The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: DAX Looking to Find Buyers Soon

Read MoreDAX has reached 100% in 3 swing pullback and can see support soon. This article and video look at the short term Elliott Wave path.

-

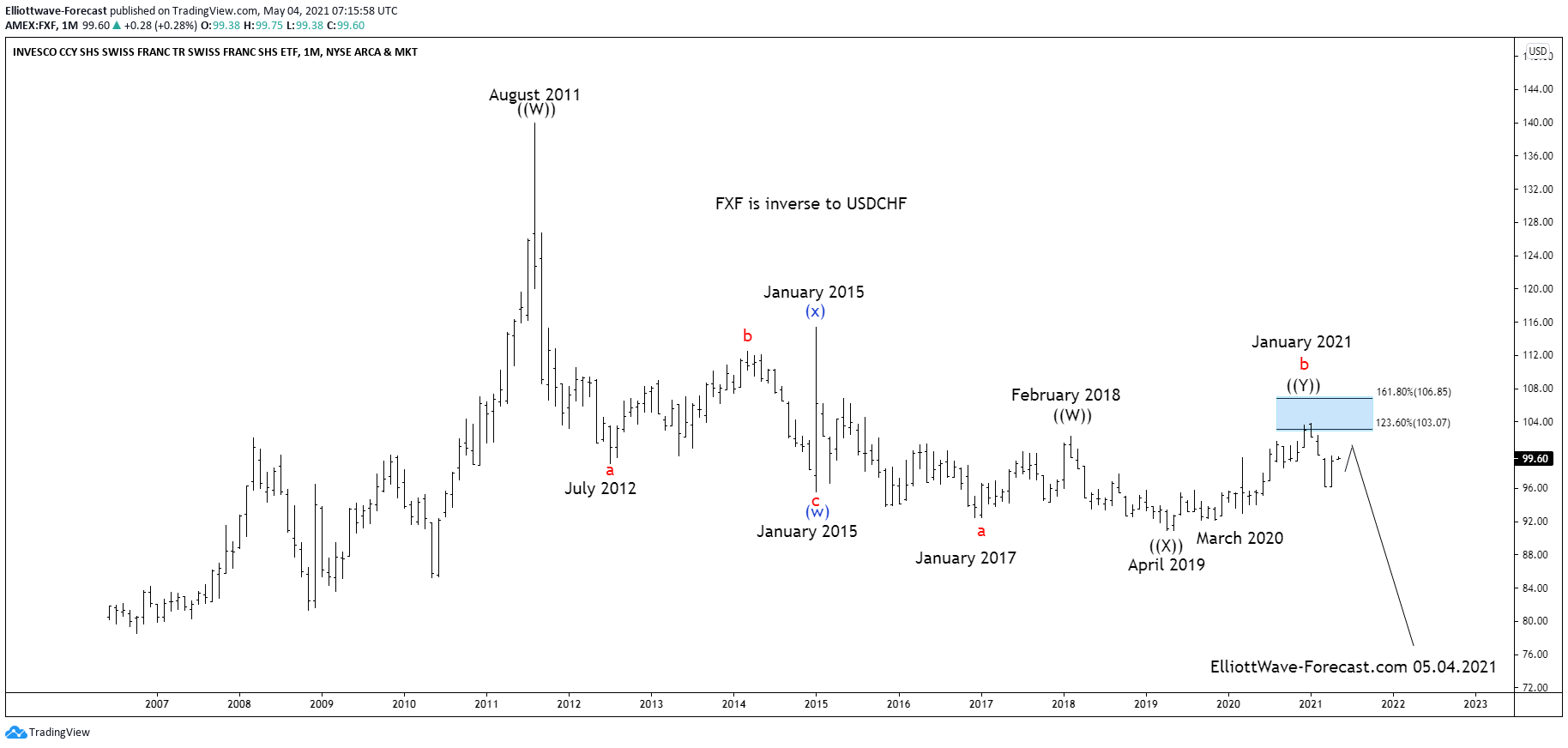

The $FXF Longer Term Cycles & Elliott Wave Analysis

Read MoreThe $FXF Longer Term Cycles & Elliott Wave Analysis Firstly there is data back to when the ETF fund began in 2006 as low as 78.43. Data correlated in the USDCHF foreign exchange pair suggests the FXF high in August 2011 is also the lows of a cycle lower from the all time in the USDCHF. In this […]

-

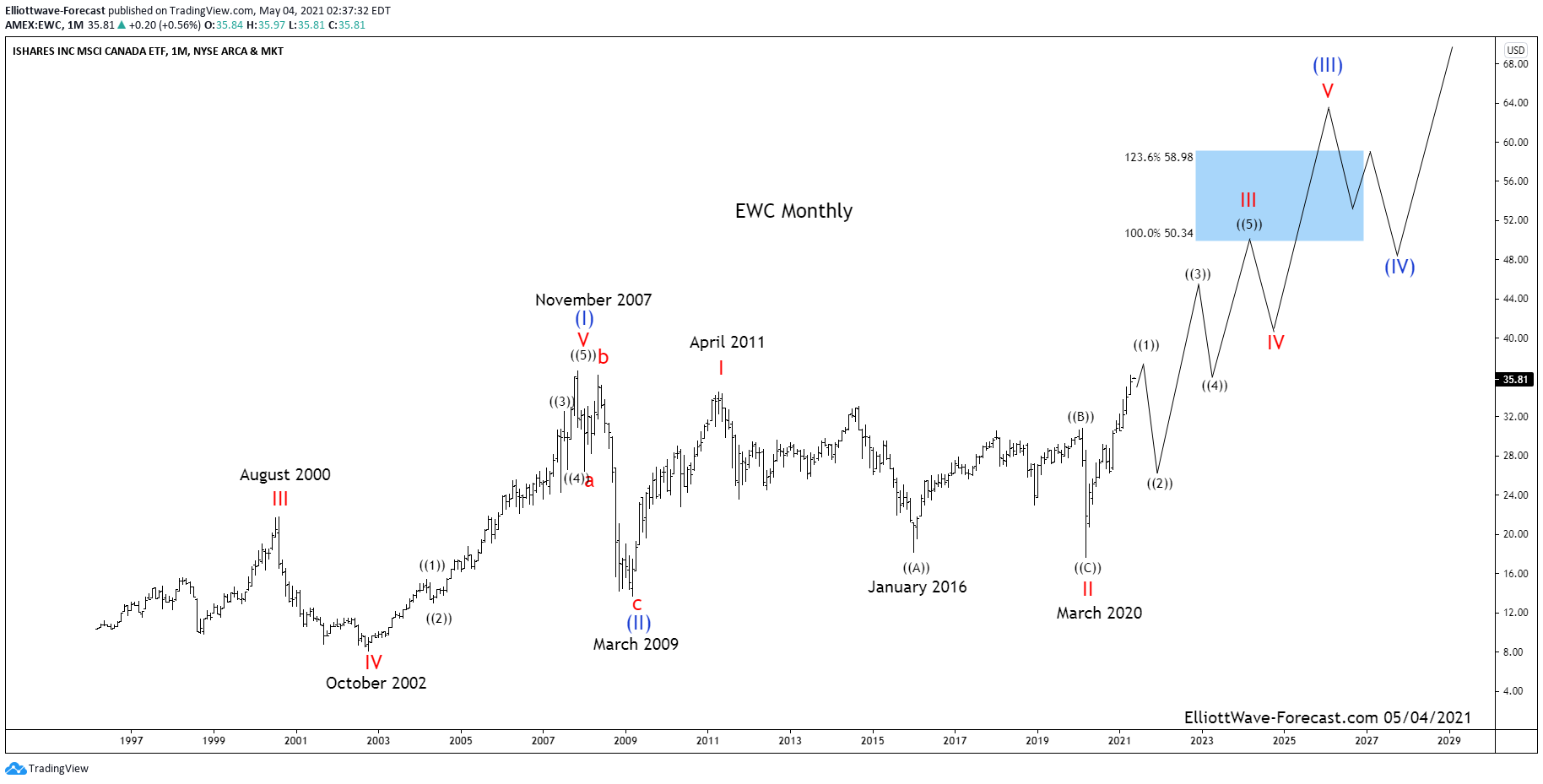

$EWC Elliott Wave & Long Term Uptrend Cycles

Read More$EWC Elliott Wave & Long Term Uptrend Cycles Firstly the EWC instrument inception date was 3/12/1996. The Canada ETF seeks to track the investment results of an index composed of large and mid-sized companies in Canada. This is of course reflected in the price. The best Elliott Wave reading of the long term cycles presume some […]

-

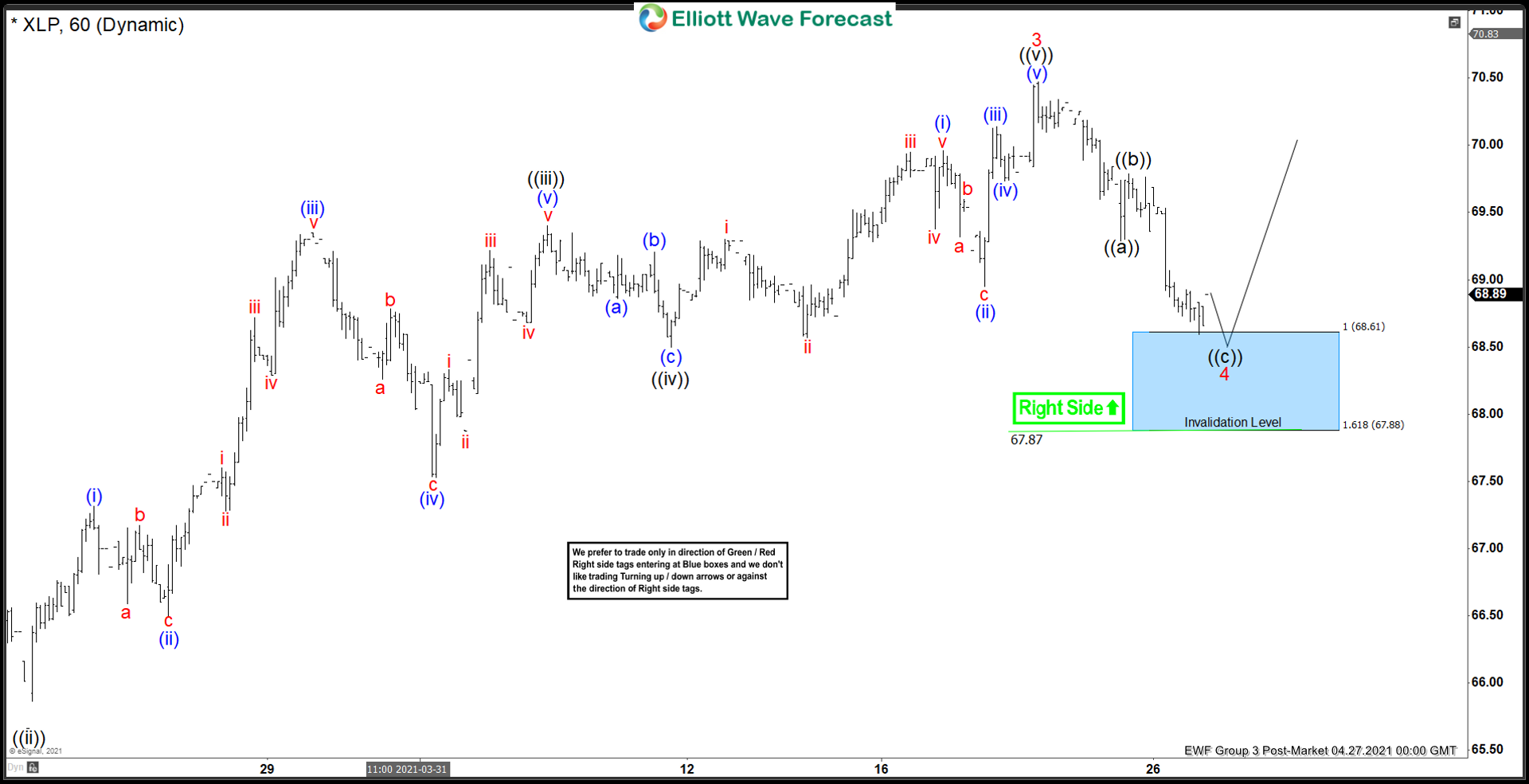

XLP Another Dip Offered Another Buying Opportunity

Read MoreIn this blog, we take a look at the past performance of 1 hour Elliott Wave charts of XLP In which our members took advantage of the blue box areas.