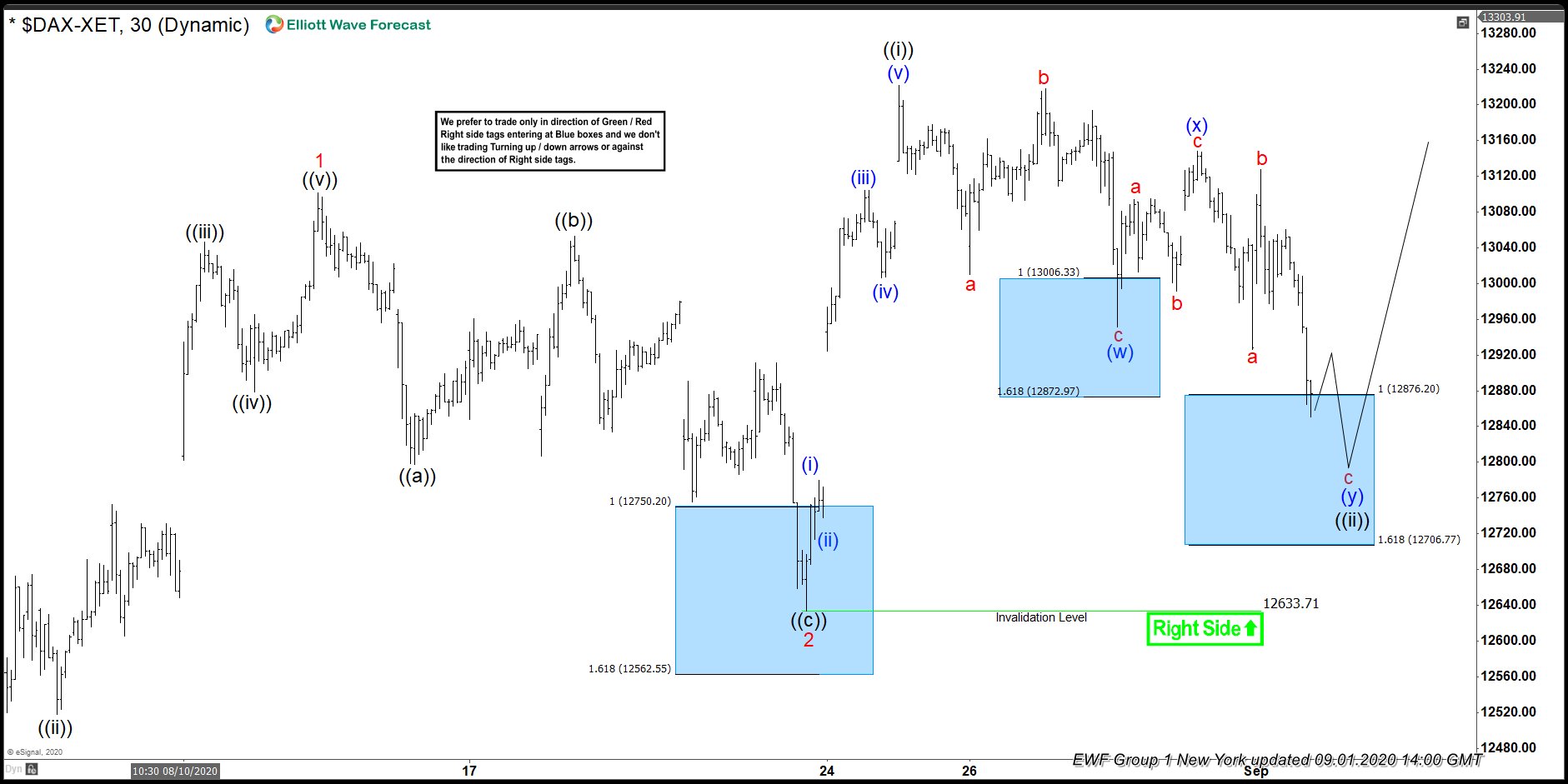

DAX Keep Finding Buyers in 3,7,11 Swings

Read MoreHello fellow traders. DAX is one of the instruments that has been giving us a lot of good trades recently. In this technical blog we’re going to take a quick look at the Elliott Wave charts of DAX, published in members area of the website. As our members know, we’ve been calling rally in DAX […]