The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Bitcoin rallies 34% since September. Will the Rally Continue or Fail?

Read MoreBitcoin has been rallying for the last few weeks and this week it managed to make a new high above August 17, 2020 peak. The low seen on 8th September 2020 was 9825 and last week’s high was 13235 which makes it 3410 and equates to 34.7% rally since 8th September 2020. In today’s article, […]

-

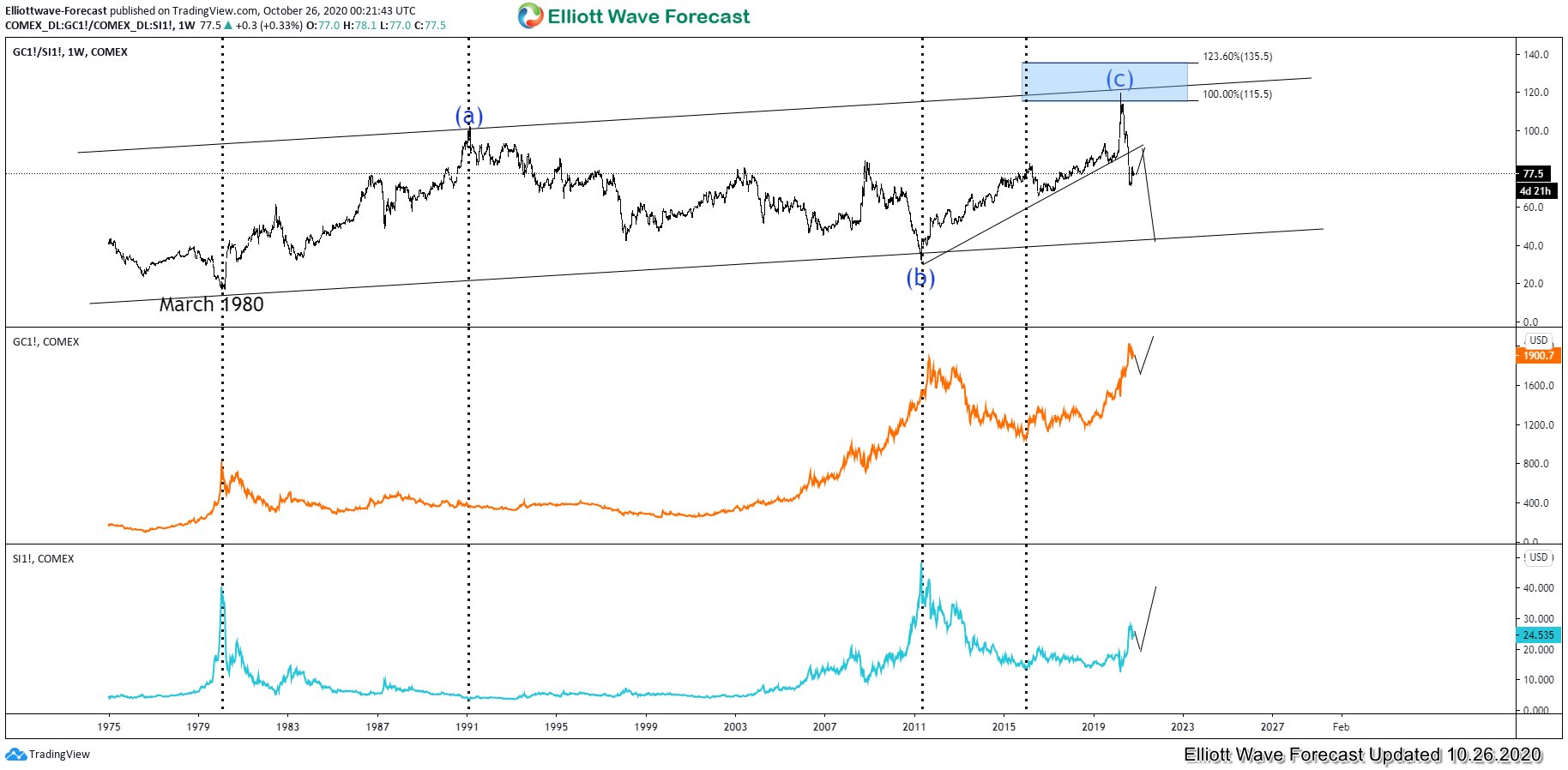

Gold-to-Silver Ratio Suggests Further Upside in Precious Metals

Read MoreGovernment and corporations around the world continue to accumulate unsustainable debt. Since it’s unthinkable for developed countries such as the United States to default on the obligation, the only way out of this situation is to continue to debase currencies. This environment is very supportive for Gold and Silver in coming years. Indeed, Gold has […]

-

Elliott Wave View: ASX 200 Looking for Support

Read MoreASX 200 has reached 100% in 3 swing from Oct 19 peak and can see support for 3 waves bounce at least. This article and video look at the Elliott Wave path.

-

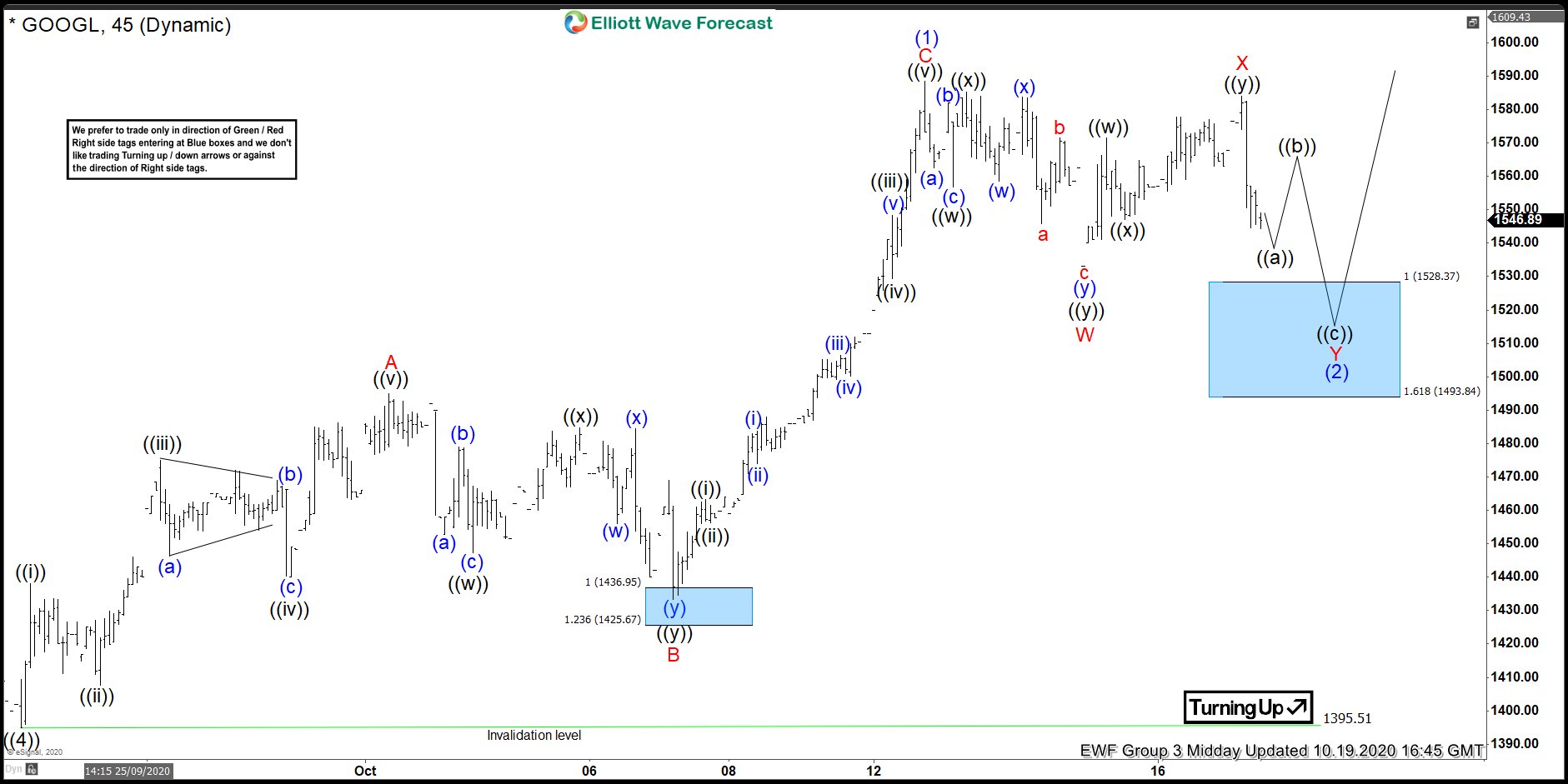

GOOGLE Found Buyers At The Blue Box After Double Three Pattern

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of GOOGLE stock ( $GOOGL) published in members area of the Elliottwave-Forecast . As our members know, GOOGLE stock is trading higher in the cycle from the September 1394.15 low. Recently we got short term pull back that has unfolded […]