The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Relative Strength Index – Basics and RSI Trading Strategies

Read MoreRelative Strength Index – Table of Contents 1.What is Relative Strength Index 2.Benefits of Relative Strength Index 3.Basic Relative Strength Index Strategies 4.Relative Strength Index as used by Elliott Wave Forecast 5.Relative Strength Index Trading strategies 6.RSI Settings for Day Trading 1.What is Relative Strength Index? Relative Strength Index is a momentum oscillator that is […]

-

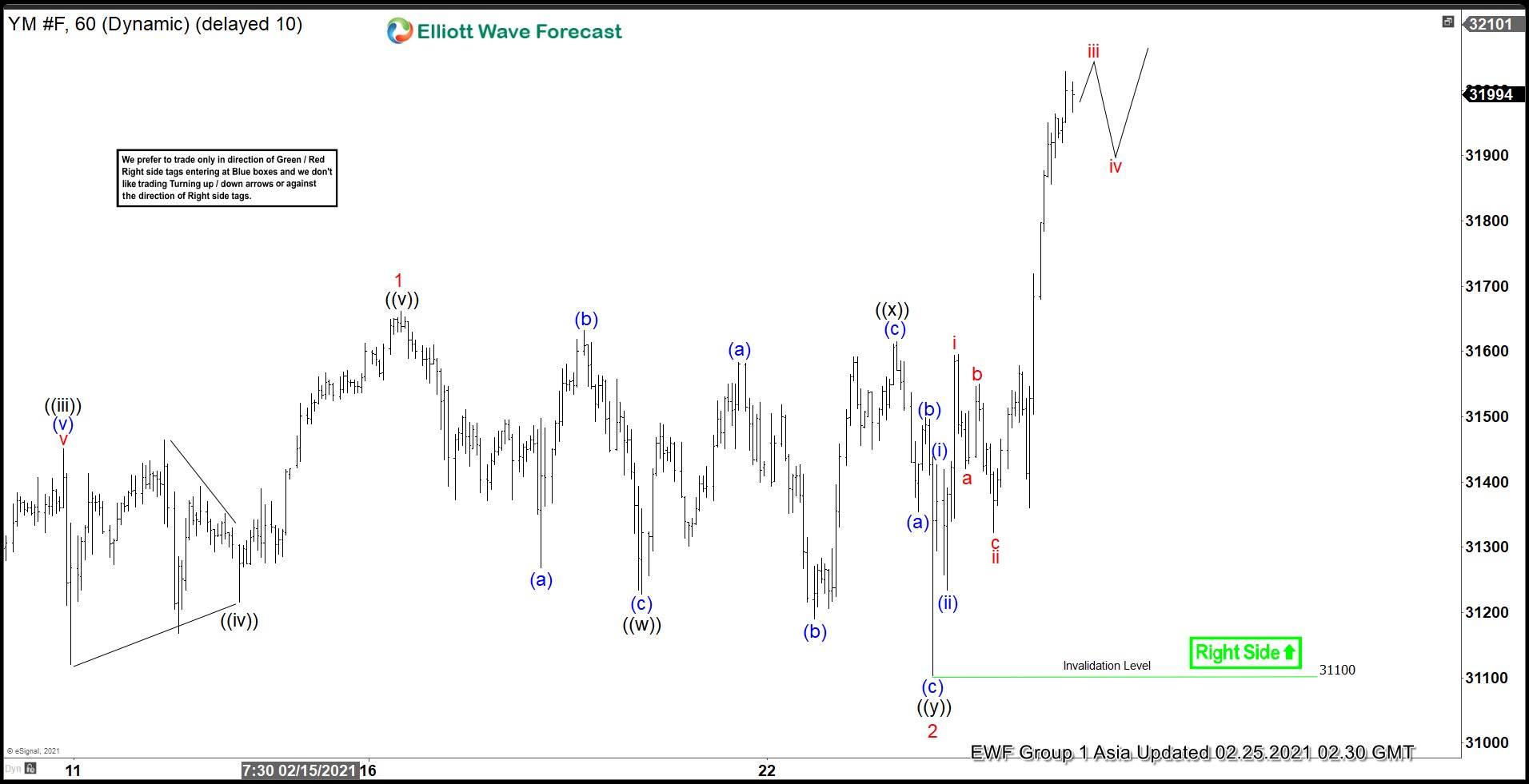

Elliott Wave View: Dow Futures (YM) Should Continue to Print All-Time High

Read MoreDow Futures has made an all time high and should continue higher. This article and video look at the Elliott Wave path of the Index.

-

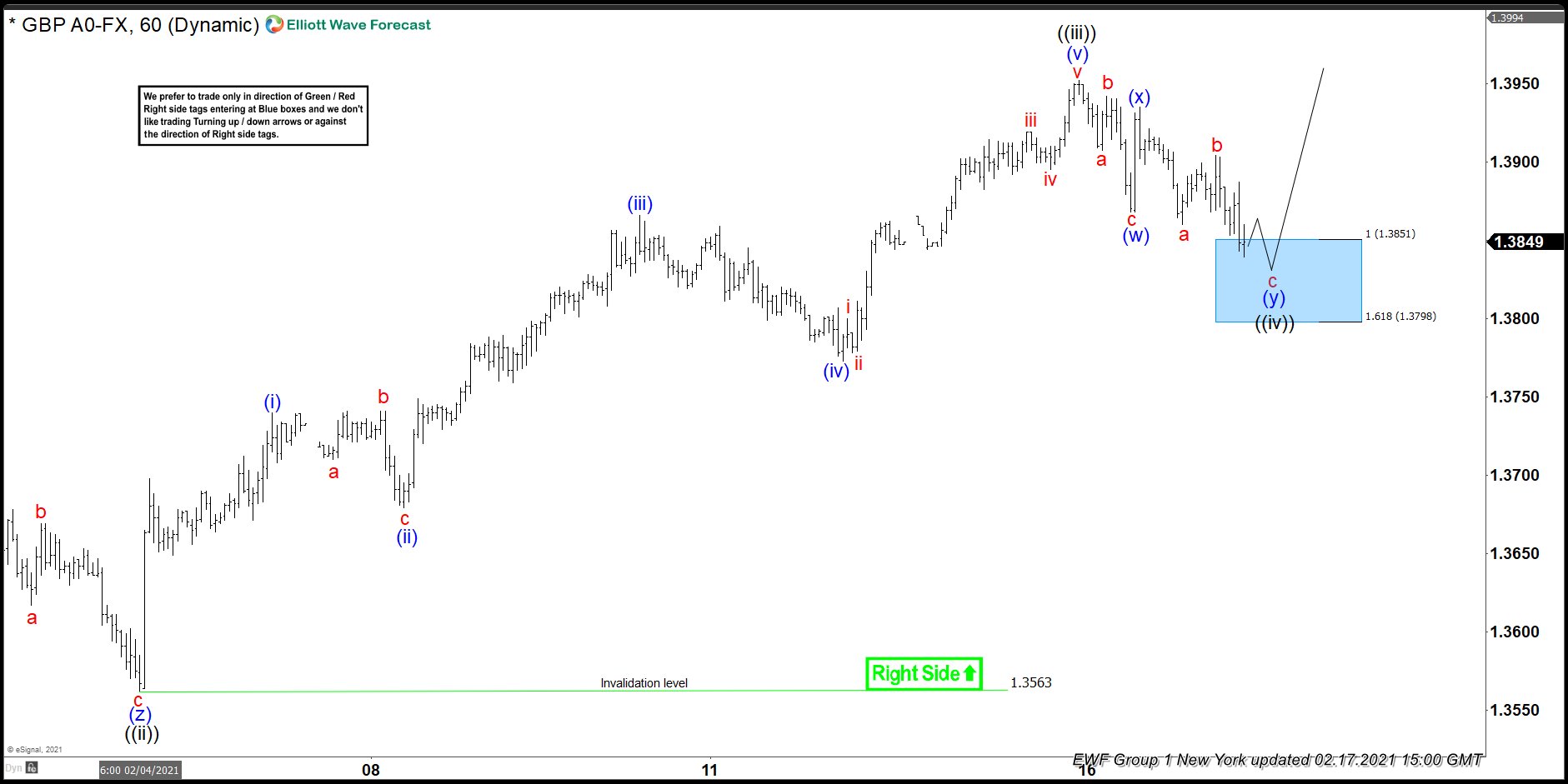

GBPUSD Elliott Wave : Buying The Dips At The Blue Box Area

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of GBPUSD, published in members area of the website. GBPUSD is another Forex pair that we have been trading lately. The price is showing bullish sequences in the cycle from the March 1.1412 low. Consequently, we […]

-

Elliott Wave View: GBPJPY Rally Likely to Extend Higher

Read MoreGBPJPY rally in impulsive structure from January 18 low and pullback likely continues to be supported. This article and video look at the Elliott Wave path.