The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Starbucks ($SBUX) Ended A Double Correction And It Should Continue Higher

Read MoreStarbucks Corporation (SBUX) is an American multinational chain of coffeehouses and roastery reserves. It is the world’s largest coffeehouse chain. As of November 2021, the company had 33,833 stores in 80 countries, 15,444 of which were located in the United States. Out of Starbucks’ U.S.-based stores, over 8,900 are company-operated, while the remainder are licensed. Starbucks ($SBUX) Elliott Wave Analysis – […]

-

Amazon (AMZN) Elliott Wave : Impulsive Sequences Calling The Rally

Read MoreHello fellow traders. In this technical article we’re going to take a quick look at the Elliott Wave charts of Amazon stock. We have been calling for the rally in the stock due to impulsive bullish sequences in the cycles from the June lows. Consequently, we recommended members to avoid selling the stock, while keep […]

-

OKE : Should Expect More Weakness After A Corrective Bounce

Read MoreONEOK, Inc., (OKE) together with its subsidiaries, engages in gathering, processing, storage & transportation of natural gas in the United States. It operates through Natural gas gathering & processing, Natural gas liquids & Natural gas pipelines segments. The company has headquartered in Tulsa, Oklahoma, comes under Energy sector and trades as “OKE” ticker at NYSE. […]

-

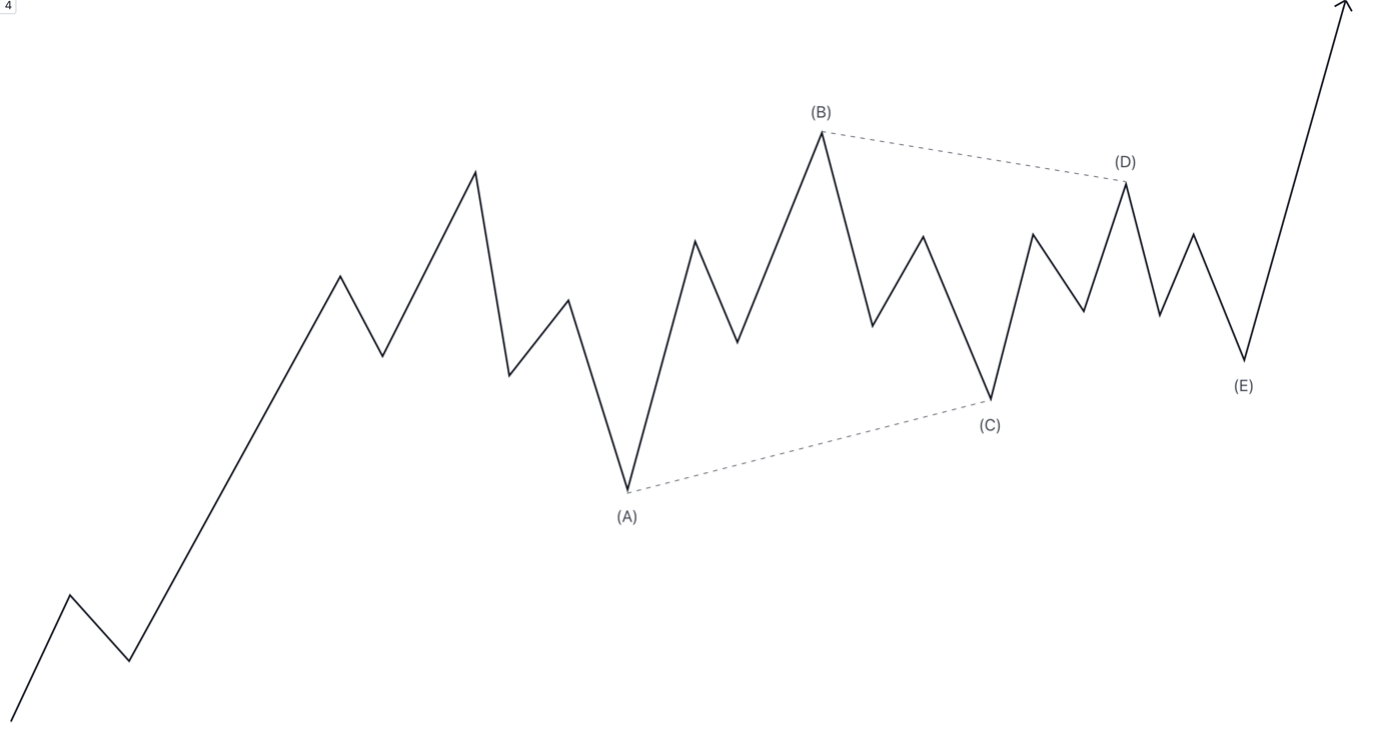

Running Triangle and how they are different to regular Triangles

Read MoreWithin the list Elliott Wave corrective patterns, alongside Zigzags, Flats and Complex Corrections we have triangles. Triangles are a sideways correction that occurs only prior to the final wave in the current trend. Therefore, can only present themselves in wave 4, B or X. The only exception they present themselves in wave 2 is if […]