The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

22 Best Trading and Forex Signal Providers in 2025

Read MoreForex markets are brutal and uncertain territories to explore but at the same time, it offers an immense opportunity to build wealth, prosperity, and enable you to achieve your financial goals in no time. It is nearly impossible for everyone to be an expert but the great news is you don’t have to be an […]

-

Bitcoin Made New Highs From Another Blue Box Area

Read MoreIn this blog, we take a look at the past performance of 1 hour Elliott Wave charts of Bitcoin In which our members took advantage of the blue box areas.

-

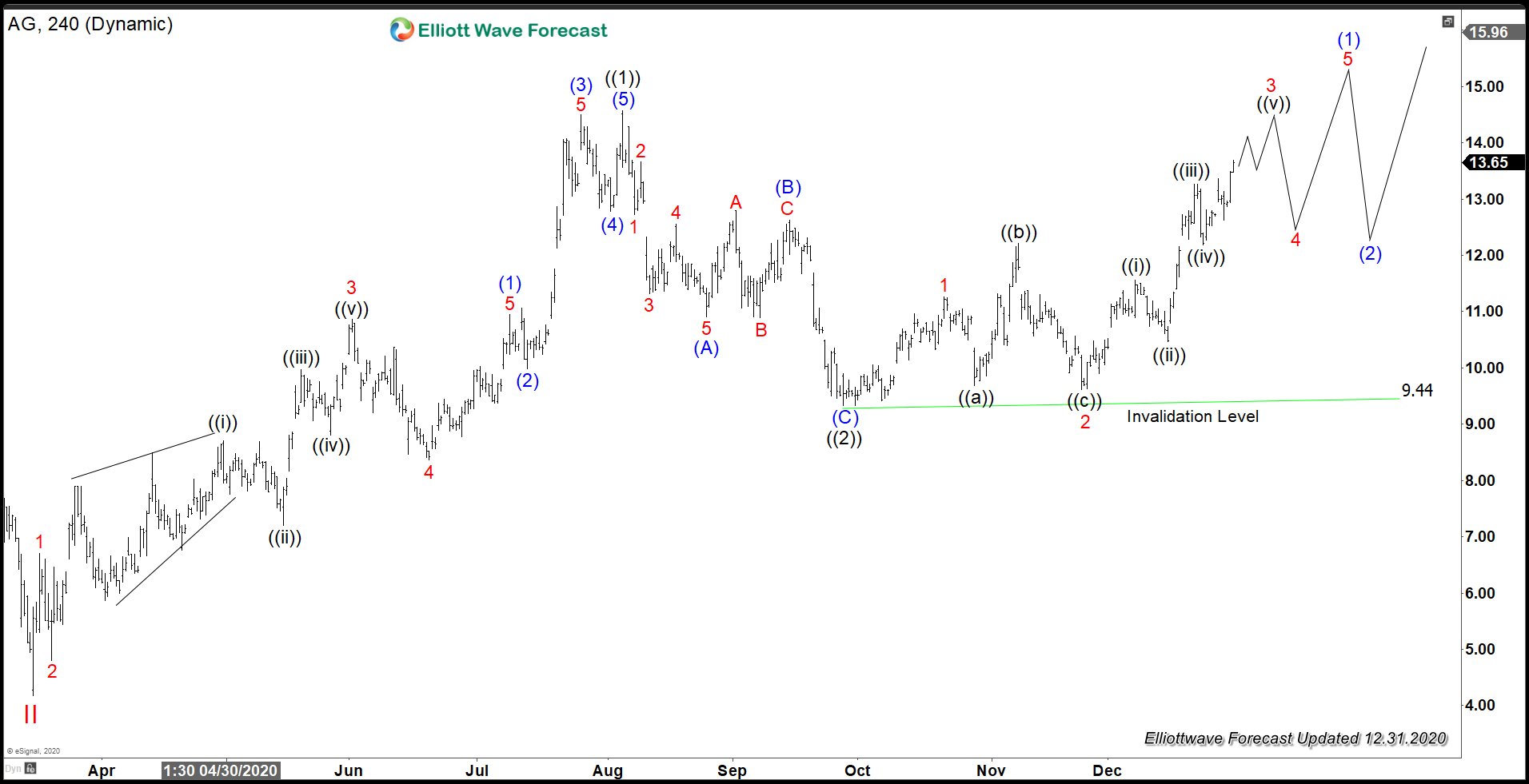

First Majestic Looking to Outperform in 2021

Read MoreFirst Majestic Silver (symbol: $AG) is one of the purest Silver miners in the market. It’s one of the best primary silver producers with healthy balance sheet and ample cash flow. This year, one of the most prominent mining and billionaire investors Eric Sprott has invested C$ 78 million to get a 2.3% stake in […]

-

Elliott Wave View: Dow Futures (YM) Remains Bullish as We End Year 2020

Read MoreDow Future is near all-time high as we end year 2020. Structure of the Index remains bullish as this article and video explains using Elliott Wave.