The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

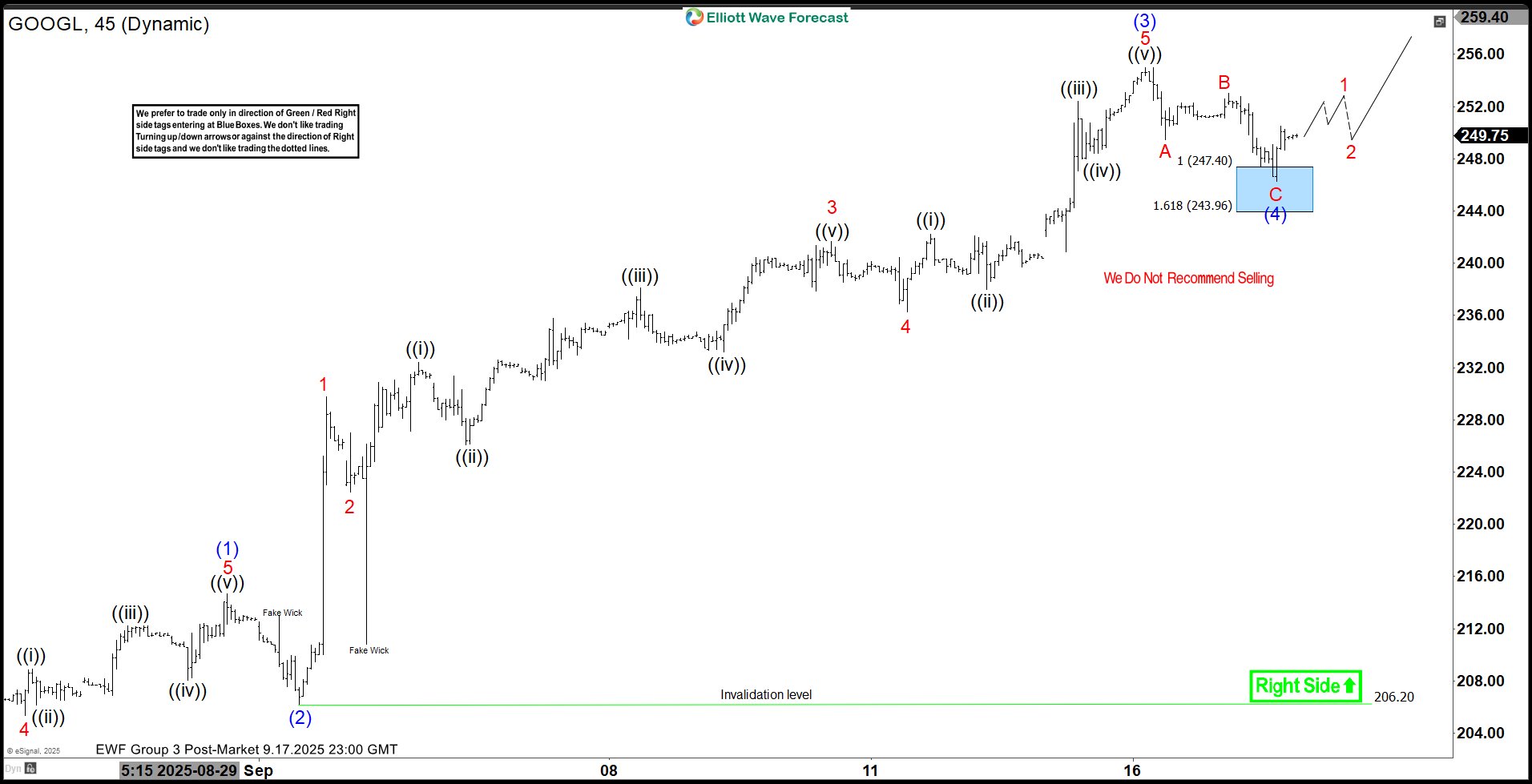

Elliott Wave Analysis: Google (GOOGL) Targets Wave (5) at $257

Read MoreGoogle (GOOGL) rallies higher in wave (5). This article and video looks at the Elliott Wave path and target for the stock

-

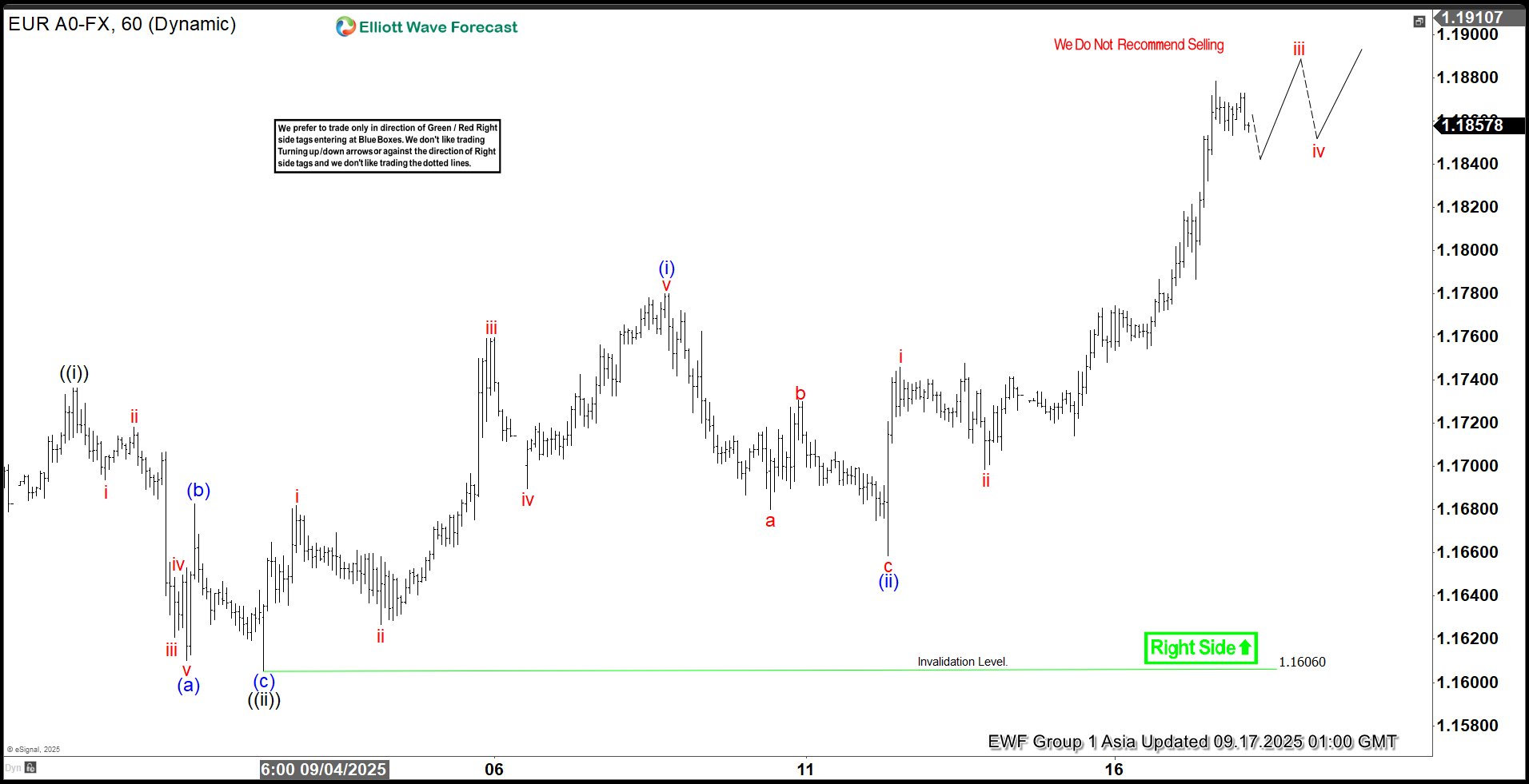

EURUSD Elliott Wave Outlook: Bullish Impulse Structure Signals Further Gains

Read MoreEURUSD shows bullish sequence from 1 August 2025 low favoring upside. This article and video look at the Elliott Wave path of the pair.

-

Microsoft Corp. $MSFT Blue Box Area Offers A Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Microsoft Corp. ($MSFT) through the lens of Elliott Wave Theory. We’ll review how the rally from the April 07, 2025 low unfolded as a 5-wave impulse followed by a 3-swing correction (ABC) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock. […]

-

Gartner Inc. (IT) Elliott Wave Analysis: Wave IV Correction Targets Key Support Zone

Read MoreGartner Inc. enters a corrective wave IV, targeting key Fibonacci support before resuming its bullish Elliott Wave V trend. Gartner Inc. (NYSE: IT) has delivered an impressive multi-decade bullish cycle, advancing from the lows near $5 in 2002 to above $700 before the current pullback. The Elliott Wave count suggests that the stock recently completed […]