The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Liquidia (LQDA): Bullish Sequence Eyes For 28.98 – 39.60 Area Before Pullback Start

Read MoreLiquidia Corporation, (LQDA) is a biopharmaceutical company. It develops, manufactures & commercializes various products for unmet patient needs in the United States. It comes under Healthcare sector in Biotechnology Industry & trades as “LQDA” ticker at Nasdaq. LQDA is showing higher high since August-2021 low & expect short term upside to extend the sequence started […]

-

IIFL Finance Elliott Wave Analysis: Wave (2) Correction Nears Completion, Bullish Rally Ahead

Read MoreIIFL Finance (NSE: IIFL) shows a corrective Elliott Wave pattern (2) with key support at ₹370.10. A potential bullish wave (3) rally may follow soon. IIFL Finance Ltd (NSE: IIFL) continues to follow a well-defined Elliott Wave structure, suggesting the stock is undergoing a corrective phase before resuming its larger bullish trend. After completing wave […]

-

Raydium (RAYUSD) Elliott Wave Analysis: Wave II Correction Approaching Completion

Read MoreRaydium (RAYUSD) Elliott Wave analysis indicates Wave II correction is in progress, with a potential bullish Wave III rally expected after reaching the blue box support zone. Raydium (RAYUSD) completed a clean five-wave impulse from the January 2023 low, reaching $8.6642. According to Elliott Wave analysis, this move marked the end of Wave I. Since […]

-

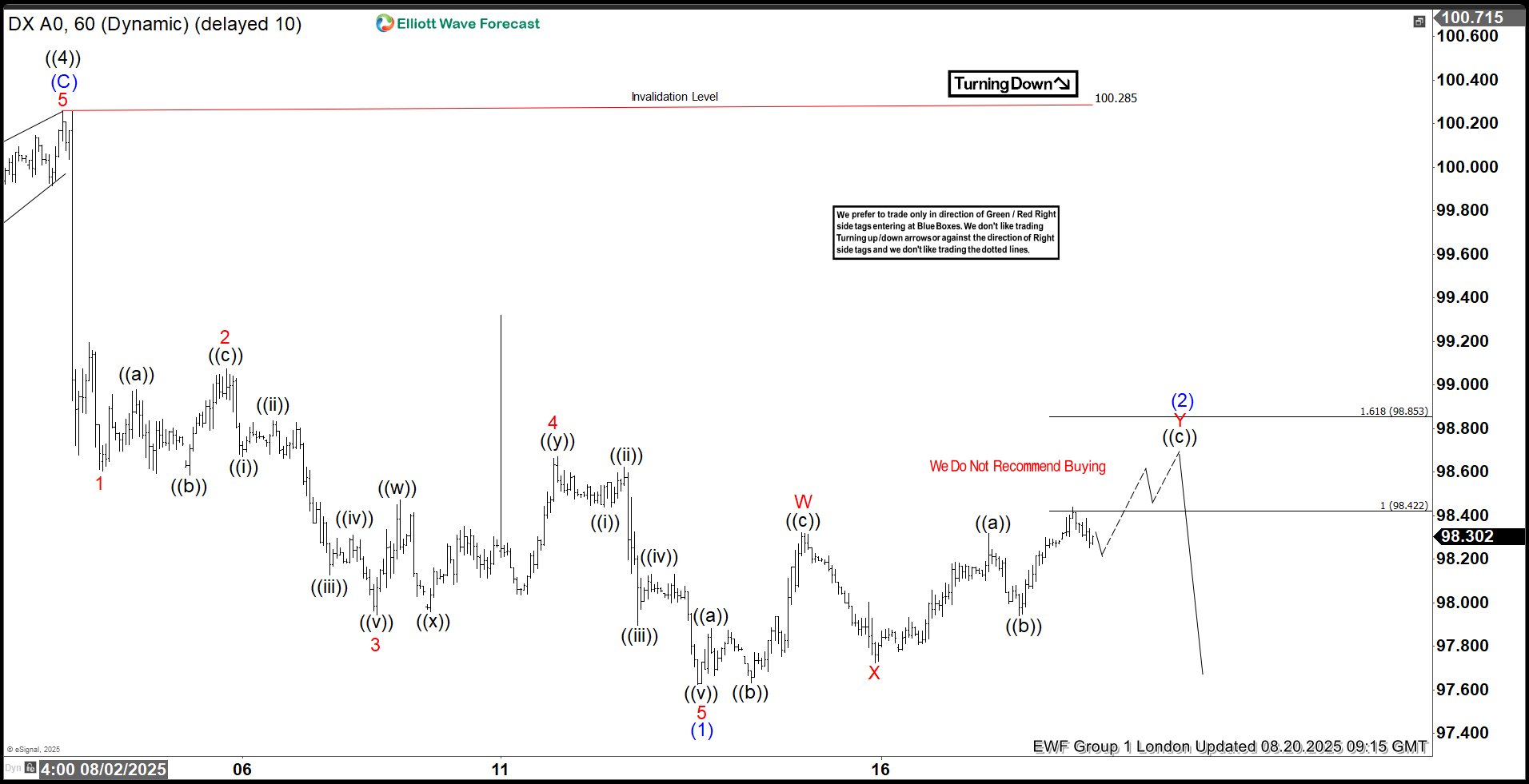

Dollar Index (DXY) : Forecasting the Decline From the Equal Legs Zone

Read MoreIn this technical article we’re going to look at the Elliott Wave charts of Dollar index DXY published in members area of the website. US Dollar has recently given us Double Three pull back and found buyers again precisely at the equal legs area as we expected. In this discussion, we’ll break down the Elliott Wave pattern […]