The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

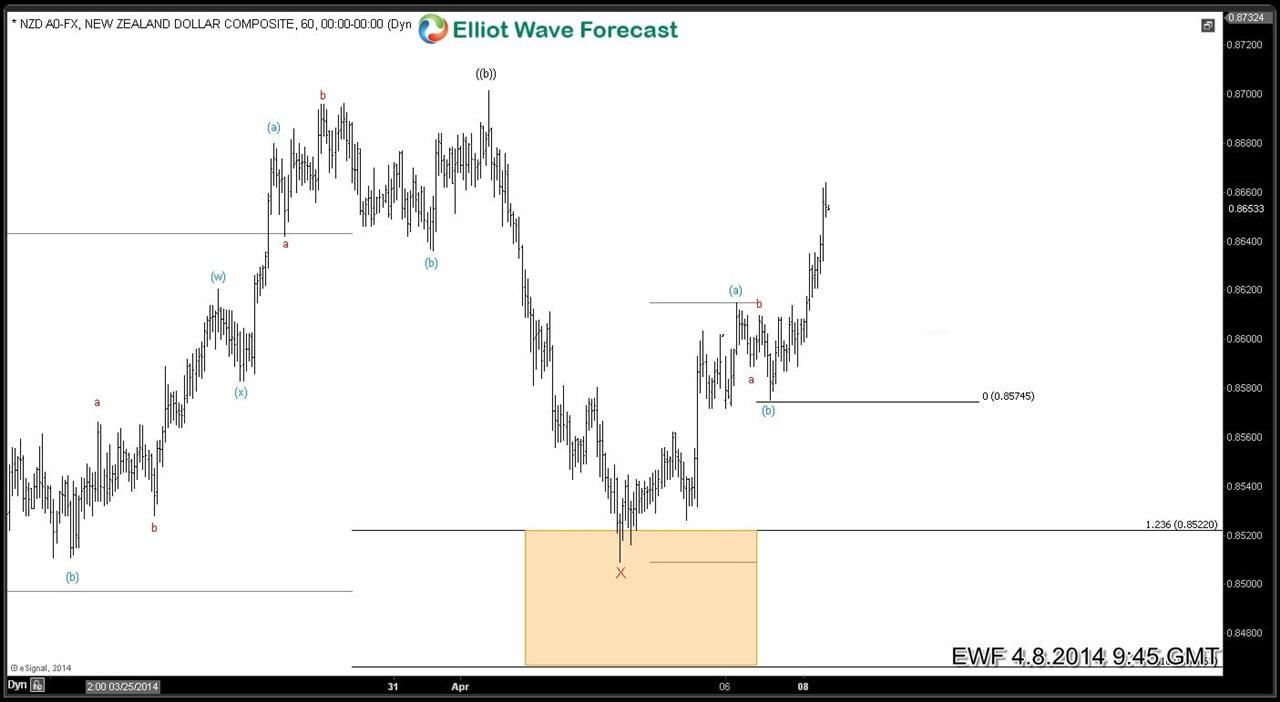

NZDUSD: Riding the Kiwi waves

Read MoreSince April 2/2014 we were expecting a bounce after the dip. Take a look at some charts from members area below and see how we forecasted Elliott wave structure in NZDUSD pair. NZDUSD April 2/2014 (Asia Update) NZDUSD April 3/2014 (New York Update) NZDUSD April 4/2014 (London Update) NZDUSD April 5/2014 […]

-

$CL_F 1 Hour Elliott Wave Analysis 4.7.2014

Read MoreComplex price action continues in Oil. Decline from 102.24 -98.84 was a 5 wave move and though recovery after that has been corrective in nature as far as Elliott wave structure is concerned but it has broken the pivot at 102.24 in proprietary system due to which our primary view is that dip to 98.84 […]

-

$HG_F (Copper) 1 Hour Elliott Wave Analysis 4.4.2014

Read MoreMove up from 2.877 (3.19.2014) low – 3.074 (4.2.2014) high was a corrective 7 swing Elliott wave structure. 7 swings is a corrective sequence and our system is also confirming the end of a cycle from 2.877 low, therefore preferred Elliott wave view is that wave “X” has completed and decline has resumed for new […]

-

EWF Live Trading Room

Read MoreIf you were ever curious about our Live Trading Room webinar – here is a video where the host, Dan Hussey, takes you through how the webinar adds to your EWF experience. The room is open daily from 11:30 am EST through 1:30 pm EST and covers everything you need to know to turn the […]