The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

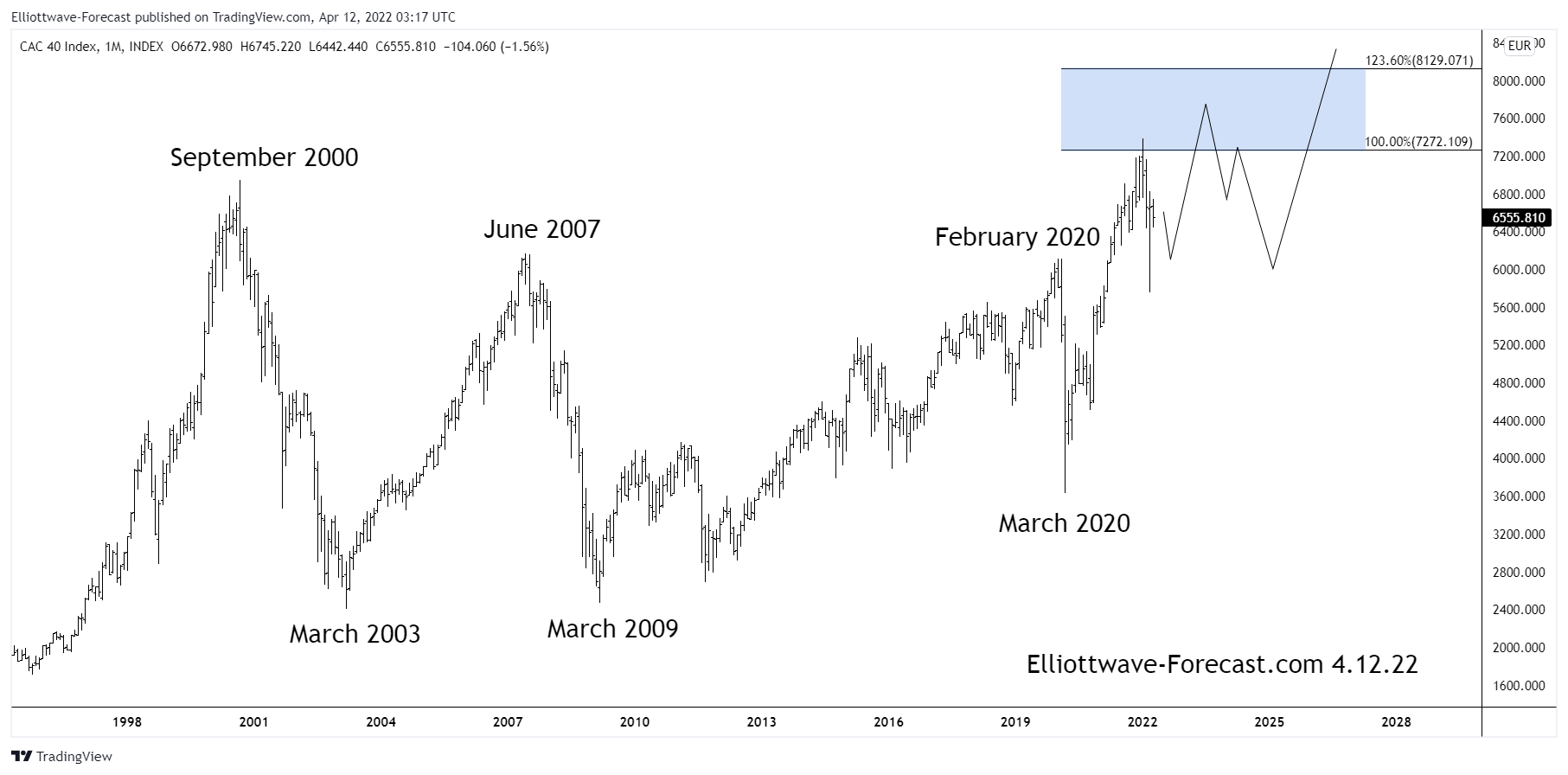

The $CAC40 Index Bullish Cycles & Longer Term Swings

Read MoreThe $CAC40 Index Bullish Cycles & Longer Term Swings Firstly the CAC 40 index has been trending higher with other world indices where in September 2000 it put in an all time high at that point. From there it followed the rest of the world indices lower into the March 2003 lows which was a […]

-

Delta (DAL): A Nest Into Higher Levels Might Be Happening

Read MoreBack in 2020, during the big pullback in Delta (DAL), we were able to tell members and followers to buy the pullback. We suspect that a nest is taking place A nest is a series of 1 and 2 with extension within the extended portion of an impulse structure. Below is a graph showing how […]

-

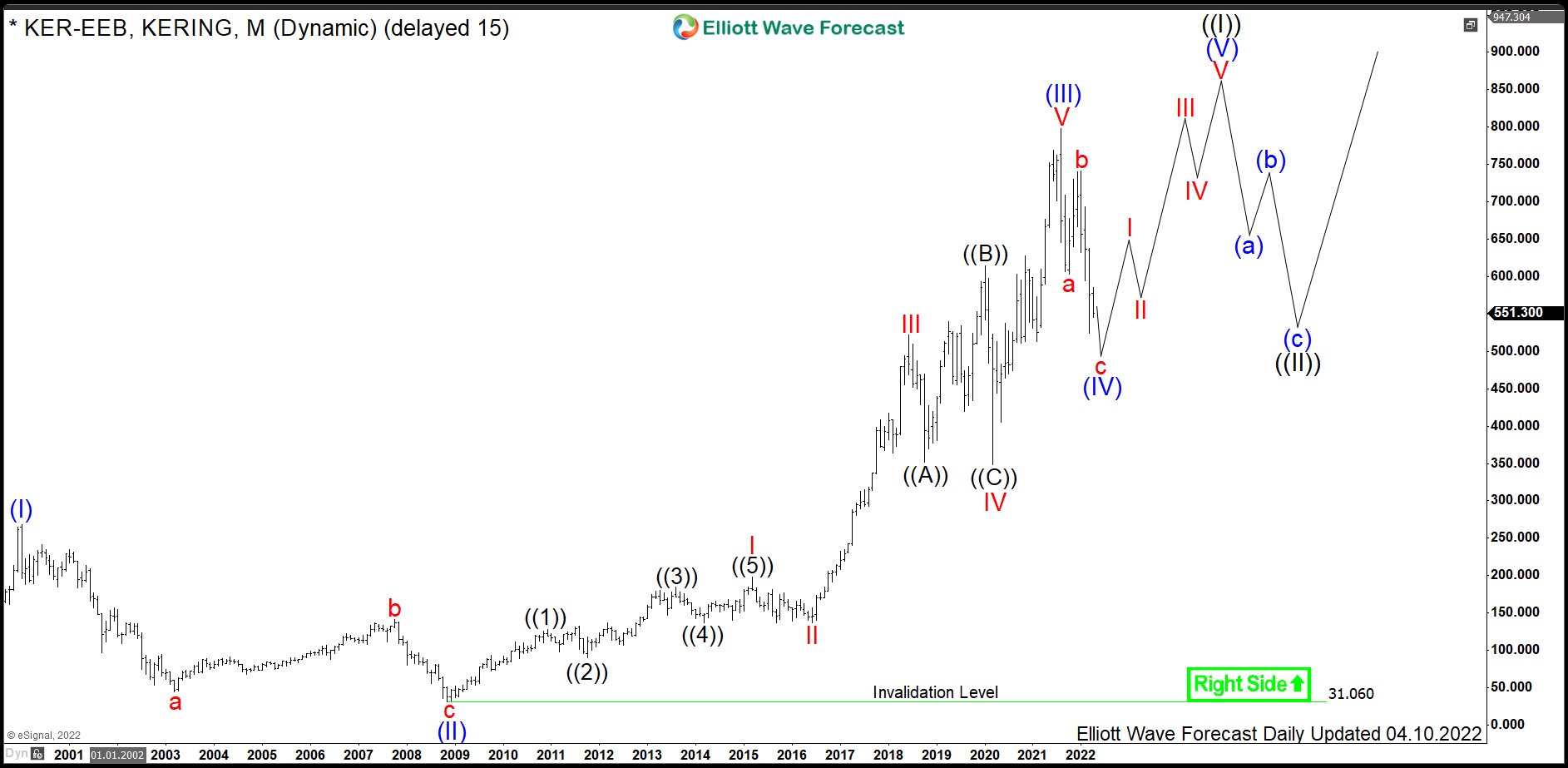

$KER: Luxury Goods Stock Kering Provides a Buying Opportunity

Read MoreKering is a French multinational luxury goods company. Headquartered in Paris, Kering was founded 1963 as Pinault S.A. The company controls and manages 3 prestigious brands: Gucci, Yves Saint Laurent and Bottega Veneta. Kering is a part of CAC40 index. Investors can trade it under the ticker $KER at Euronext Paris. Kering Monthly Elliott Wave […]

-

Platinum Elliott Wave Outlook

Read MorePrecious metals and other commodities continue their bullish run as a result of inflationary pressure and war in Ukraine. In this article, we will take a look at Platinum. Platinum is considered as a precious metal. However, unlike gold, Platinum has industrial application. 75% of the worlds’ supply of gold is used in coins, bars […]