The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: Pullback in Bitcoin Should Find Support

Read MoreBitcoin rally from April 25 low is impulsive and favors further upside. This article and video look at the Elliott wave path.

-

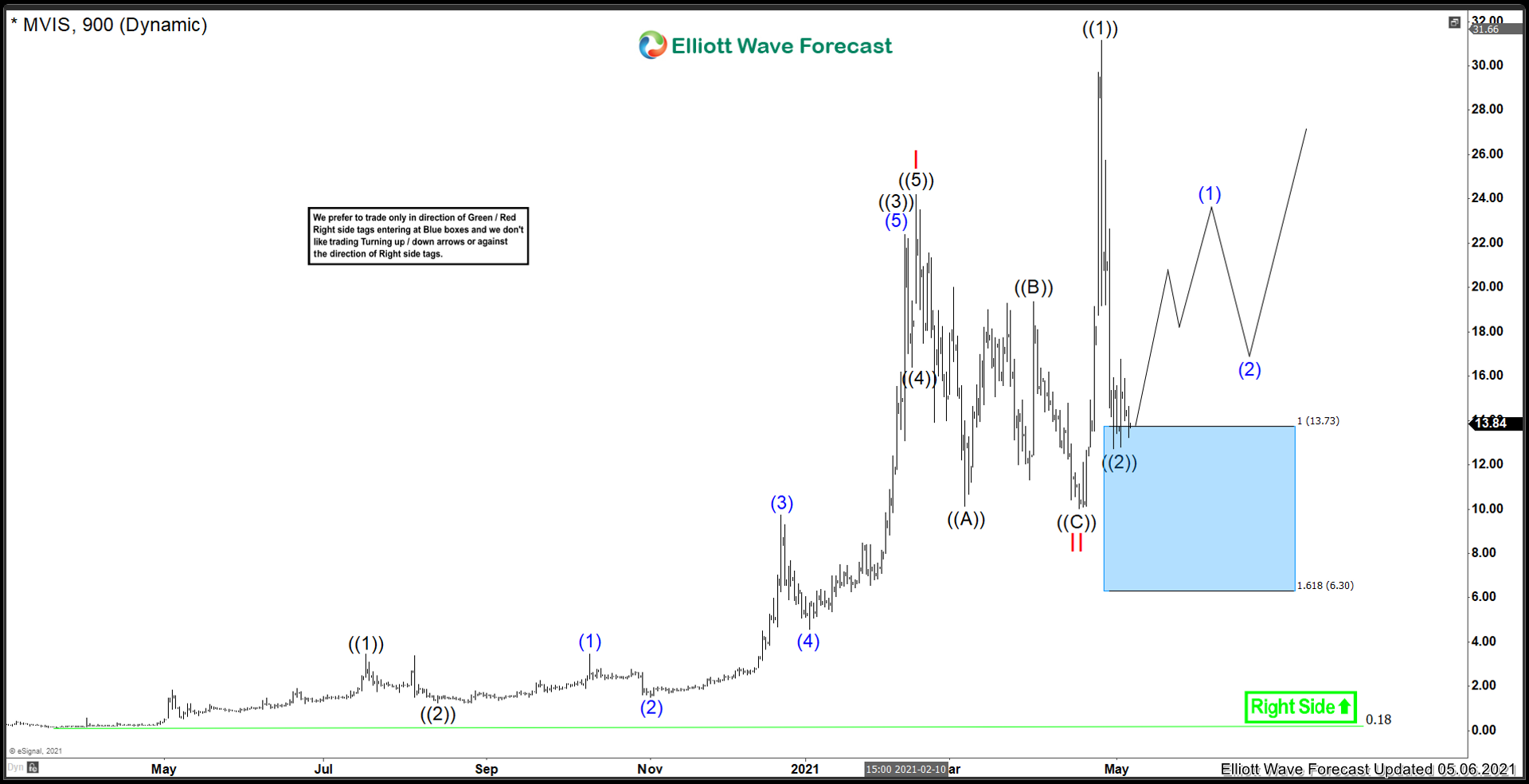

Microvision Inc. ($MVIS) Ready For Another Advance

Read MoreMicrovision was a little well known company during the March 2020 correction. It set an all time low at 18 cents at the time. From that low, it has exploded to as high as $31.14 recently due to its technology possibly being utilized in the auto industry among other sectors. Lets take a look at […]

-

Inflation Risk Supports Gold and Silver

Read MoreAn increasing number of companies gave warning for supply shortage which force them to raise prices. Manufacturers and producers from various industries such as semiconductors, lumber and cotton scramble to replenish stockpiles to keep up with demand and higher input prices. However, central bankers still argue that price gains are transitory. They claim it will […]

-

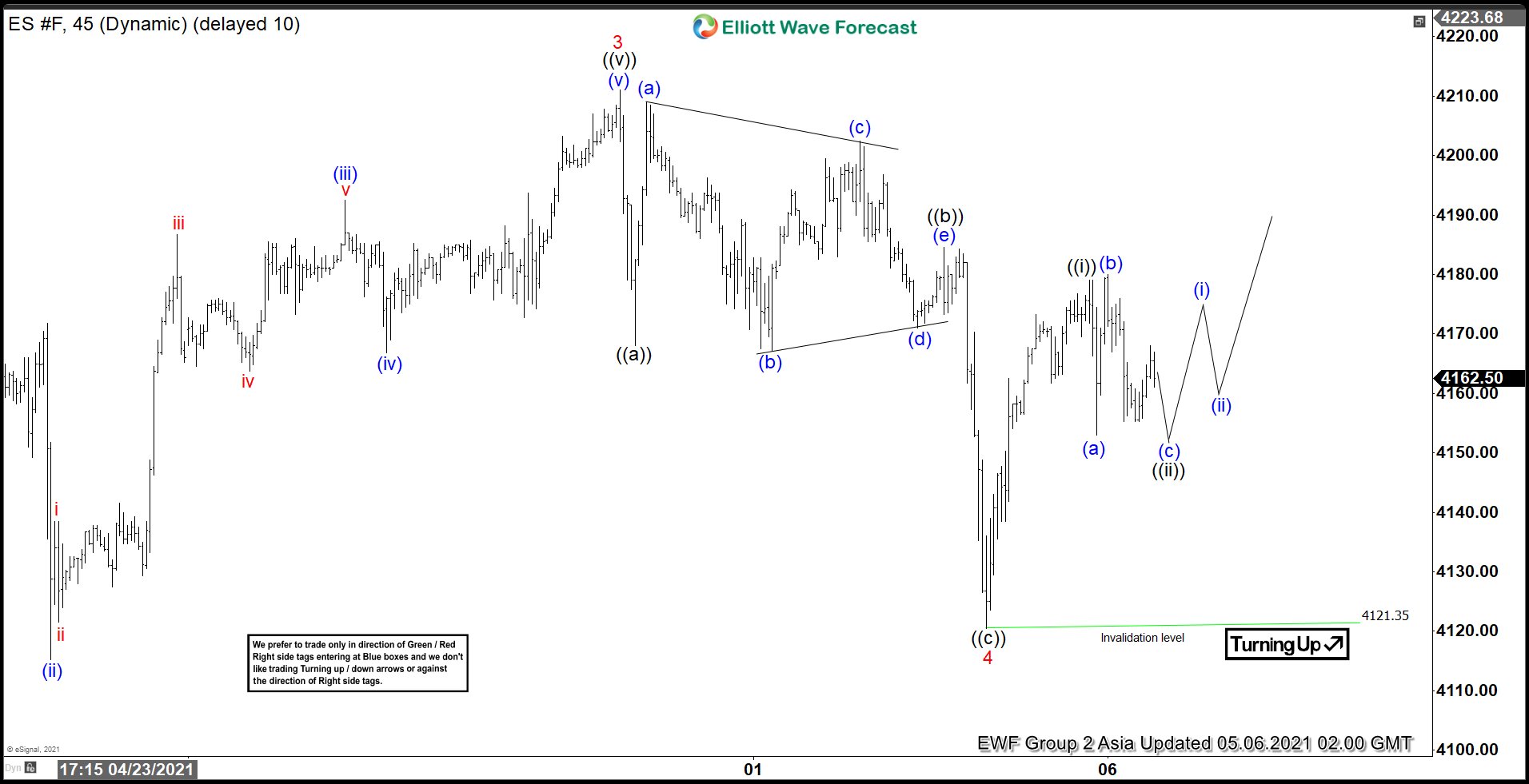

Elliott Wave View: S&P 500 E-Mini Futures (ES) Resumes Higher

Read MoreS&P 500 E-Mini Futures (ES) rally from February 1, 2021 low is unfolding as a 5 waves impulse Elliott Wave structure. Up from February 1 low, wave 1 ended at 3959.25 and pullback in wave 2 ended at 3720.5. The Index extends higher in wave 3 towards 4211 as the 45 minutes Elliott Wave chart […]