The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

TSLA Managed To Reach Another Blue Box Buying Area

Read MoreIn this blog, we take a look at the past performance of TSLA charts. In which, the stock managed to reach another blue box buying area.

-

PepsiCo May End The Bearish Cycle From 2023 Soon

Read MorePepsico ($PEP) has been in a bearish cycle since May 2023. However, the cycle is getting extreme and the sell-off may relax in the coming weeks or months. While we may not know what will trigger the buyers to find entries soon, traders should be aware of this key zone for opportunities. PepsiCo is a […]

-

AT&T (T) Stock’s Bullish Run: What Investors Should Expect

Read MoreAT&T Inc. (T) is an American multinational telecommunications holding company headquartered in Dallas, Texas. It is the world’s largest telecommunications company by revenue and the third-largest provider of mobile telephone services in the U.S. AT&T (T) Monthly Chart September 2024 In the last […]

-

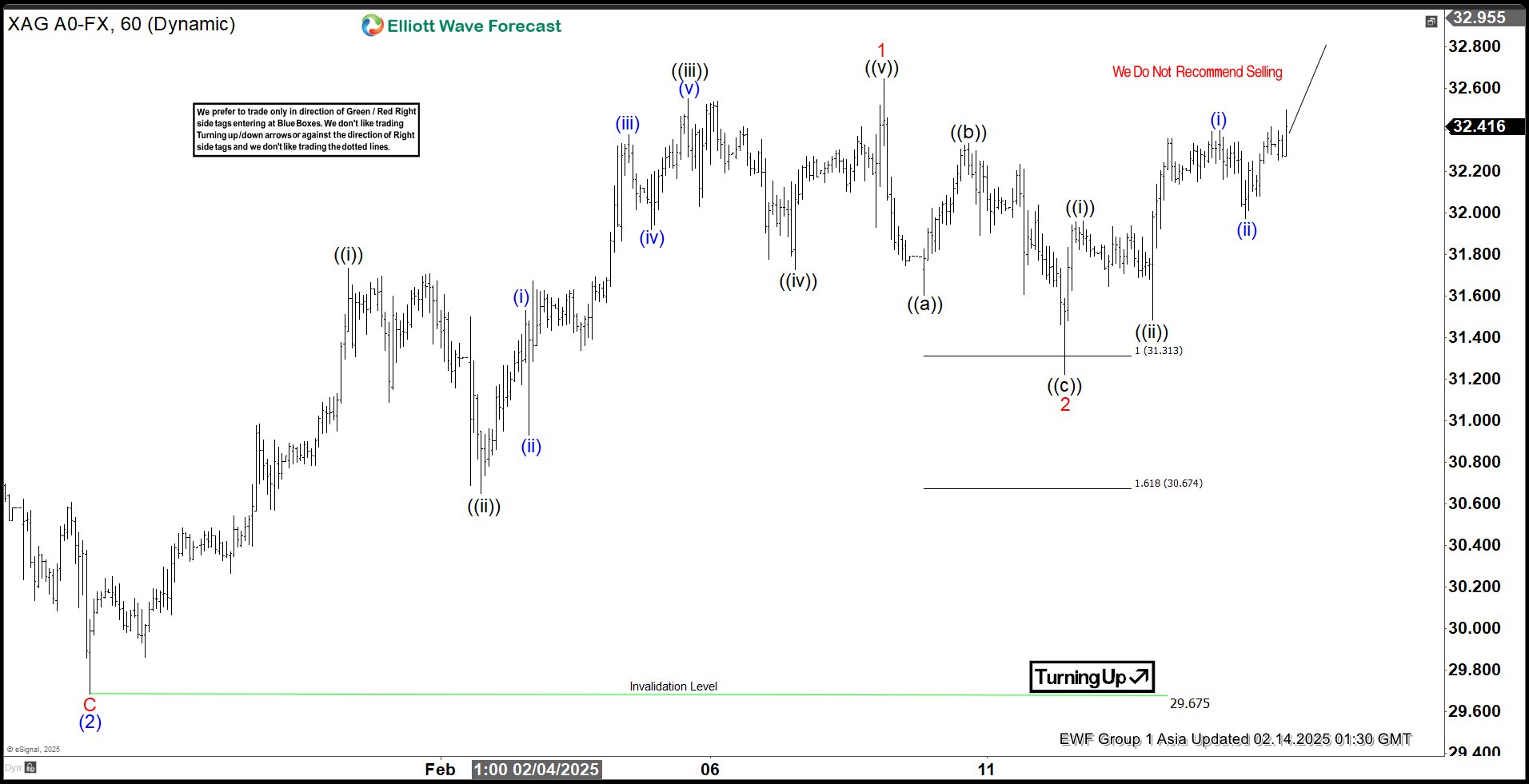

Elliott Wave View: Silver (XAGUSD) Looking for the Next Leg Higher

Read MoreSilver (XAGUSD) is looking to extend higher as an impulse. This article and video look at the Elliott Wave path of the metal.