The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

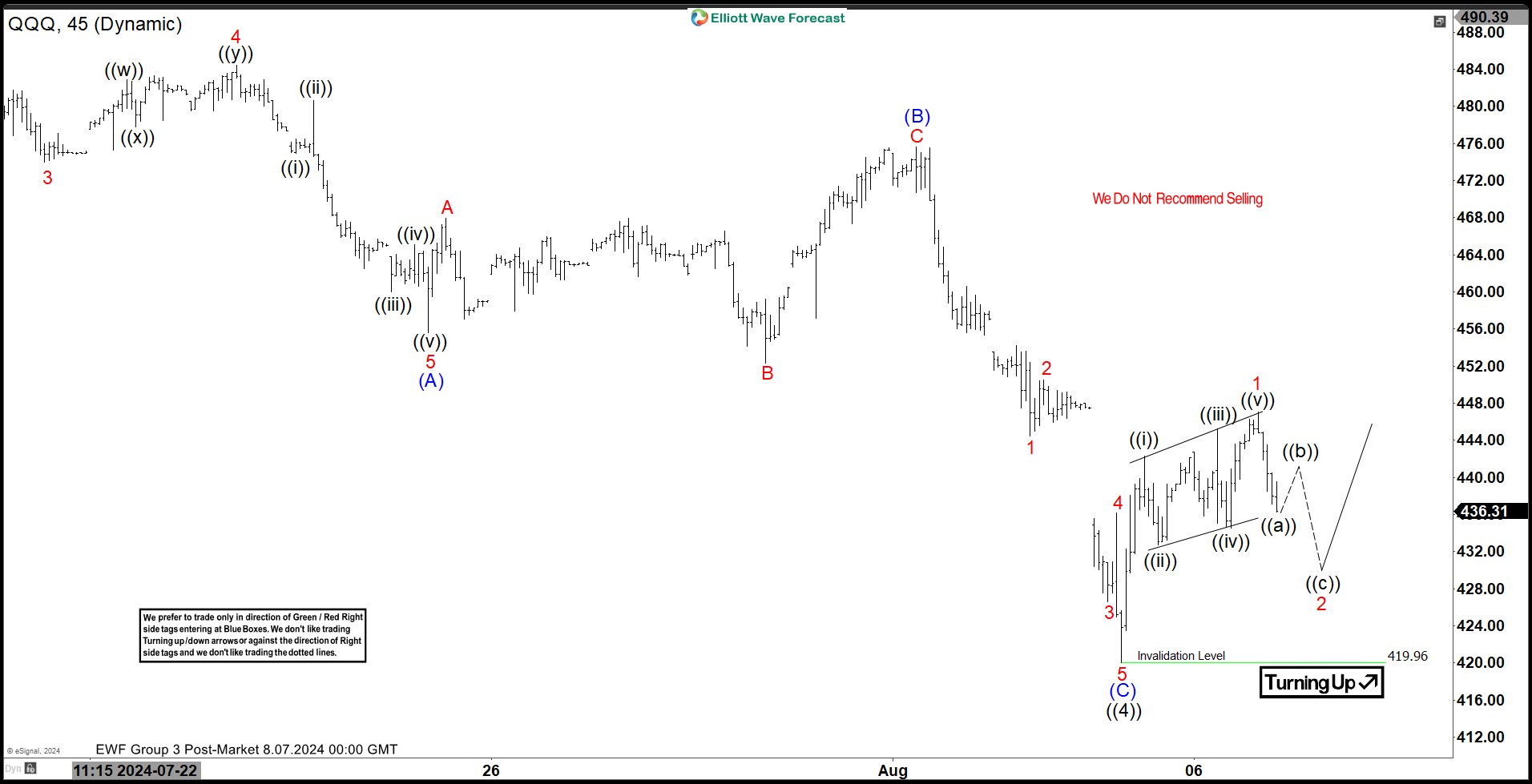

QQQ Completed a Cycle Expecting to Resume the Rally

Read MoreShort Term Elliott Wave in QQQ suggests that the ETF has completed a bearish sequence from 7.11.2024 high. The decline made a zig zag Elliott Wave structure. Down from 7.11.2024 high, wave (A) ended at 455.63 low. Rally in wave (B) ended at 475.61 with internal subdivision as a expanded flat structure. Up from wave […]

-

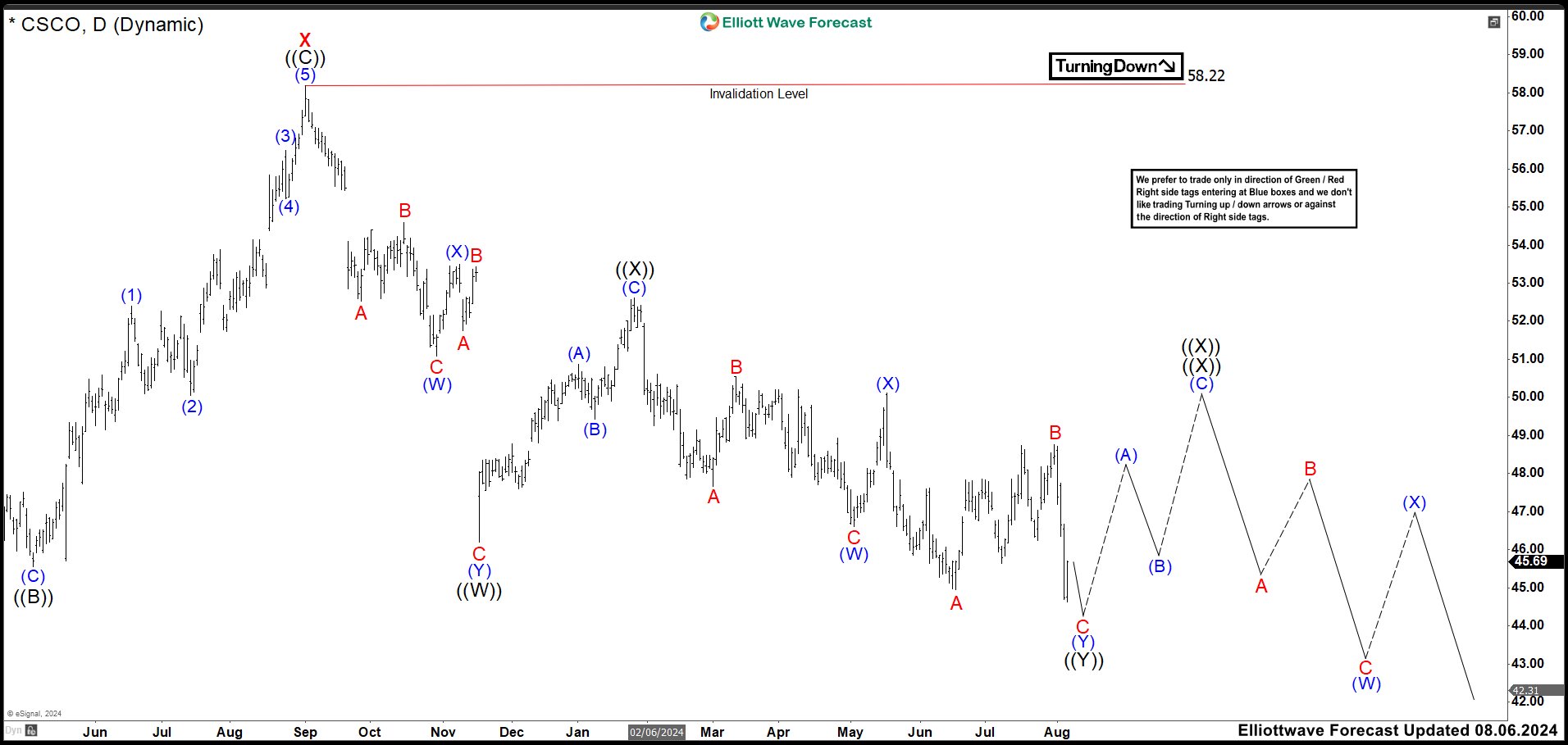

Cisco Systems CSCO is Showing Weakness to Build a Triple.

Read MoreCisco Systems, Inc., commonly known as Cisco (CSCO), is an American-based multinational digital communications technology conglomerate corporation headquartered in San Jose, California. Cisco develops, manufactures, and sells networking hardware, software, telecommunications equipment and other high-technology services and products. CSCO Daily Chart March 2024 In the chart above, we can see a double correction structure formed from wave X. Down from 58.19 high, CSCO dropped in 3 swing […]

-

Invesco Nasdaq ETF ( $QQQ) Found Buyers At The Blue Box Area As Expected.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 4H Hour Elliott Wave chart of Invesco Nasdaq ETF ($QQQ) . The rally from 10.23.2023 low unfolded as 5 waves impulse. So, we expected the pullback to unfold in 7 swings and find buyers again. We will explain the structure & […]

-

Deckers Outdoor (DECK) Favors Sideways Correction Before Rally Again

Read MoreDeckers Outdoor Corporation (DECK), designs, markets & distributes footwear, apparel & accessories for casual lifestyle use & high-performance activities in US and internationally. It sells products through domestic & international sellers, distributors & directly its consumers through direct to consumer (D2C) business. It is based in Goleta, CA, comes under Consumer Cyclical sector & trades […]